Answered step by step

Verified Expert Solution

Question

1 Approved Answer

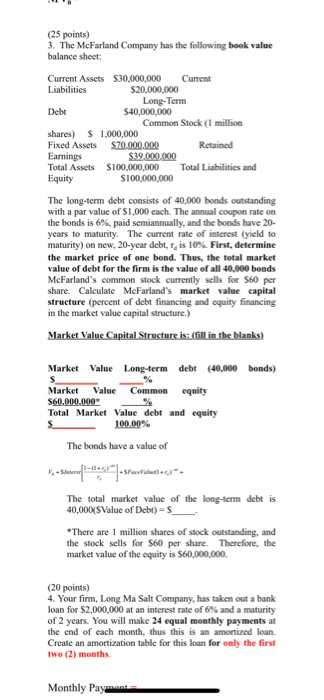

use information to answer quesrion 4 (25 points) 3. The McFarland Company has the following book value balance sheet: Current Assets $30,000,000 Current Liabilities $20,000,000

use information to answer quesrion 4

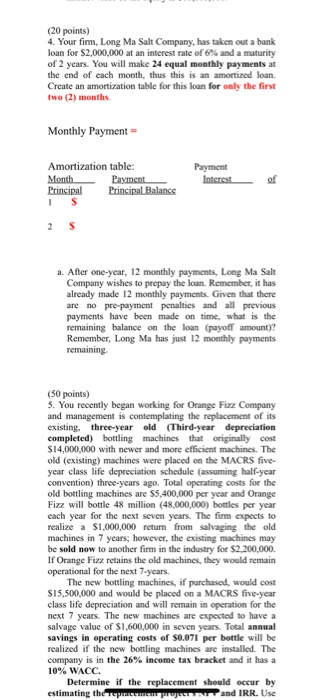

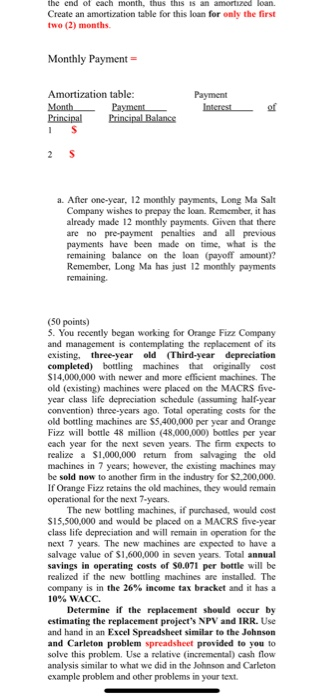

(25 points) 3. The McFarland Company has the following book value balance sheet: Current Assets $30,000,000 Current Liabilities $20,000,000 Long-Term Debt $40,000,000 Common Stock (1 million shares) $ 1,000,000 Fixed Assets $70.000.000 Retained Earnings $39.000.000 Total Assets $100,000,000 Total Liabilities and Equity S100,000,000 The long-term debt consists of 40,000 bonds outstanding with a par value of $1.000 cach. The annual coupon rate on the bonds is 6%, paid semiannually, and the bonds have 20- years to maturity. The current rate of interest yield to maturity) on new, 20-year debt, is 10% First, determine the market price of one bond. Thus, the total market value of debt for the firm is the value of all 40.000 bonds McFarland's common stock currently sells for $60 per share. Calculate McFarland's market value capital structure (percent of debt financing and equity financing in the market value capital structure.) Market Value Capital Structure is: (fill in the blanks) Market Value Long-term debt (40,000 bonds) Market Value $60.000.000* Common % equity 100.00% The bonds have a value of The total market value of the long-term 40.000/SValue of Debt) $ debt is * There are 1 million shares of stock outstanding, and the stock sells for $60 per share. Therefore, the market value of the equity is $60,000,000 (20 points) 4. Your firm, Long Ma Salt Company, has taken out a bank loan for $2,000,000 at an interest rate of 6% and a maturity of 2 years. You will make 24 equal monthly payments at the end of each month, thus this is an amortized loan. Create an amortization table for this loan for only the first two (2) months. Monthly Payment (20 points) 4. Your firm, Long Ma Salt Company, has taken out a bank loan for $2,000,000 at an interest rate of 6% and a maturity of 2 years. You will make 24 equal monthly payments at the end of each month, thus this is an amortized loan. Create an amortization table for this loan for only the first two (2) months Monthly Payment Amortization table: Month Payment Principal Principal Balance IS Payment Interest of 2 S a. After one-year, 12 monthly payments, Long Ma Salt Company wishes to prepay the loan. Remember, it has already made 12 monthly payments. Given that there are no pre-payment penalties and all previous payments have been made on time, what is the remaining balance on the loan (payoff amount)? Remember, Long Ma has just 12 monthly payments remaining (50 points) S. You recently began working for Orange Fizz Company and management is contemplating the replacement of its existing, three-year old (Third-year depreciation completed) bottling machines that originally cost $14,000,000 with newer and more efficient machines. The old (existing) machines were placed on the MACRS five year class life depreciation schedule (assuming half-year convention) three years ago. Total operating costs for the old