Question

Investment Expert As a long-time investment expert, you have come to firmly believe in the following rules: If a person is age thirty-five or younger,

Investment Expert

As a long-time investment expert, you have come to firmly believe in the following rules:

-

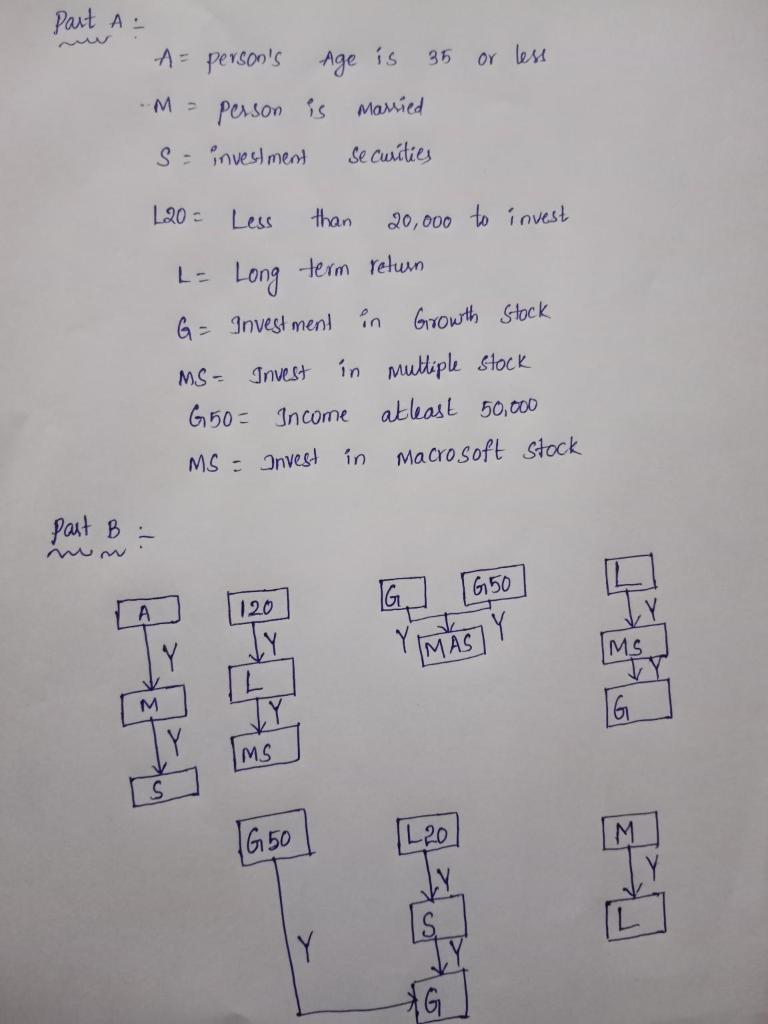

If a person is age thirty-five or younger, and is married, then he or she should invest in securities.

-

If a person has less than $20,000 to invest and is looking for long-term return, then he or she should invest in multiple stocks.

-

If a person wants to invest in growth stocks or has an annual income of at least $50,000, then he or she should invest in Macrosoft stock.

-

If a person seeks long-term return, and wants to invest in multiple stocks, then he or she should invest in growth stocks.

-

If a person has less than $20,000 to invest and wants to invest in securities, or if he or she has an annual income of at least $50,000, then he or she should invest in growth stocks.

-

If a person is married, then he or she should look for long-term return.

-

C. Integrate the above graphic fragments into a single diagram showing all the conditions/actions and all the rules. It may take several trials to create a neat, elegant

diagram. If the diagram becomes too messy and unreadable, rearrange the items to eliminate crossed lines. Use the drawing toolbar (Insert/Shapes) in MS-Word to draw the arrows.

D. An investor approaches you to seek advice on investing in Macrosoft stock. She is married and has $15,000 to invest. Use the above diagram to figure out what advice you would offer her. Clearly explain your thinking process.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started