Complete Problem 2-2B and submit your work to the drag & drop area below. P2-2B Iris Beck is a licensed CPA. During the first

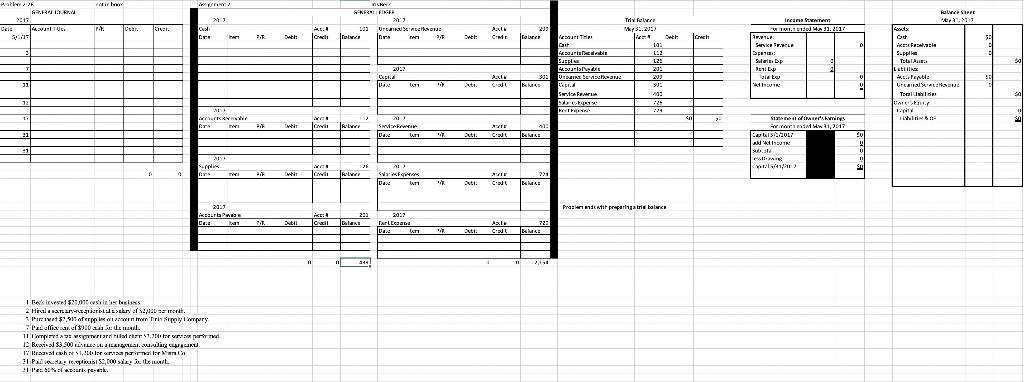

Complete Problem 2-2B and submit your work to the drag & drop area below. P2-2B Iris Beck is a licensed CPA. During the first month of operations of her business, the following events and transactions occurred. 5/1 Beck invested $20,000 cash in her business. 5/2 Hired a secretary-receptionist at a salary of $2,000 per month. 5/3 Purchased $2,500 of supplies on account from Tinio Supply Company. 5/7 Paid office rent of $900 cash for the month. 5/11 Completed a tax assignment and billed client $3,200 for services performed. 5/12 Received $3,500 advance on a management consulting engagement. 5/17 Received cash of $1,200 for services performed for Misra Co. 5/31 Paid secretary-receptionist $2,000 salary for the month. 5/31 Paid 60% of balance due Tinio Supply Company. Iris uses the following chart of accounts: No. 101 Cash, No. 112 Accounts Receivable, No. 126 Supplies, No. 201 Accounts Payable, No. 209 Unearned Service Revenue, No. 301 Owner's Capital, No. 400 Service Revenue, No. 726 Salaries and Wages Expense, and No. 729 Rent Expense. Instructions 1. Journalize the transactions. 2. Post to the ledger accounts. 3. Prepare a trial balance on May 31, 2017. eorir bo instr'e Triv Felwe Ircane StypTem Col 233 Jowet rolwen talbren ea TH Jowch Cdr Savie Spen 2i able Splie Salais. DE 20: 12 urlalveds Latiilka Capt.d ala tu ti. Sette Total l e 224 17 wwrii Mw1, 17 Towi 20:7 Prazien ndeatit preparinga trie balanc 211 an . Et oil la 20: Tartteana 722 Outi: I Bek iesesed 52ot ces ie an beisKS 2 Hiral asanary arbEhry ofal merat. 3 Pirivet911 of erpp let o wen n'Tirin Srpply l'ompery 11 I'mpireta: wegrertardi lat rter 1, hr vr parr 12 Beaisal 3500 ie LA ar. MA y u. 17 Reaavad h t1,Ir r narimai Ier Ann

Step by Step Solution

3.43 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started