Answered step by step

Verified Expert Solution

Question

1 Approved Answer

is based on Delta Airline's 2022 annual report. Use the following formula to calculate the company's sales to Property and Equipment for year ended 12/31/2022

is based on Delta Airline's 2022 annual report.

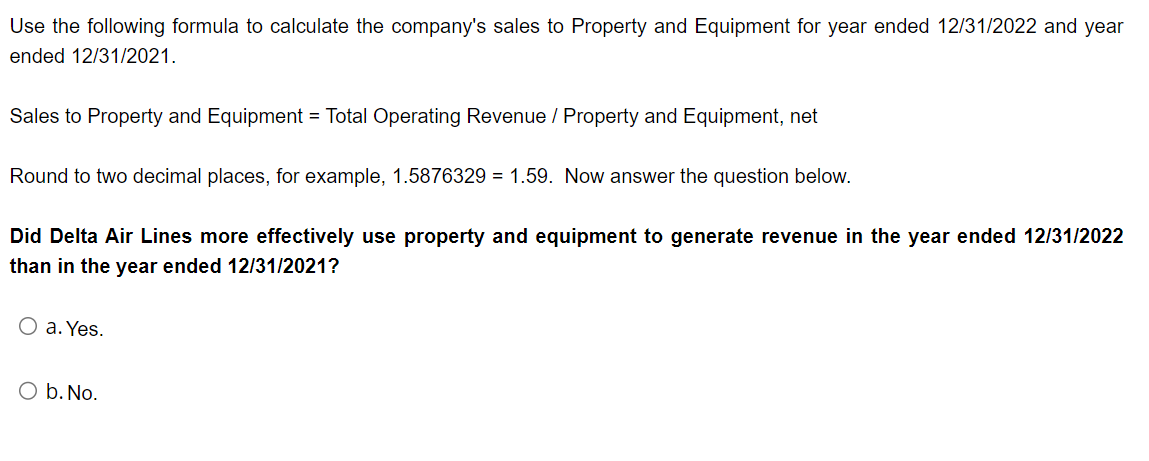

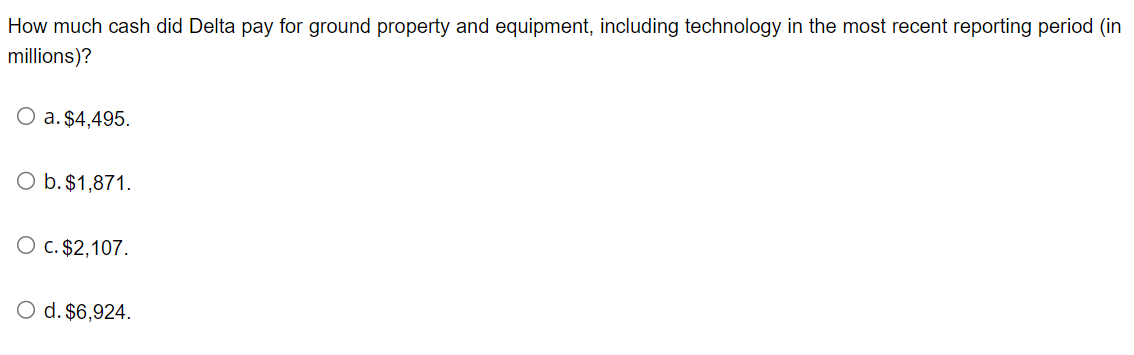

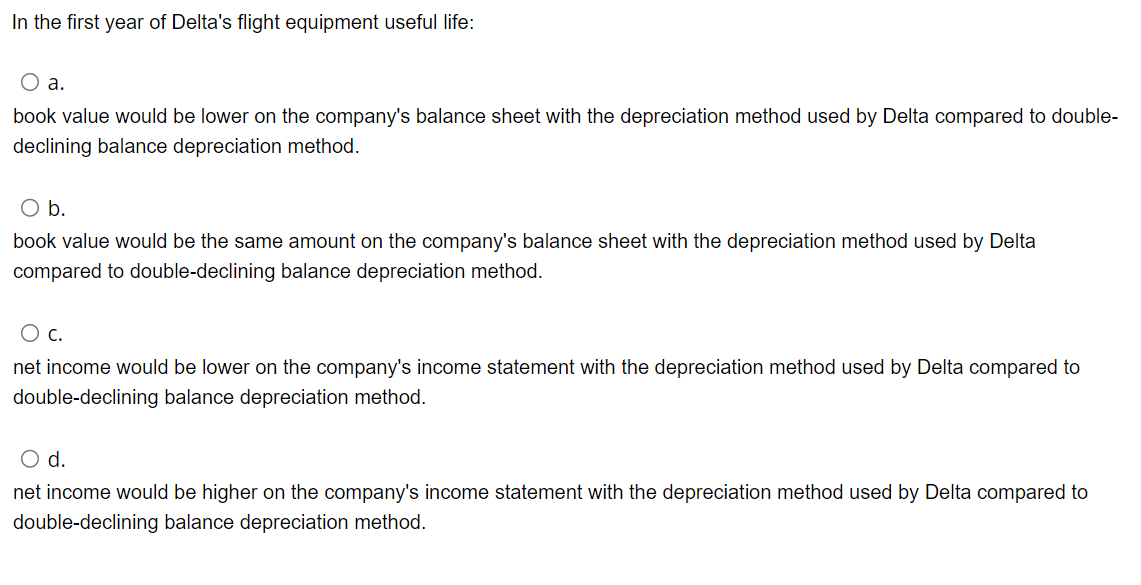

Use the following formula to calculate the company's sales to Property and Equipment for year ended 12/31/2022 and year ended 12/31/2021. Sales to Property and Equipment = Total Operating Revenue / Property and Equipment, net Round to two decimal places, for example, 1.5876329=1.59. Now answer the question below. Did Delta Air Lines more effectively use property and equipment to generate revenue in the year ended 12/31/2022 than in the year ended 12/31/2021? a. Yes. b. No. Delta depreciates ground property and equipment over useful lives of 25-34 years. a. True. b. False. In the first year of Delta's flight equipment useful life: a. book value would be lower on the company's balance sheet with the depreciation method used by Delta compared to doubledeclining balance depreciation method. b. book value would be the same amount on the company's balance sheet with the depreciation method used by Delta compared to double-declining balance depreciation method. c. net income would be lower on the company's income statement with the depreciation method used by Delta compared to double-declining balance depreciation method. d. net income would be higher on the company's income statement with the depreciation method used by Delta compared to double-declining balance depreciation method. Delta uses. depreciation method. a. double-declining balance b. straight-line C. units of activity