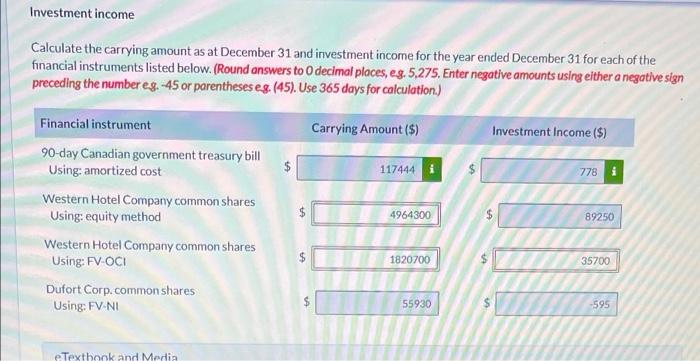

Investments On December 1, PHL purchased a $119,000, 90-day Canadian government treasury bill for $116,666 to yield 8%. During the year, PHL purchased 30% of the shares in Western Hotel Company, a company that owns a similar hotel property in a nearby city, for $5 million, a price corresponding to 30% of its book value. Subsequently, Western Hotel Company paid a dividend totalling $119,000 and earned income of $297,500. The fair value of the common shares as at December 31 was $6,069,000 PHL also purchased common shares of Dufort Corp, as a temporary investment for $57,120. At the end of the year, these shares had a fair value of $55,930, according to the December 31 closing price on the Toronto Stock Exchange. A dividend of $595 was received during the year. Investment income Calculate the carrying amount as at December 31 and investment income for the year ended December 31 for each of the financial instruments listed below. (Round answers to decimal places, eg. 5,275, Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses eg. (45). Use 365 days for calculation.) Carrying Amount ($) Investment Income (5) 117444 i 7781 Financial instrument 90-day Canadian government treasury bill Using: amortized cost Western Hotel Company common shares Using: equity method Western Hotel Company common shares Using: FV OCI Dufort Corp.common shares Using: FV.NI 4964300 $ $ 89250 $ 1820700 $ 35700 LA 55930 $ -595 e Textbook and Media Investments On December 1, PHL purchased a $119,000, 90-day Canadian government treasury bill for $116,666 to yield 8%. During the year, PHL purchased 30% of the shares in Western Hotel Company, a company that owns a similar hotel property in a nearby city, for $5 million, a price corresponding to 30% of its book value. Subsequently, Western Hotel Company paid a dividend totalling $119,000 and earned income of $297,500. The fair value of the common shares as at December 31 was $6,069,000 PHL also purchased common shares of Dufort Corp, as a temporary investment for $57,120. At the end of the year, these shares had a fair value of $55,930, according to the December 31 closing price on the Toronto Stock Exchange. A dividend of $595 was received during the year. Investment income Calculate the carrying amount as at December 31 and investment income for the year ended December 31 for each of the financial instruments listed below. (Round answers to decimal places, eg. 5,275, Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses eg. (45). Use 365 days for calculation.) Carrying Amount ($) Investment Income (5) 117444 i 7781 Financial instrument 90-day Canadian government treasury bill Using: amortized cost Western Hotel Company common shares Using: equity method Western Hotel Company common shares Using: FV OCI Dufort Corp.common shares Using: FV.NI 4964300 $ $ 89250 $ 1820700 $ 35700 LA 55930 $ -595 e Textbook and Media