Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ion 9 et ered Assume you work in a mutual fund company in Oman and you manage an Equity Fund portfolio consisting of five stocks.

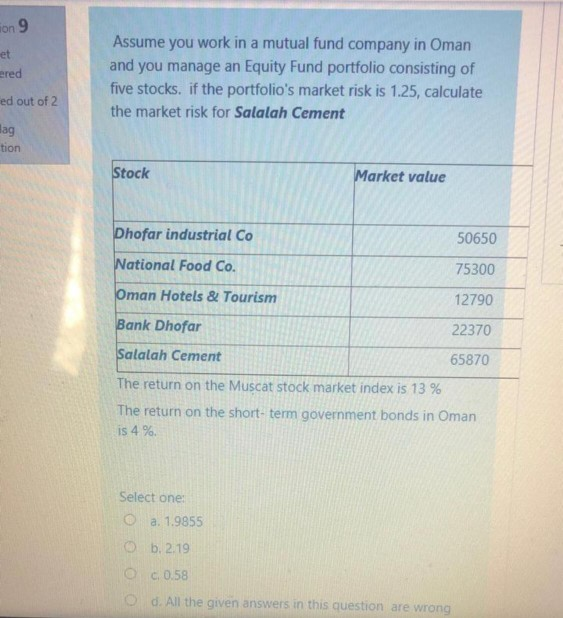

ion 9 et ered Assume you work in a mutual fund company in Oman and you manage an Equity Fund portfolio consisting of five stocks. if the portfolio's market risk is 1.25, calculate the market risk for Salalah Cement ed out of 2 lag tion Stock Market value Dhofar industrial Co 50650 National Food Co. 75300 Oman Hotels & Tourism 12790 Bank Dhofar 22370 Salalah Cement 65870 The return on the Muscat stock market index is 13% The return on the short-term government bonds in Oman is 4% Select one a. 1.9855 b. 2.19 C 0.58 Od. All the given answers in this question are wrong ion 9 et ered Assume you work in a mutual fund company in Oman and you manage an Equity Fund portfolio consisting of five stocks. if the portfolio's market risk is 1.25, calculate the market risk for Salalah Cement ed out of 2 lag tion Stock Market value Dhofar industrial Co 50650 National Food Co. 75300 Oman Hotels & Tourism 12790 Bank Dhofar 22370 Salalah Cement 65870 The return on the Muscat stock market index is 13% The return on the short-term government bonds in Oman is 4% Select one a. 1.9855 b. 2.19 C 0.58 Od. All the given answers in this question are wrong

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started