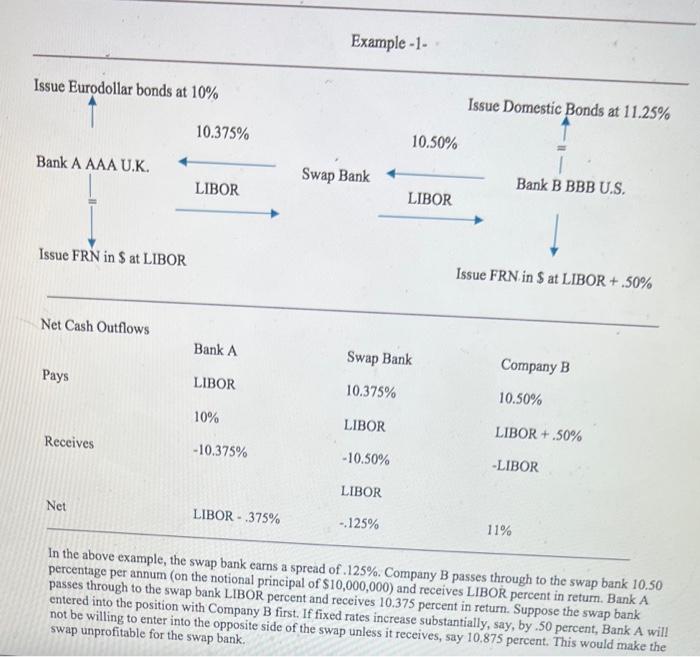

Issue Eurodollar bonds at 10% Bank A AAA U.K. Issue FRN in S at LIBOR Net Cash Outflows Pays Receives Net 10.375% LIBOR Bank A LIBOR 10% -10.375% LIBOR-.375% Example-1- Swap Bank 10.50% -.125% LIBOR Swap Bank 10.375% LIBOR -10.50% LIBOR Issue Domestic Bonds at 11.25% Bank B BBB U.S. Issue FRN. in $ at LIBOR +.50% Company B 10.50% LIBOR +50% -LIBOR 11% In the above example, the swap bank earns a spread of .125%. Company B passes through to the swap bank 10.50 percentage per annum (on the notional principal of $10,000,000) and receives LIBOR percent in return. Bank A passes through to the swap bank LIBOR percent and receives 10.375 percent in return. Suppose the swap bank entered into the position with Company B first. If fixed rates increase substantially, say, by .50 percent, Bank A will not be willing to enter into the opposite side of the swap unless it receives, say 10.875 percent. This would make the swap unprofitable for the swap bank. Having covered this example, come up with your own numbers illustrating the example above and expliang your answer, under what conditions in your example swap be unprofitable? Explain the following, give examples for each. Basis risk Exchange-rate risk Mismatch risk Sovereign risk Issue Eurodollar bonds at 10% Bank A AAA U.K. Issue FRN in S at LIBOR Net Cash Outflows Pays Receives Net 10.375% LIBOR Bank A LIBOR 10% -10.375% LIBOR-.375% Example-1- Swap Bank 10.50% -.125% LIBOR Swap Bank 10.375% LIBOR -10.50% LIBOR Issue Domestic Bonds at 11.25% Bank B BBB U.S. Issue FRN. in $ at LIBOR +.50% Company B 10.50% LIBOR +50% -LIBOR 11% In the above example, the swap bank earns a spread of .125%. Company B passes through to the swap bank 10.50 percentage per annum (on the notional principal of $10,000,000) and receives LIBOR percent in return. Bank A passes through to the swap bank LIBOR percent and receives 10.375 percent in return. Suppose the swap bank entered into the position with Company B first. If fixed rates increase substantially, say, by .50 percent, Bank A will not be willing to enter into the opposite side of the swap unless it receives, say 10.875 percent. This would make the swap unprofitable for the swap bank. Having covered this example, come up with your own numbers illustrating the example above and expliang your answer, under what conditions in your example swap be unprofitable? Explain the following, give examples for each. Basis risk Exchange-rate risk Mismatch risk Sovereign risk