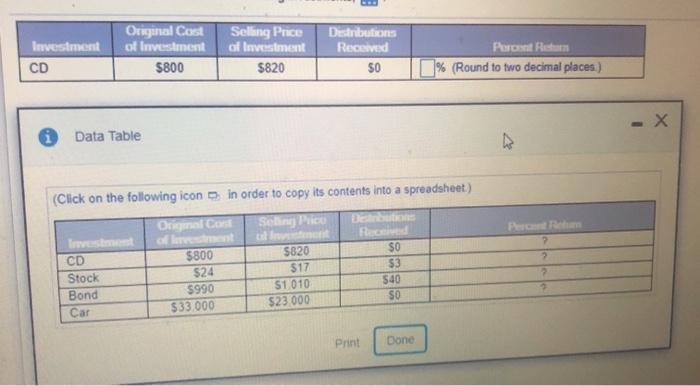

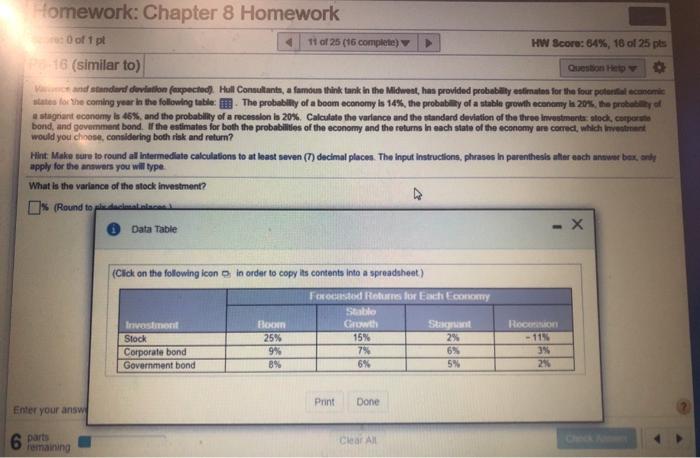

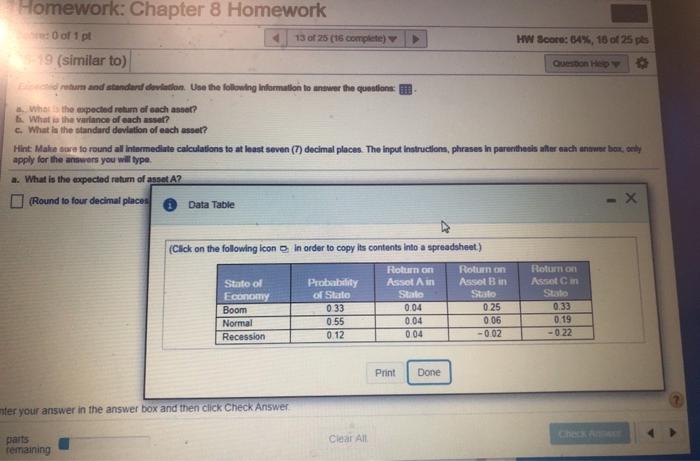

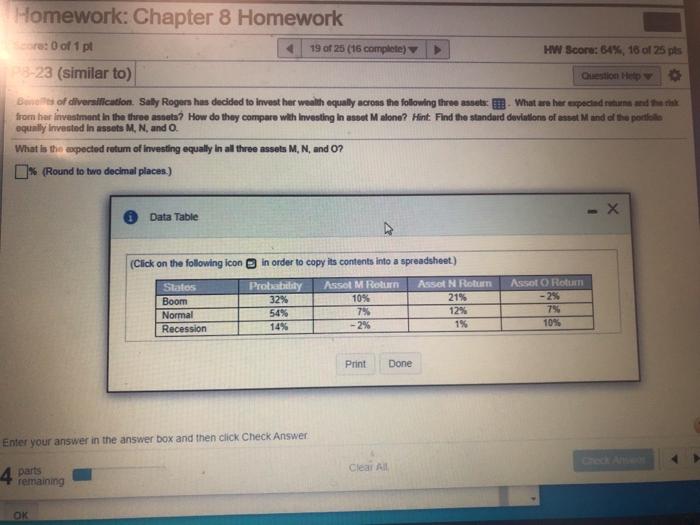

Investment CD Original Cost of Investment $800 Selling Price ol Investment $820 Destributions RECENT 50 Per Rea % (Round to two decimal places) Data Table 2 (Click on the following icon in order to copy its contents into a spreadsheet) Original Com Set Price Den Invest of een Rece CD $800 $820 $0 Stock $24 $17 53 Bond 5990 51 010 $40 Car $33.000 $23.000 SO Print Done Homework: Chapter 8 Homework of 1 pl 11 of 25 (16 complete) HW Score: 64%, 16 of 25 pts 16 (similar to) Quan H and standard deviation expected. Hull Consultants, a famous think tank in the Midwest has provided probability estimates for the four potential economie ates for the coming year in the following table: The probabilty of a boom economy is 14%, the probability of a stable growth economy a 20%, the probeer a stagnant economy is 45%, and the probability of a recession is 20% Calculate the variance and the standard deviation of the three investments, stock, corporums bond and government bond. If the estimates for both the probabilities of the economy and the returns in each state of the economy are correct, which is would you choose, considering both risk and return? Hint Make sure to round all intermediate calculations to at least seven (7) decimal places. The input instructions, phrases In parenthesis after each w boxonly apply for the answers you will type What is the variance of the stock investment? Os (Round to declinac Data Table (Click on the following icon in order to copy its contents into a spreadsheet) Investor Stock Corporate bond Government bond Boon 25% 9% B% Food Recor Each Oy Stable Crowth Stag 15% 29 7% 6% 5% Rocion - 115 35 2 6% Print Done Enter your answ 6 parti Clear All remaining Homework: Chapter 8 Homework 0 of 1 pl 13 of 25 (16 complete) HW Score: 64%, 15 of 25 pts 9 (similar to) Q-Con H Enced return and standard deviation. Use the following Information to enter the questions: What the expected return of each asset? What is the variance of each asset? c. What the standard deviation of each asset? Hint: Make sure to round all intermediate calculations to at least seven (7) decimal places. The input Instructions, phrases in parenthesis after each antworbou cely apply for the answers you will type a. What is the expected return of asset A? (Round to four decimal places Data Table Roturno Assolo (Click on the following icon in order to copy its contents into a spreadsheet) Return on Rotun State of Probability Assol A Asset B in Economy of State Stale Stato Boom 033 0.04 0.25 Normal 0.55 004 006 Recession 0.12 0.04 -002 0.33 0.19 -022 Print Done nter your answer in the answer box and then click Check Answer Clear All parts remaining Homework: Chapter 8 Homework ro: 0 of 1 pt 19 of 25 (15 complete) HW Score: 64%, 16 of 25 pts 323 (similar to) Gestion Help B of diversification Sally Rogers has decided to invest her wealth equally across the following three assets. What are her especiadrature and the from har investment in the three astetaHow do they compare with Investing in sout Malone? Hint Find the standard deviation of asset Mand dl the poole equally invested in assets M, N, and O. What is the taxpected return of Investing equally in all three assets M, N, and O? % (Round to two decimal places.) Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) Slatos Boom Normal Recession Prolatility 32% 54% 1455 Assol M Rotun 10% 7% -2% Ass N Rotun 21% 12% 1% Assol Rouen -25 75 10% Print Done Enter your answer in the answer box and then click Check Answer Clear All 4 parts remaining OK