Answered step by step

Verified Expert Solution

Question

1 Approved Answer

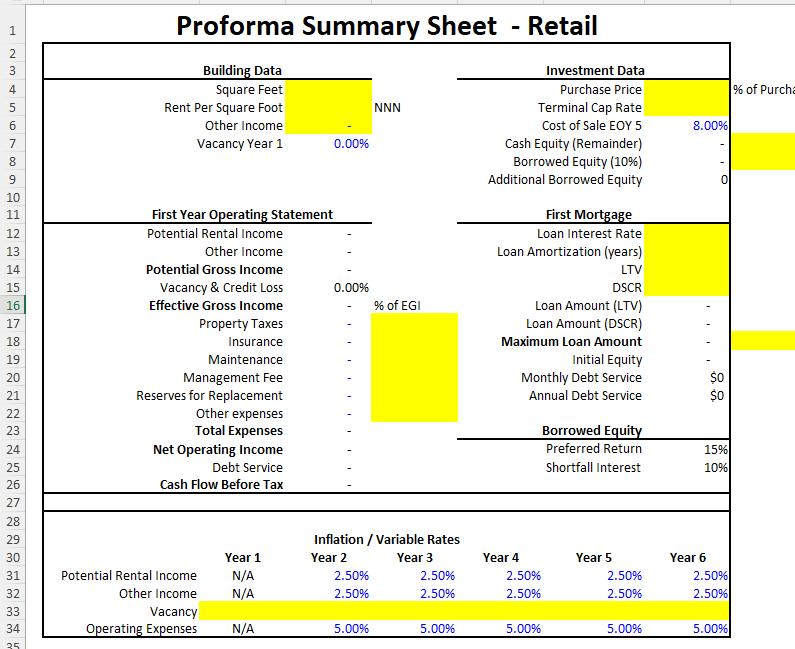

Investment Opportunity #1: RETAIL Fully occupied single tenant 50,000 SF Junior Big Box Retail Building on 5 acres of land. B+ Credit Tenant (i.e. TJ

Investment Opportunity #1: RETAIL

- Fully occupied single tenant 50,000 SF "Junior Big Box" Retail Building on 5 acres of land. "B+" Credit Tenant (i.e. TJ Maxx/Marshalls/Burlington Coat/Barnes & Noble)

- 0% Vacancy

- Rent $20/SF NNN

- No additional income

- Lease Term = 20 years, start 1/1/2020

- Expenses are as follows (all as a % of EGI)

- Property Taxes 15%

- Insurance 3%

- Maintenance 20%

- Management Fee 8%

- Reserves for Replacement 5%

- Other expenses 5%

- Price = $11,500,000

- Capital Stack:

- 80% LTV @7.5% Interest Rate, 25 Year Term, Fully Amortized

- Constrained by 1.2 DSCR

- 10% Borrowed Equity@ 12% Preferred Return (Interest)

- 10% Interest Rate on Shortfalls

- Remainder Cash Equity

- Terminal Cap Rate = 9%

1 2 3 8 9 10 11 12 456700 = Proforma Summary Sheet - Retail Building Data Square Feet Rent Per Square Foot Other Income NNN Vacancy Year 1 0.00% 16 17 18 19 20 21 22 23 24 25 26 13 2345 14 15 First Year Operating Statement Potential Rental Income Other Income Potential Gross Income Vacancy & Credit Loss Effective Gross Income Property Taxes Insurance Maintenance Management Fee Reserves for Replacement Other expenses Total Expenses Net Operating Income Debt Service Cash Flow Before Tax Investment Data Purchase Price Terminal Cap Rate Cost of Sale EOY 5 Cash Equity (Remainder) Borrowed Equity (10%) Additional Borrowed Equity First Mortgage Loan Interest Rate Loan Amortization (years) % of Purcha 8.00% 0 LTV 0.00% - % of EGI DSCR Loan Amount (LTV) Loan Amount (DSCR) Maximum Loan Amount Initial Equity Monthly Debt Service $0 Annual Debt Service $0 Borrowed Equity Preferred Return. 15% Shortfall Interest 10% SSS 27 28 29 Inflation/Variable Rates 30 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 31 Potential Rental Income N/A 2.50% 2.50% 2.50% 2.50% 2.50% 32 Other Income N/A 2.50% 2.50% 2.50% 2.50% 2.50% 33 Vacancy 34 Operating Expenses N/A 5.00% 5.00% 5.00% 5.00% 5.00% 35

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started