Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Isabelle purchased a house for $520,000. She paid 20% of the purchase price as down payment and received a mortgage for the balance. The amortization

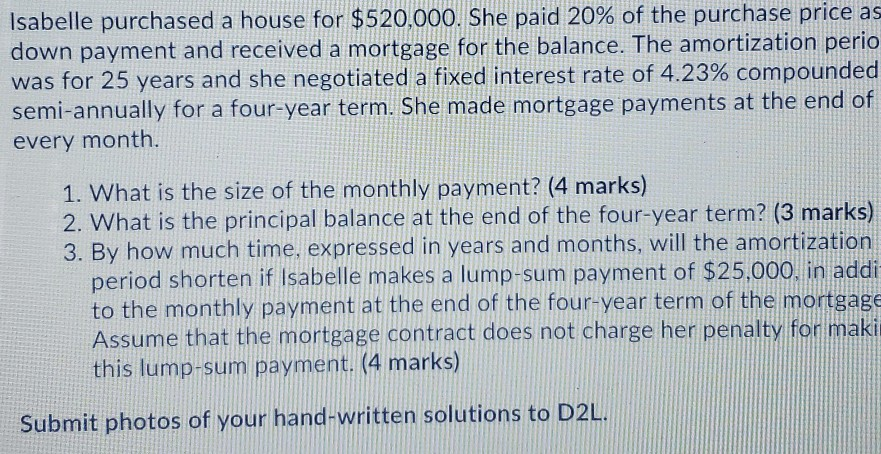

Isabelle purchased a house for $520,000. She paid 20% of the purchase price as down payment and received a mortgage for the balance. The amortization perio was for 25 years and she negotiated a fixed interest rate of 4.23% compounded semi-annually for a four-year term. She made mortgage payments at the end of every month. 1. What is the size of the monthly payment? (4 marks) 2. What is the principal balance at the end of the four-year term? (3 marks) 3. By how much time, expressed in years and months, will the amortization period shorten if Isabelle makes a lump-sum payment of $25,000, in addi to the monthly payment at the end of the four-year term of the mortgage Assume that the mortgage contract does not charge her penalty for maki this lump-sum payment. (4 marks) Submit photos of your hand-written solutions to D2L

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started