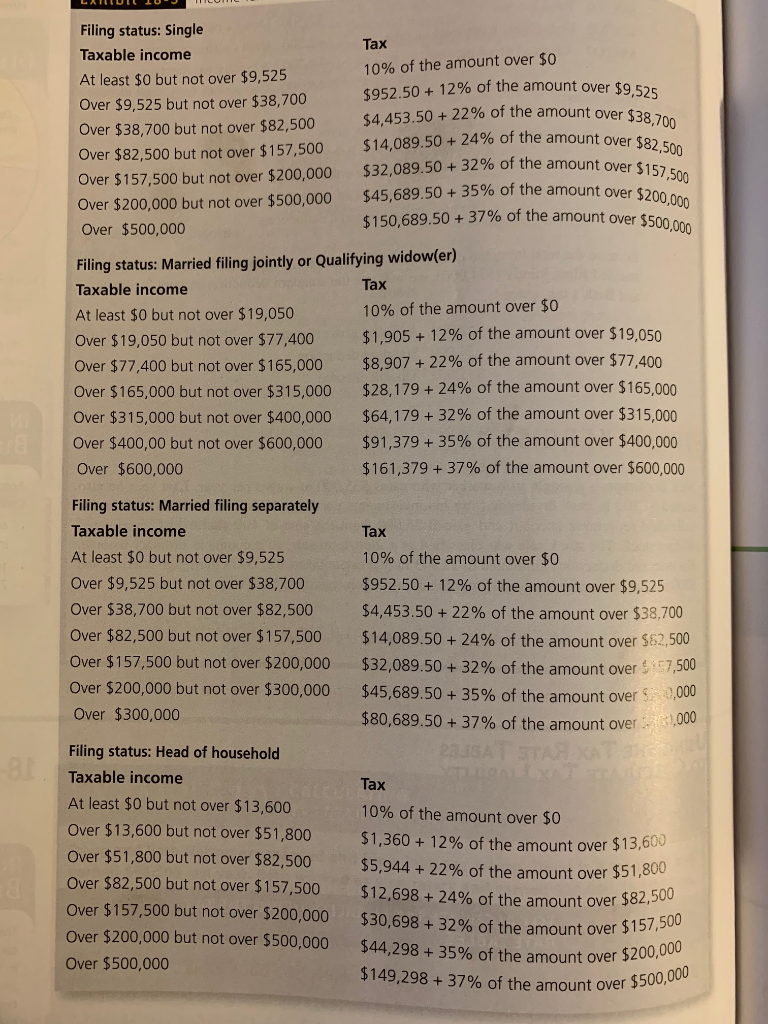

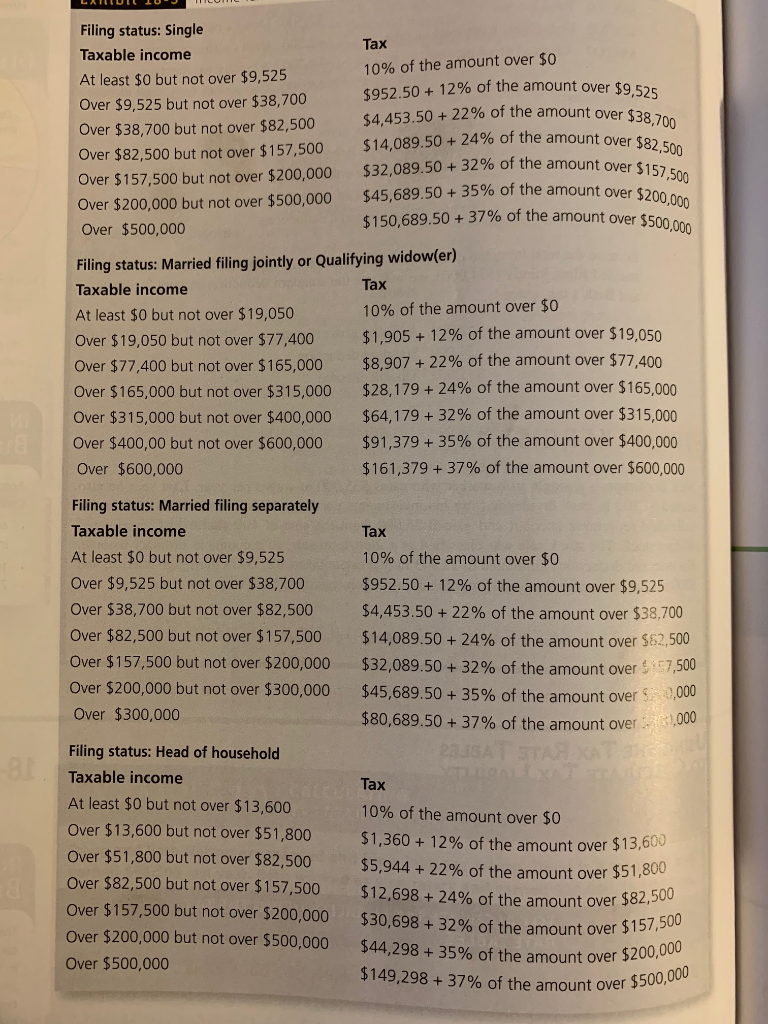

Isabella is filing as head of a household. Her taxable income is $68,014. Use the tax table attached to find the tax liability.

