Answered step by step

Verified Expert Solution

Question

1 Approved Answer

is concerned abou between a firm's profit and the exchange rate between US dollars and British pounds Draw an exposure diagram to illustrate the relationship

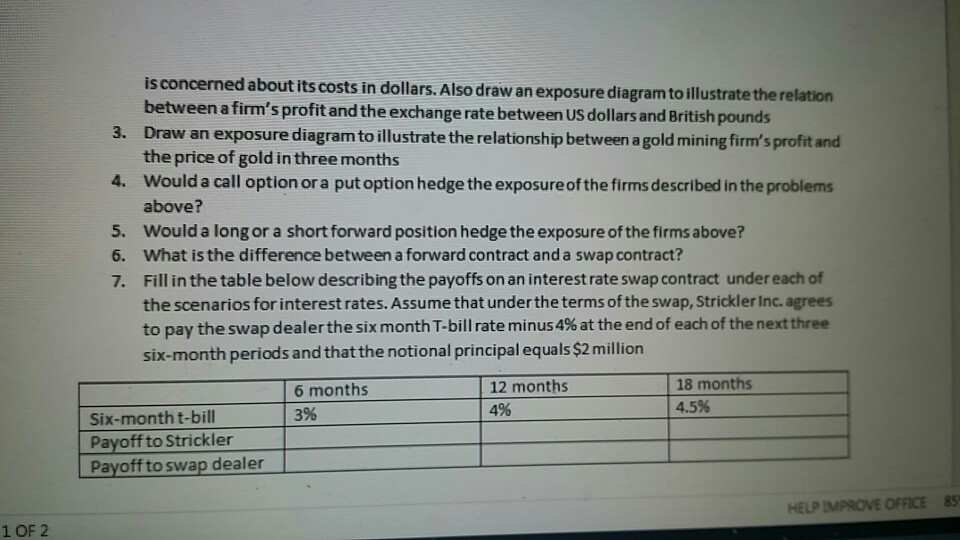

is concerned abou between a firm's profit and the exchange rate between US dollars and British pounds Draw an exposure diagram to illustrate the relationship between a gold mining firm's profit and the price of gold in three months Would a call option or a put option hedge the exposure of the firms described in the problems above? Would a long or a short forward position hedge the exposure of the firms above? What is the difference between a forward contract and a swap contract? Fill in the table below describing the payoffs on an interest rate swap contract under each of the scenarios for interest rates. Assume that underthe terms of the swap, Strickler Inc. agrees to pay the swap dealer the six month T-bill rate minus 4% at the end of each of the next three six-month periods and that the notional principal equals $2 million t its costs in dollars. Also draw an exposure diagram to illustrate the relation 3. 4. 5. 6. 7. 6 months 3% 12 months 4% 18 months 4.5% Six-month t-bill Payoff to Strickler Payoff to swap dealer HELP IMPROVE OFFICE 85 1 OF 2 is concerned abou between a firm's profit and the exchange rate between US dollars and British pounds Draw an exposure diagram to illustrate the relationship between a gold mining firm's profit and the price of gold in three months Would a call option or a put option hedge the exposure of the firms described in the problems above? Would a long or a short forward position hedge the exposure of the firms above? What is the difference between a forward contract and a swap contract? Fill in the table below describing the payoffs on an interest rate swap contract under each of the scenarios for interest rates. Assume that underthe terms of the swap, Strickler Inc. agrees to pay the swap dealer the six month T-bill rate minus 4% at the end of each of the next three six-month periods and that the notional principal equals $2 million t its costs in dollars. Also draw an exposure diagram to illustrate the relation 3. 4. 5. 6. 7. 6 months 3% 12 months 4% 18 months 4.5% Six-month t-bill Payoff to Strickler Payoff to swap dealer HELP IMPROVE OFFICE 85 1 OF 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started