Investment decision:

Please give advise me on what else needs to be calculated, considering the below topics. I will ask this question again with additional necessary steps needing to be done. Thanks!

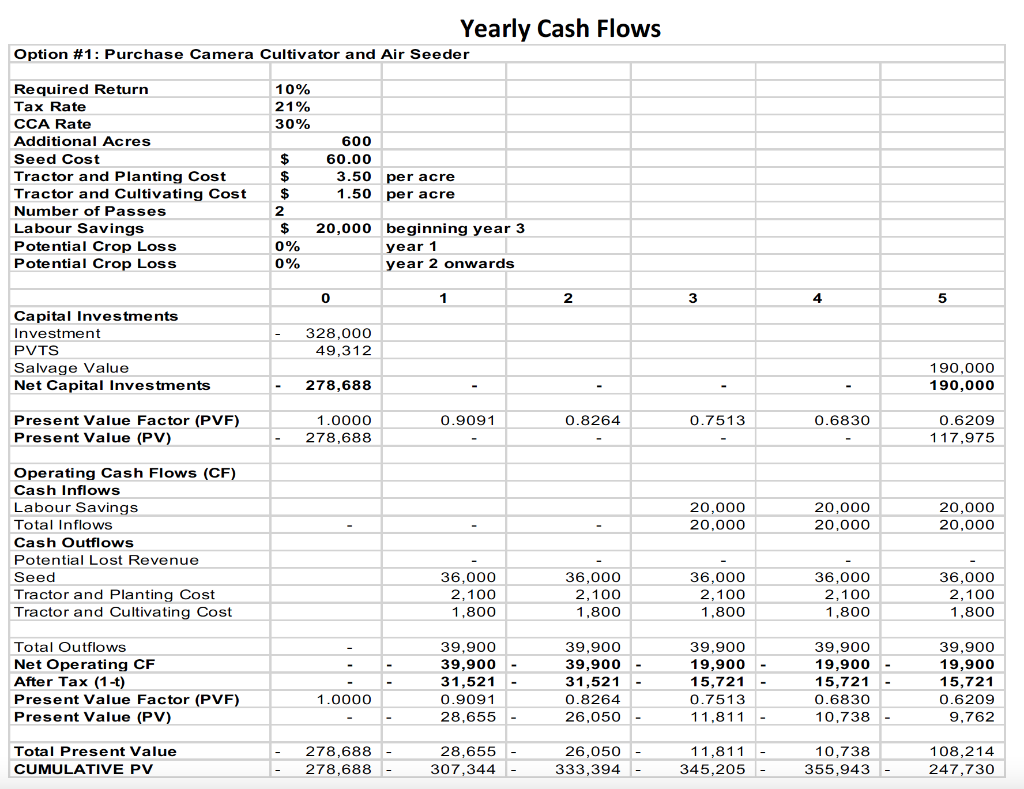

Note: The investor estimated that the additional 600 acres of this crop would generate an additional $ 1 million annually, starting from the second year. Also, the investor decided to exclude values such as soil fertility ($ 125 per acre) and operating costs ($ 230 per acre) from their analysis. Therefore, these are not included in the calculation. It is planned to use these equipments for fifteen years.

