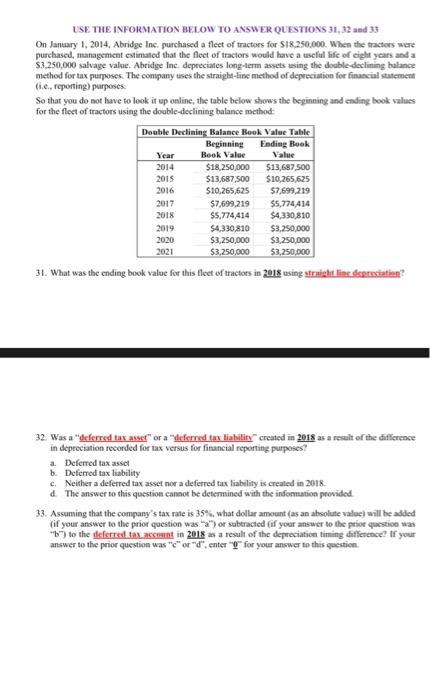

ISE THE INFORMATION BEILOW TO ANSWER QUESTIONS 31,32 and 3% On Jantary 1. 2014 , Abridge Inc. purchased a flect of tractors for 518,250.000. When the tractors were purchased, management estimated that the flect of tractors would have a useful hife of cight years and a $3,250,000 salvage valae. Abridge Ine. depreciales long-lerm assets asing the dochledeclining halance method for tax pumpses. The company tises the straigh-line method of depeciation for financial statement (i.c., foporting) parposes. So that you do not have to look it up online, the table below shows the beginning and ending book values for the fleet of tractors using the doable-declining balance method: 31. What was the cnding book value for this flect of tractots in 2018 using sfraight lime decpimatian? 32. Was a "uleferred tar awet" or a "deferred tas liabiliny" created in 2018 as a reselt of the difference in dcpecciation recorded for tax versus for financial reporting purposes? a. Deferted tax asset b. Defcrred tax liability c. Neither a deferred tax asset nor a deferred tax liablity is created in 2018 . d. The answer to ths question cannot be determined with the information provided. 33. Assuming that the company's tax rate is 35, what dollar amount (as an absolute valoe) will be added (if your answer to the prior question was - a1 ) or subtracted (if your answer to the priot gucseion was " b ") to the deferrest ias. accratnt in 201x as a result of the depreciation tirning difference? lf your answer to the prior question was "c" or "d", enter " " " for your answer to this caestion. ISE THE INFORMATION BEILOW TO ANSWER QUESTIONS 31,32 and 3% On Jantary 1. 2014 , Abridge Inc. purchased a flect of tractors for 518,250.000. When the tractors were purchased, management estimated that the flect of tractors would have a useful hife of cight years and a $3,250,000 salvage valae. Abridge Ine. depreciales long-lerm assets asing the dochledeclining halance method for tax pumpses. The company tises the straigh-line method of depeciation for financial statement (i.c., foporting) parposes. So that you do not have to look it up online, the table below shows the beginning and ending book values for the fleet of tractors using the doable-declining balance method: 31. What was the cnding book value for this flect of tractots in 2018 using sfraight lime decpimatian? 32. Was a "uleferred tar awet" or a "deferred tas liabiliny" created in 2018 as a reselt of the difference in dcpecciation recorded for tax versus for financial reporting purposes? a. Deferted tax asset b. Defcrred tax liability c. Neither a deferred tax asset nor a deferred tax liablity is created in 2018 . d. The answer to ths question cannot be determined with the information provided. 33. Assuming that the company's tax rate is 35, what dollar amount (as an absolute valoe) will be added (if your answer to the prior question was - a1 ) or subtracted (if your answer to the priot gucseion was " b ") to the deferrest ias. accratnt in 201x as a result of the depreciation tirning difference? lf your answer to the prior question was "c" or "d", enter " " " for your answer to this caestion