Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Investors expect the market rate of return this y 1.2, and the excess return of ABC when market is neutral is expected to be 2

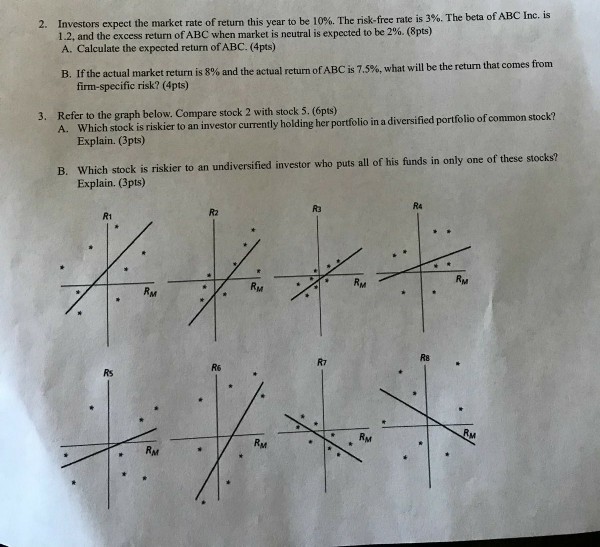

Investors expect the market rate of return this y 1.2, and the excess return of ABC when market is neutral is expected to be 2 A. Calculate the expected return of ABC. (4pts) ear to be 10%. The nsk-free rate is 3%. The beta of ABC Inc. is %. (8pts) 2. B. If the actual market return is 8% and the actual return ofABC is 7.5% what will be the return that comes from firm-specific risk? (4pts) Refer to the graph below. Compare stock 2 with stock 5. (6pts) A. Which stock is riskier to an investor currently holding her portfolio in a diversified portfolio of common stock? Explain. (3pts) 3. B. Which stock is riskier to an undiversified investor who puts all of his funds in only one of these stocks? Explain. (3pts) R3 R4 R1 R2 RM RM R8 R7 RM RM

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started