Yearly Cash Flows Option #1: Purchase Camera Cultivator and Air Seeder 10% 21% 30% Required Return Tax Rate CCA Rate Additional Acres Seed Cost Tractor and Planting Cost Tractor and Cultivating Cost Number of Passes Labour Savings Potential Crop Loss Potential Crop Loss 600 60.00 3.50 1.50 per acre per acre $ $ $ 2 $ 0% 0% 20,000 beginning year 3 year 1 year 2 onwards 0 1 2 3 4 5 Capital Investments Investment PVTS Salvage Value Net Capital Investments 328,000 49,312 190,000 190,000 278,688 0.9091 0.8264 0.7513 0.6830 Present Value Factor (PVF) Present Value (PV) 1.0000 278,688 0.6209 117,975 20,000 20,000 20,000 20,000 20,000 20,000 Operating Cash Flows (CF) Cash Inflows Labour Savings Total Inflows Cash Outflows Potential Lost Revenue Seed Tractor and Planting Cost Tractor and Cultivating Cost 36,000 2,100 1,800 36,000 2,100 1.800 36,000 2,100 1,800 36,000 2,100 1,800 36,000 2,100 1,800 Total Outflows Net Operating CF After Tax (1-t) Present Value Factor (PVF) Present Value (PV) 39,900 39,900 31,521 0.9091 28,655 39,900 39,900 31,521 0.8264 26,050 39,900 19,900 15,721 0.7513 11,811 39,900 19,900 15,721 0.6830 10.738 39,900 19,900 15,721 0.6209 9,762 1.0000 Total Present Value CUMULATIVE PV 278,688 278,688 28.655 307,344 26,050 333,394 11,811 345,205 10,738 355,943 108,214 247,730 . . . . -Net Present Value Calculation Learning Objectives: Calculate future values and present values; Apply the concepts of perpetuities and annuities; Use perpetuities and annuities; and Understand how interest is paid and quoted. -Investment Decision Making Learning Objectives: Calculate book rate of return and payback; Apply concepts of internal rate of return; Be able to choose capital investments when resources are limited; Use the net present value rule; Understand the effects of corporate income taxes for investment decision making; Use the NPV rule to choose among projects; Take into account the investment timing decision; Assess the choice between long- and short-lived equipment; Know when to replace an old machine; and Be able to assess the cost of excess capacity. -Risk and Return Learning Objectives: Explain the concepts of expected return, security risk, diversification, portfolio risk, and beta; Calculate expected return and variance of return (or standard deviation) for single securities and portfolios; Evaluate the beta of a security or portfolio; and Understand diversification and value-adding property. - Project Analysis (in-person) Learning Objectives: Perform sensitivity analysis and break-even analysis; Comprehend the usefulness of decision trees and simulation in project analysis; Conduct real options analysis of a project; Understand that a thorough analysis is essential before accepting or rejecting a project; Explain the link between corporate strategy and finance; Apply the concept of economic rent; Quantify the sources of economic rent, like competitive advantages; and Understand the relationship between market price, economic rent, competitive advantage, and NPV in capital budgeting problems. . Yearly Cash Flows Option #1: Purchase Camera Cultivator and Air Seeder 10% 21% 30% Required Return Tax Rate CCA Rate Additional Acres Seed Cost Tractor and Planting Cost Tractor and Cultivating Cost Number of Passes Labour Savings Potential Crop Loss Potential Crop Loss 600 60.00 3.50 1.50 per acre per acre $ $ $ 2 $ 0% 0% 20,000 beginning year 3 year 1 year 2 onwards 0 1 2 3 4 5 Capital Investments Investment PVTS Salvage Value Net Capital Investments 328,000 49,312 190,000 190,000 278,688 0.9091 0.8264 0.7513 0.6830 Present Value Factor (PVF) Present Value (PV) 1.0000 278,688 0.6209 117,975 20,000 20,000 20,000 20,000 20,000 20,000 Operating Cash Flows (CF) Cash Inflows Labour Savings Total Inflows Cash Outflows Potential Lost Revenue Seed Tractor and Planting Cost Tractor and Cultivating Cost 36,000 2,100 1,800 36,000 2,100 1.800 36,000 2,100 1,800 36,000 2,100 1,800 36,000 2,100 1,800 Total Outflows Net Operating CF After Tax (1-t) Present Value Factor (PVF) Present Value (PV) 39,900 39,900 31,521 0.9091 28,655 39,900 39,900 31,521 0.8264 26,050 39,900 19,900 15,721 0.7513 11,811 39,900 19,900 15,721 0.6830 10.738 39,900 19,900 15,721 0.6209 9,762 1.0000 Total Present Value CUMULATIVE PV 278,688 278,688 28.655 307,344 26,050 333,394 11,811 345,205 10,738 355,943 108,214 247,730 . . . . -Net Present Value Calculation Learning Objectives: Calculate future values and present values; Apply the concepts of perpetuities and annuities; Use perpetuities and annuities; and Understand how interest is paid and quoted. -Investment Decision Making Learning Objectives: Calculate book rate of return and payback; Apply concepts of internal rate of return; Be able to choose capital investments when resources are limited; Use the net present value rule; Understand the effects of corporate income taxes for investment decision making; Use the NPV rule to choose among projects; Take into account the investment timing decision; Assess the choice between long- and short-lived equipment; Know when to replace an old machine; and Be able to assess the cost of excess capacity. -Risk and Return Learning Objectives: Explain the concepts of expected return, security risk, diversification, portfolio risk, and beta; Calculate expected return and variance of return (or standard deviation) for single securities and portfolios; Evaluate the beta of a security or portfolio; and Understand diversification and value-adding property. - Project Analysis (in-person) Learning Objectives: Perform sensitivity analysis and break-even analysis; Comprehend the usefulness of decision trees and simulation in project analysis; Conduct real options analysis of a project; Understand that a thorough analysis is essential before accepting or rejecting a project; Explain the link between corporate strategy and finance; Apply the concept of economic rent; Quantify the sources of economic rent, like competitive advantages; and Understand the relationship between market price, economic rent, competitive advantage, and NPV in capital budgeting problems