Answered step by step

Verified Expert Solution

Question

1 Approved Answer

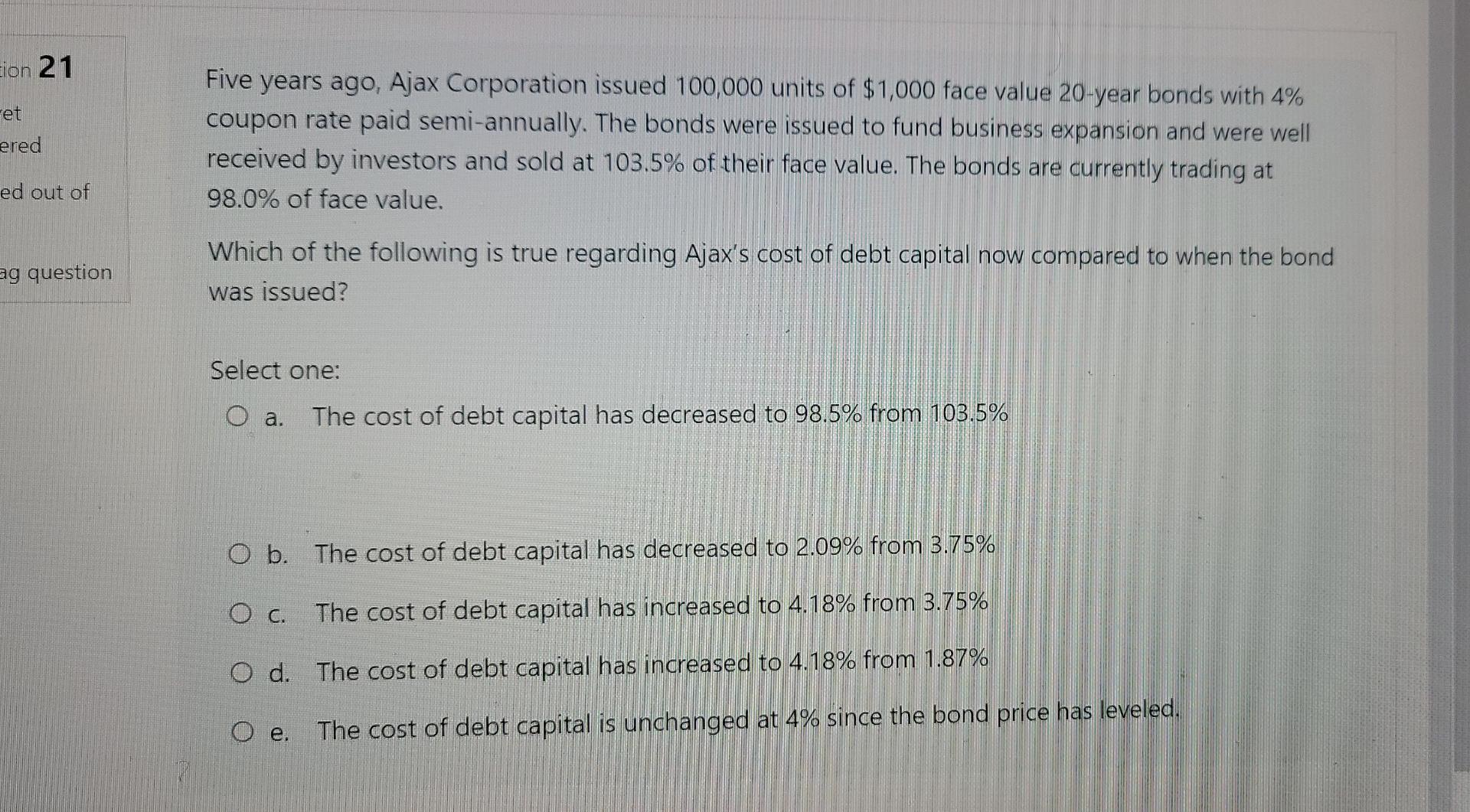

ion 21 et ered ed out of ag question Five years ago, Ajax Corporation issued 100,000 units of $1,000 face value 20-year bonds with 4%