bottling machines are 55,400,000 per year and Orange Fizz will bottle 48 million (48,000,000) bottles per year each year for the next seven years. The firm expects to realize a $1,000,000 retum from salvaging the old machines in 7 years, however, the existing machines may be sold now to another firm in the industry for $2.200.000 If Orange Fizz retains the old machines, they would remain operational for the next 7-years. The new bottling machines, if purchased, would cost SI5,500,000 and would be placed on a MACRS five-year class life depreciation and will remain in operation for the next 7 years. The new machines are expected to have a salvage value of $1.600.000 in seven years. Total annual savings in operating costs of $0.071 per bottle will be realized if the new bottling machines are installed. The company is in the 26% income tax bracket and it has a 10% WACC. Determine if the replacement should occur by estimating the price and IRR. Use the end of each month, thus this is an amortized loan. Create an amortization table for this loan for only the first two (2) months Monthly Payment = Amortization table: Month Payment - Principal Principal Balance IS Payment Interest of 2 S a. After one-year, 12 monthly payments, Long Ma Salt Company wishes to prepay the loan. Remember, it has already made 12 monthly payments. Given that there are no pre-payment penalties and all previous payments have been made on time, what is the remaining balance on the loan (payoff amount)? Remember, Long Ma has just 12 monthly payments remaining (50 points) 5. You recently began working for Orange Fizz Company and management is contemplating the replacement of its existing, three-year old (Third-year depreciation completed) bottling machines that originally cost $14,000,000 with newer and more efficient machines. The old (existing) machines were placed on the MACRS five year class life depreciation schedule (assuming half-year convention) three-years ago. Total operating costs for the old bottling machines are $5,400,000 per year and Orange Fizz will bottle 48 million (48,000,000) bottles per year each year for the next seven years. The firm expects to realize a $1,000,000 retum from salvaging the old machines in 7 years, however, the existing machines may be sold now to another firm in the industry for $2,200,000 If Orange Fizz retains the old machines, they would remain operational for the next 7-years. The new bottling machines, if purchased, would cost $15,500,000 and would be placed on a MACRS five-year class life depreciation and will remain in operation for the next 7 years. The new machines are expected to have a salvage value of $1.600.000 in seven years. Total annual savings in operating costs of S0.071 per bottle will be realized if the new bottling machines are installed. The company is in the 26% income tax bracket and it has a 10% WACC. Determine if the replacement should occur by estimating the replacement project's NPV and IRR. Use and hand in an Excel Spreadsheet similar to the Johnson and Carleton problem spreadsheet provided to you to solve this problem. Use a relative (incremental) cash flow analysis similar to what we did in the Johnson and Carleton example problem and other problems in your text Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started