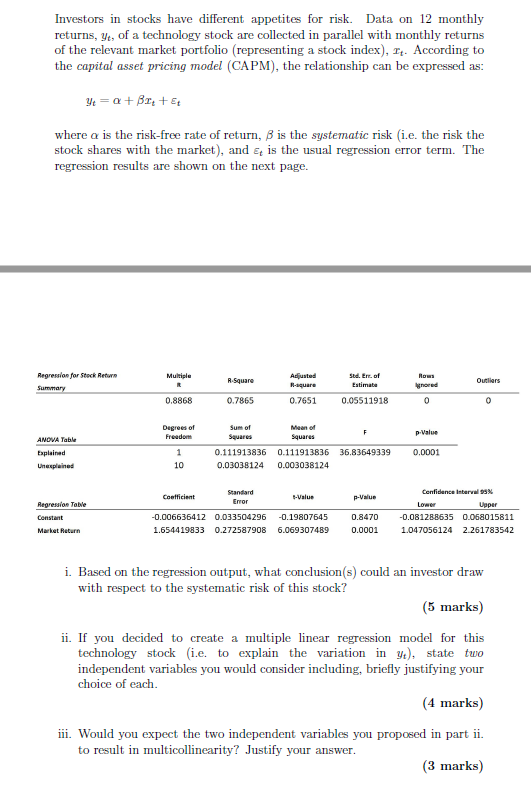

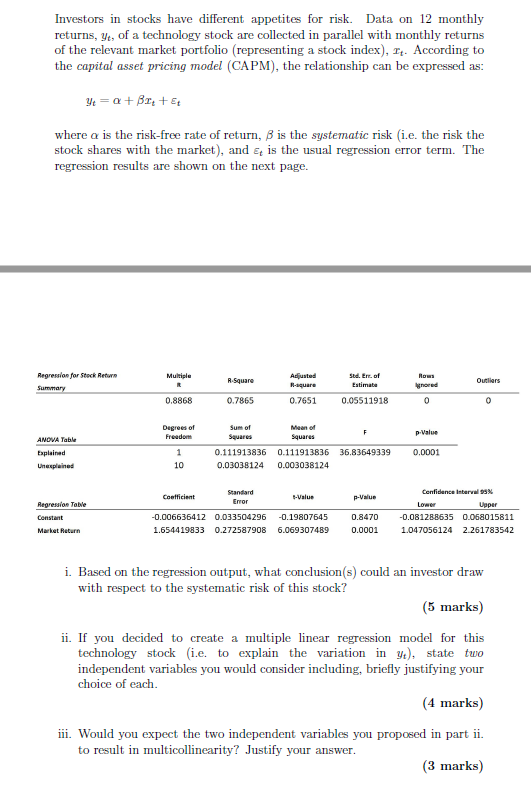

Investors in stocks have different appetites for risk. Data on 12 monthly returns, ye, of a technology stock are collected in parallel with monthly returns of the relevant market portfolio (representing a stock index), Tt. According to the capital asset pricing model (CAPM), the relationship can be expressed as: Ye=+BI++ Et where a is the risk-free rate of return, B is the systematic risk (i.e. the risk the stock shares with the market), and E is the usual regression error term. The regression results are shown on the next page. Regression for Stock Retwe Multiple R.Square Adjusted H-aquare sed. Err. of Estimate Outliers nored Summary 0.8868 0.7865 0.7651 0.05511918 0 O Sum of Mean of Degrees of Freedom F p Value ANOVA Table Squares Squares Explained 1 0.111913836 0.111913836 36.83649339 0.0001 Unexplained 10 0.03038124 0.003038124 Standard Confidence interval Coefficient s-Value | p-value Error Regression Table Upper Lower -0.081288635 0.068015811 Constant -0.006636412 0.033504296 -0.19807645 0.8470 Market Return 1.654419833 0.272587908 6.069307489 0.0001 1.047056124 2.261783542 i. Based on the regression output, what conclusion(s) could an investor draw with respect to the systematic risk of this stock? (5 marks) ii. If you decided to create a multiple linear regression model for this technology stock (i.e. to explain the variation in y), state two independent variables you would consider including, briefly justifying your choice of each. (4 marks) iii. Would you expect the two independent variables you proposed in part ii. to result in multicollinearity? Justify your answer. (3 marks) Investors in stocks have different appetites for risk. Data on 12 monthly returns, ye, of a technology stock are collected in parallel with monthly returns of the relevant market portfolio (representing a stock index), Tt. According to the capital asset pricing model (CAPM), the relationship can be expressed as: Ye=+BI++ Et where a is the risk-free rate of return, B is the systematic risk (i.e. the risk the stock shares with the market), and E is the usual regression error term. The regression results are shown on the next page. Regression for Stock Retwe Multiple R.Square Adjusted H-aquare sed. Err. of Estimate Outliers nored Summary 0.8868 0.7865 0.7651 0.05511918 0 O Sum of Mean of Degrees of Freedom F p Value ANOVA Table Squares Squares Explained 1 0.111913836 0.111913836 36.83649339 0.0001 Unexplained 10 0.03038124 0.003038124 Standard Confidence interval Coefficient s-Value | p-value Error Regression Table Upper Lower -0.081288635 0.068015811 Constant -0.006636412 0.033504296 -0.19807645 0.8470 Market Return 1.654419833 0.272587908 6.069307489 0.0001 1.047056124 2.261783542 i. Based on the regression output, what conclusion(s) could an investor draw with respect to the systematic risk of this stock? (5 marks) ii. If you decided to create a multiple linear regression model for this technology stock (i.e. to explain the variation in y), state two independent variables you would consider including, briefly justifying your choice of each. (4 marks) iii. Would you expect the two independent variables you proposed in part ii. to result in multicollinearity? Justify your