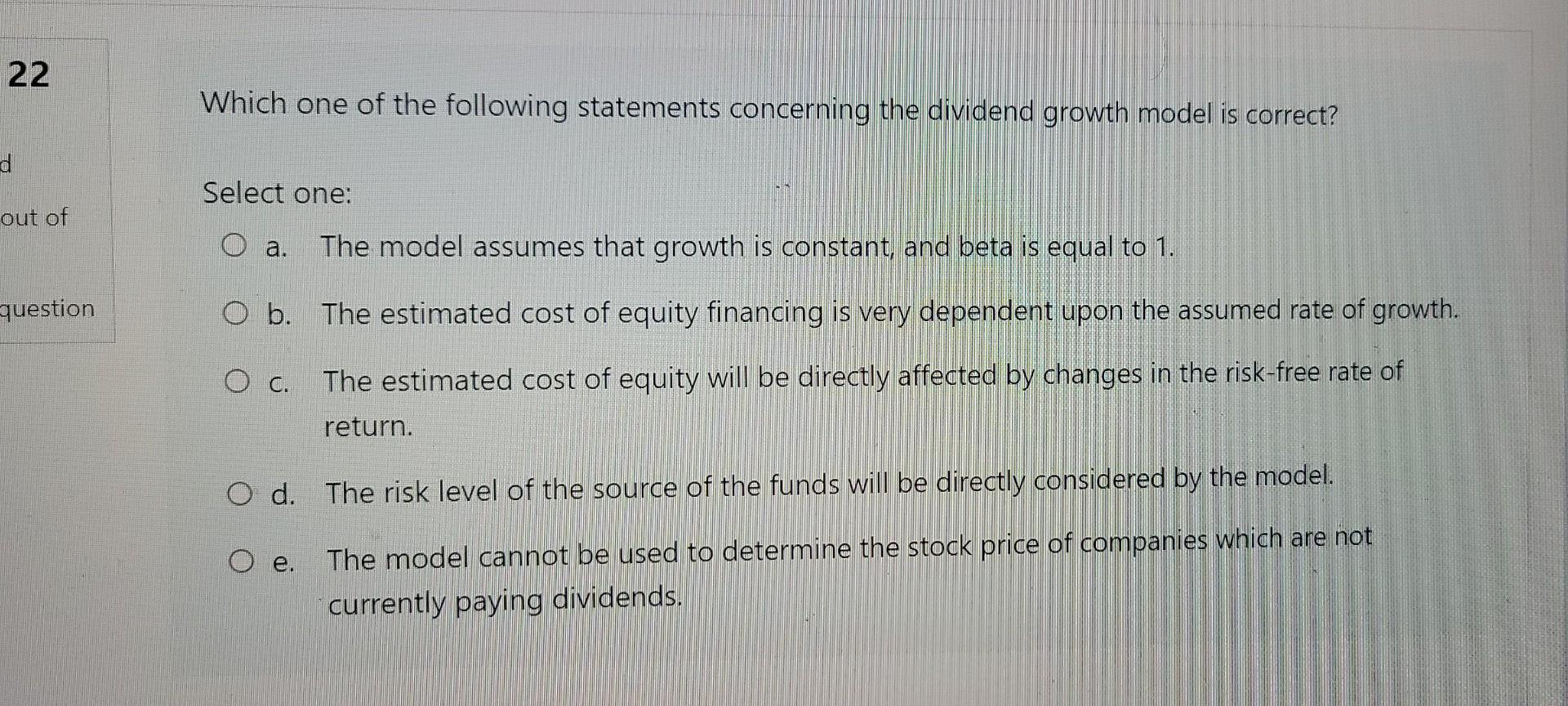

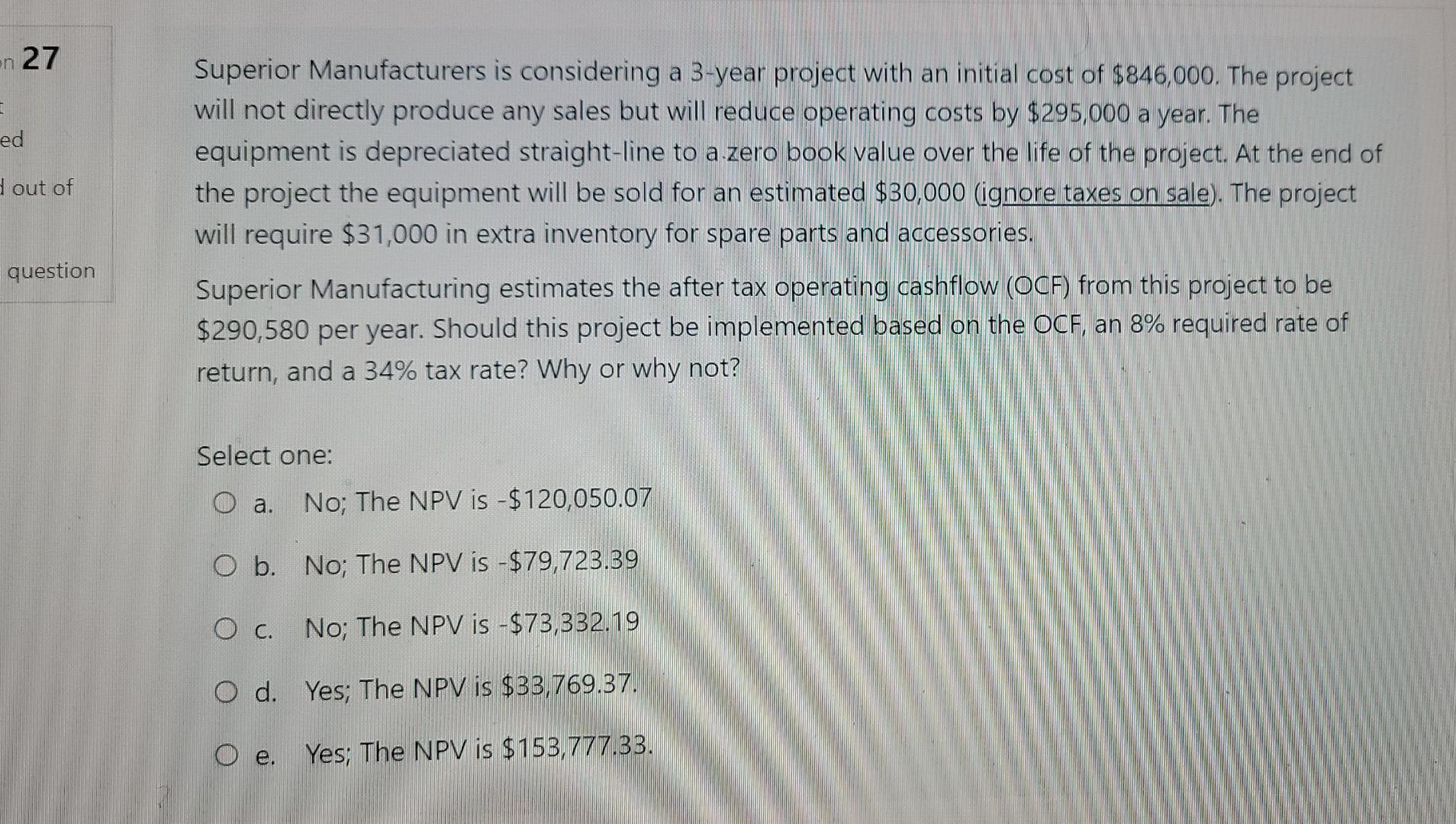

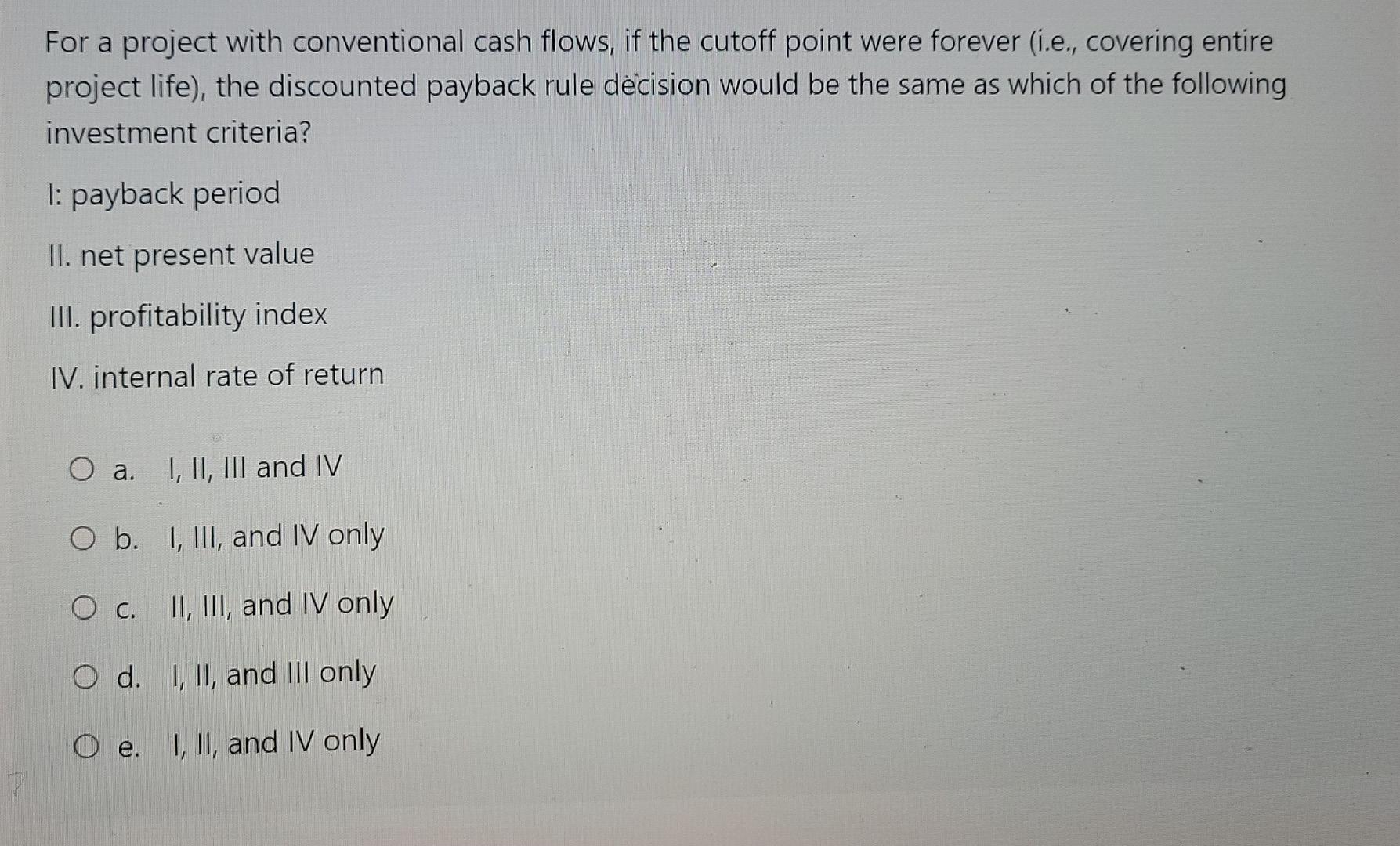

ion 21 et ered ed out of ag question Five years ago, Ajax Corporation issued 100,000 units of $1,000 face value 20-year bonds with 4% coupon rate paid semi-annually. The bonds were issued to fund business expansion and were well received by investors and sold at 103.5% of their face value. The bonds are currently trading at 98.0% of face value. Which of the following is true regarding Ajax's cost of debt capital now compared to when the bond was issued? Select one: Oa. The cost of debt capital has decreased to 98.5% from 103.5% O b. The cost of debt capital has decreased to 2.09% from 3.75% O c. The cost of debt capital has increased to 4.18% from 3.75% O d. The cost of debt capital has increased to 4.18% from 1.87% O e. The cost of debt capital is unchanged at 4% since the bond price has leveled. 