a. $9,296.76

b. 12,863.09

c. $12,393.08

d. $13,206.64

Filing status: Single Tax Taxable income 10% of the amount over $0 At least $0 but not over $9,525 Over $9,525 but not over $38,700 $952.50 + 12% of the amount over $9.52s $4,453.50 + 22% of the amount over $38,700 $14,089.50 + 24% of the amount over $82,500 Over $38,700 but not over $82,500 Over $82,500 but not over $157,500 $32,089.50 + 32% of the amount over $157 500 $45,689.50 + 35% of the amount over $200,000 $150.689.50 + 37% of the amount over $500 000 Over $157,500 but not over $200,000 Over $200,000 but not over $500,000 Over $500,000 Filing status: Married filing jointly or Qualifying widow(er) Tax Taxable income 10% of the amount over $0 At least $0 but not over $19,050 $1,905 + 12% of the amount over $19,050 Over $19,050 but not over $77,400 $8,907 + 22% of the amount over $77,400 Over $77,400 but not over $165,000 $28,179 + 24% of the amount over $165,000 Over $165,000 but not over $315,000 $64,179 + 32% of the amount over $315,000 Over $315,000 but not over $400,000 BE $91,379 + 35% of the amount over $400,000 Over $400,00 but not over $600,000 $161,379 + 37% of the amount over $600,000 Over $600,000 Filing status: Married filing separately Taxable income Tax At least $0 but not over $9,525 10% of the amount over $0 Over $9,525 but not over $38,700 $952.50 + 12% of the amount over $9,525 Over $38,700 but not over $82,500 $4,453.50 + 22% of the amount over $38,700 Over $82,500 but not over $157,500 $14,089.50 + 24% of the amount over $62,500 Over $157,500 but not over $200,000 $32,089.50 + 32% of the amount over 7,500 Over $200,000 but not over $300,000 $45,689.50 + 35% of the amount over $0,000 $80,689.50 + 37% of the amount over ,000 Over $300,000 Filing status: Head of household Taxable income Tax At least $0 but not over $13,600 10% of the amount over $0 Over $13,600 but not over $51,800 $1,360 + 12% of the amount over $13,600 Over $51,800 but not over $82,500 $5,944 + 22% of the amount over $51,800 $12,698 + 24% of the amount over $82,500 $30,698 + 32% of the amount over $157,500 Over $82,500 but not over $157,500 Over $157,500 but not over $200,000 Over $200,000 but not over $500,000 $44,298 + 35% of the amount over $200,000 Over $500,000 $149,298 + 37% of the amount over $500,000 Filing status: Single Tax Taxable income 10% of the amount over $0 At least $0 but not over $9,525 Over $9,525 but not over $38,700 $952.50 + 12% of the amount over $9.52s $4,453.50 + 22% of the amount over $38,700 $14,089.50 + 24% of the amount over $82,500 Over $38,700 but not over $82,500 Over $82,500 but not over $157,500 $32,089.50 + 32% of the amount over $157 500 $45,689.50 + 35% of the amount over $200,000 $150.689.50 + 37% of the amount over $500 000 Over $157,500 but not over $200,000 Over $200,000 but not over $500,000 Over $500,000 Filing status: Married filing jointly or Qualifying widow(er) Tax Taxable income 10% of the amount over $0 At least $0 but not over $19,050 $1,905 + 12% of the amount over $19,050 Over $19,050 but not over $77,400 $8,907 + 22% of the amount over $77,400 Over $77,400 but not over $165,000 $28,179 + 24% of the amount over $165,000 Over $165,000 but not over $315,000 $64,179 + 32% of the amount over $315,000 Over $315,000 but not over $400,000 BE $91,379 + 35% of the amount over $400,000 Over $400,00 but not over $600,000 $161,379 + 37% of the amount over $600,000 Over $600,000 Filing status: Married filing separately Taxable income Tax At least $0 but not over $9,525 10% of the amount over $0 Over $9,525 but not over $38,700 $952.50 + 12% of the amount over $9,525 Over $38,700 but not over $82,500 $4,453.50 + 22% of the amount over $38,700 Over $82,500 but not over $157,500 $14,089.50 + 24% of the amount over $62,500 Over $157,500 but not over $200,000 $32,089.50 + 32% of the amount over 7,500 Over $200,000 but not over $300,000 $45,689.50 + 35% of the amount over $0,000 $80,689.50 + 37% of the amount over ,000 Over $300,000 Filing status: Head of household Taxable income Tax At least $0 but not over $13,600 10% of the amount over $0 Over $13,600 but not over $51,800 $1,360 + 12% of the amount over $13,600 Over $51,800 but not over $82,500 $5,944 + 22% of the amount over $51,800 $12,698 + 24% of the amount over $82,500 $30,698 + 32% of the amount over $157,500 Over $82,500 but not over $157,500 Over $157,500 but not over $200,000 Over $200,000 but not over $500,000 $44,298 + 35% of the amount over $200,000 Over $500,000 $149,298 + 37% of the amount over $500,000