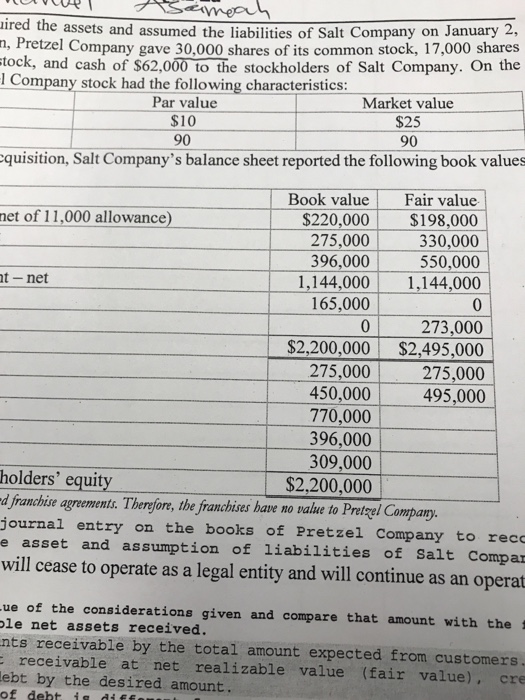

ired the assets and assumed the liabilities of Salt Company on January 2, , Pretzel Company gave 30,000 shares of its common stock, 17,000 shares tock, and cash of $62,000 to the stockholders of Salt Company. On the I Company stock had the following characteristics: Par value $10 90 Market value $25 90 quisition, Salt Company's balance sheet reported the following book values Book value Fair value S220,000 $198,000 330,000 550,000 1,144,000 1,144,000 0 273,000 $2,200,000 $2,495,000 275,000 275,000 net of 11,000 allowance) 275,000 396,000 t- net 165,000 450,000 495.000 770,000 396,000 309,000 $2,200,000 holders' equity d franchise agrements. Therefore, the franchises have no value to Pretel Company journal entry on the books of Pretzel Company to reco e asset and assumption of liabilities of Salt Compar will cease to operate as a legal entity and will continue as an operat ue of the considerations given and compare that amount with the le net assets received. nts receivable by the total amount expected from customers. receivable at net realizable value (fair value), cre ebt by the desired amount. of deht is dif ired the assets and assumed the liabilities of Salt Company on January 2, , Pretzel Company gave 30,000 shares of its common stock, 17,000 shares tock, and cash of $62,000 to the stockholders of Salt Company. On the I Company stock had the following characteristics: Par value $10 90 Market value $25 90 quisition, Salt Company's balance sheet reported the following book values Book value Fair value S220,000 $198,000 330,000 550,000 1,144,000 1,144,000 0 273,000 $2,200,000 $2,495,000 275,000 275,000 net of 11,000 allowance) 275,000 396,000 t- net 165,000 450,000 495.000 770,000 396,000 309,000 $2,200,000 holders' equity d franchise agrements. Therefore, the franchises have no value to Pretel Company journal entry on the books of Pretzel Company to reco e asset and assumption of liabilities of Salt Compar will cease to operate as a legal entity and will continue as an operat ue of the considerations given and compare that amount with the le net assets received. nts receivable by the total amount expected from customers. receivable at net realizable value (fair value), cre ebt by the desired amount. of deht is dif