22 d out of question Which one of the following statements concerning the dividend growth model is correct? Select one: a. The model assumes that growth is constant, and beta is equal to 1. O b. The estimated cost of equity financing is very dependent upon the assumed rate of growth. O C. The estimated cost of equity will be directly affected by changes in the risk-free rate of return. O d. The risk level of the source of the funds will be directly considered by the model. Oe. The model cannot be used to determine the stock price of companies which are not currently paying dividends. on 27 I ed d out of question Superior Manufacturers is considering a 3-year project with an initial cost of $846,000. The project will not directly produce any sales but will reduce operating costs by $295,000 a year. The equipment is depreciated straight-line to a zero book value over the life of the project. At the end of the project the equipment will be sold for an estimated $30,000 (ignore taxes on sale). The project will require $31,000 in extra inventory for spare parts and accessories. Superior Manufacturing estimates the after tax operating cashflow (OCF) from this project to be $290,580 per year. Should this project be implemented based on the OCF, an 8% required rate of return, and a 34% tax rate? Why or why not? Select one: O a. No; The NPV is -$120,050.07 O b. No; The NPV is -$79,723.39 O C. No; The NPV is -$73,332.19 O d. Yes; The NPV is $33,769.37. O e. Yes; The NPV is $153,777.33. For a project with conventional cash flows, if the cutoff point were forever (i.e., covering entire project life), the discounted payback rule decision would be the same as which of the following investment criteria? 1: payback period II. net present value III. profitability index IV. internal rate of return O a. I, II, III and IV O b. I, III, and IV only O c. II, III, and IV only. O d. I, II, and III only Oe. I, II, and IV only

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started