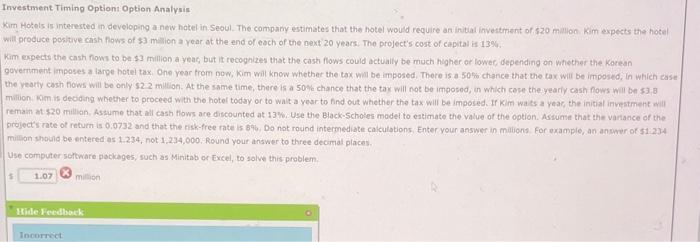

Investment Timing Options Option Aralvais kim Hotels is interested in developing a.new hatel in.Seoul. The company estimates that the hotel would require an initiat investinent of 520 mallon Kim expects the hotel Will produce positiye cish fows of 33 malion a year at the end of each of the oext 20 years. The project's cost of capital is 13%. Kam expects the cash fown to be $3 million a yeac, but it rocoghizes that the cask flows could actually be much higher or lower, depending on whether the korean. govertmment imposes a larpe hotel tax. One year trom now, kim will know whether the tax will be imposed. There is a j0ci chance that the tax wil be imposed, In whileh ease the vearty cash fows will be only 522 mulion. At the same time, there is a 50 Fe chance that the tax will not bo imposed, in which cove theyearly eash fows will be $3; B mulion. Ken is deciding whether to proceed with the hotel today or to wait a year to find out whether the tax will be imposed. If Kim waits a year, the initial investment aill remain at $20 milian, Assume that all cast flows are discounted at 13 W. Use the Black-5choles model to eatimate the value of the option. Assume that the variance of the grojects rate of return is 0,0732 and that the fisk-free rate is 846 . Do not round intermediate calculations, Enter your answer in malions. For example, an anmer of $1.3.4 millon should be entered as 1.234, not 1,234,000. Round your answer to three decimal places. Use computer software pocicages, such as Minitab or Excel, to solve this problem. Investment Timing Options Option Aralvais kim Hotels is interested in developing a.new hatel in.Seoul. The company estimates that the hotel would require an initiat investinent of 520 mallon Kim expects the hotel Will produce positiye cish fows of 33 malion a year at the end of each of the oext 20 years. The project's cost of capital is 13%. Kam expects the cash fown to be $3 million a yeac, but it rocoghizes that the cask flows could actually be much higher or lower, depending on whether the korean. govertmment imposes a larpe hotel tax. One year trom now, kim will know whether the tax will be imposed. There is a j0ci chance that the tax wil be imposed, In whileh ease the vearty cash fows will be only 522 mulion. At the same time, there is a 50 Fe chance that the tax will not bo imposed, in which cove theyearly eash fows will be $3; B mulion. Ken is deciding whether to proceed with the hotel today or to wait a year to find out whether the tax will be imposed. If Kim waits a year, the initial investment aill remain at $20 milian, Assume that all cast flows are discounted at 13 W. Use the Black-5choles model to eatimate the value of the option. Assume that the variance of the grojects rate of return is 0,0732 and that the fisk-free rate is 846 . Do not round intermediate calculations, Enter your answer in malions. For example, an anmer of $1.3.4 millon should be entered as 1.234, not 1,234,000. Round your answer to three decimal places. Use computer software pocicages, such as Minitab or Excel, to solve this