Answered step by step

Verified Expert Solution

Question

1 Approved Answer

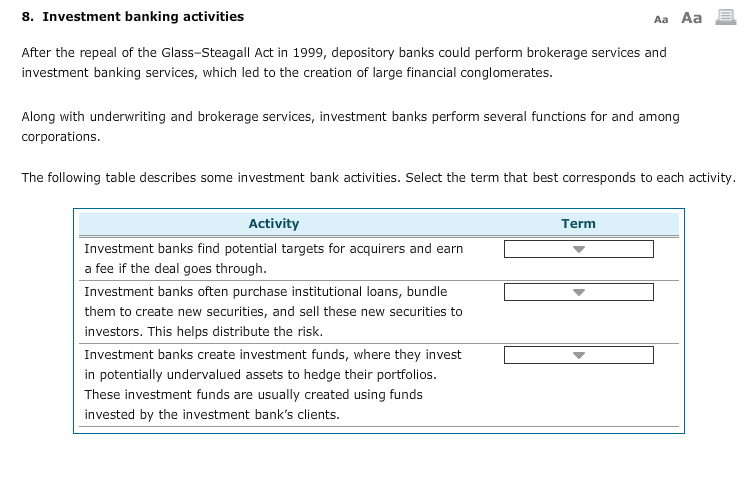

Investment Banking Activities: Question A options: Securitization, matchmaking, asset management Question B options: matchmaking, securitization, trading operations Question C options: matchmaking, underwriting, asset management 8.

Investment Banking Activities:

Question A options: Securitization, matchmaking, asset management

Question B options: matchmaking, securitization, trading operations

Question C options: matchmaking, underwriting, asset management

8. Investment banking activities Aa Aa After the repeal of the Glass-Steagall Act in 1999, depository banks could perform brokerage services and investment banking services, which led to the creation of large financial conglomerates Along with underwriting and brokerage services, investment banks perform several functions for and among corporations The following table describes some investment bank activities. Select the term that best corresponds to each activity. Activity Term Investment banks find potential targets for acquirers and earn a fee if the deal goes through. Investment banks often purchase institutional loans, bundle them to create new securities, and sell these new securities to investors. This helps distribute the risk. Investment banks create investment funds, where they invest in potentially undervalued assets to hedge their portfolios. These investment funds are usually created using funds invested by the investment bank's clients

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started