How much cash did Delta pay for ground property and equipment, including technology in the most recent reporting period (in millions)? a. $4,495. b. $1,871. C. $2,107. d. $6,924. Use the following formula to calculate the company's sales to Property and Equipment for year ended 12/31/2022 and year ended 12/31/2021. Sales to Property and Equipment = Total Operating Revenue / Property and Equipment, net Round to two decimal places, for example, 1.5876329=1.59. Now answer the question below. Did Delta Air Lines more effectively use property and equipment to generate revenue in the year ended 12/31/2022 than in the year ended 12/31/2021? a. Yes. b. No. Delta depreciates ground property and equipment over useful lives of 25-34 years. a. True. b. False. In the first year of Delta's flight equipment useful life: a. book value would be lower on the company's balance sheet with the depreciation method used by Delta compared to doubledeclining balance depreciation method. b. book value would be the same amount on the company's balance sheet with the depreciation method used by Delta compared to double-declining balance depreciation method. c. net income would be lower on the company's income statement with the depreciation method used by Delta compared to double-declining balance depreciation method. d. net income would be higher on the company's income statement with the depreciation method used by Delta compared to double-declining balance depreciation method. Delta uses. depreciation method. a. double-declining balance b. straight-line C. units of activity How much cash did Delta pay for ground property and equipment, including technology in the most recent reporting period (in millions)? a. $4,495. b. $1,871. C. $2,107. d. $6,924Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started