Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ishmael owns real estate (adjusted basis of $23,000 and fair market value of $28,000), which he uses in his business. Ishmael sells the real

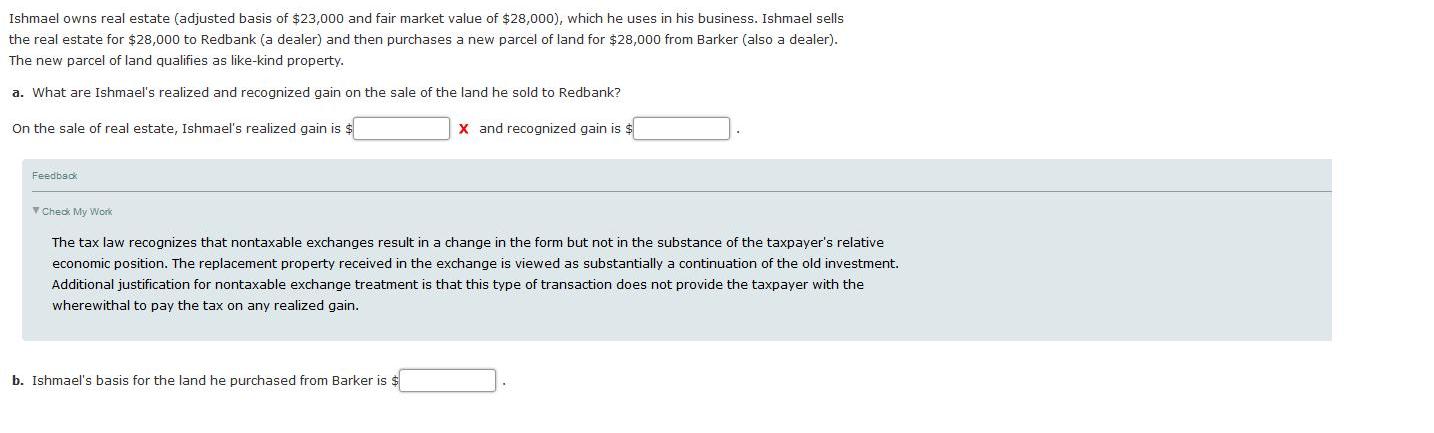

Ishmael owns real estate (adjusted basis of $23,000 and fair market value of $28,000), which he uses in his business. Ishmael sells the real estate for $28,000 to Redbank (a dealer) and then purchases a new parcel of land for $28,000 from Barker (also a dealer). The new parcel of land qualifies as like-kind property. a. What are Ishmael's realized and recognized gain on the sale of the land he sold to Redbank? On the sale of real estate, Ishmael's realized gain is $ Feedback Check My Work X and recognized gain is $ The tax law recognizes that nontaxable exchanges result in a change in the form but not in the substance of the taxpayer's relative economic position. The replacement property received in the exchange is viewed as substantially a continuation of the old investment. Additional justification for nontaxable exchange treatment is that this type of transaction does not provide the taxpayer with the wherewithal to pay the tax on any realized gain. b. Ishmael's basis for the land he purchased from Barker is $

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Realized gain appears when the asset is sold at higher price than the original price or book va...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started