Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Issue Questions: 1) Is the contract with Beta Corp a lease agreement for accounting purposes? Consider (a) Thetas right to mine the land, and (b)

Issue Questions:

1) Is the contract with Beta Corp a lease agreement for accounting purposes? Consider (a) Thetas right to mine the land, and (b) Thetas right to use Lessors access road. Using guidance from ASC 840 (Leases)

2) Determine how Theta should account for its contractual lease payments to Beta if this contract is determined not to be a lease for accounting purposes.

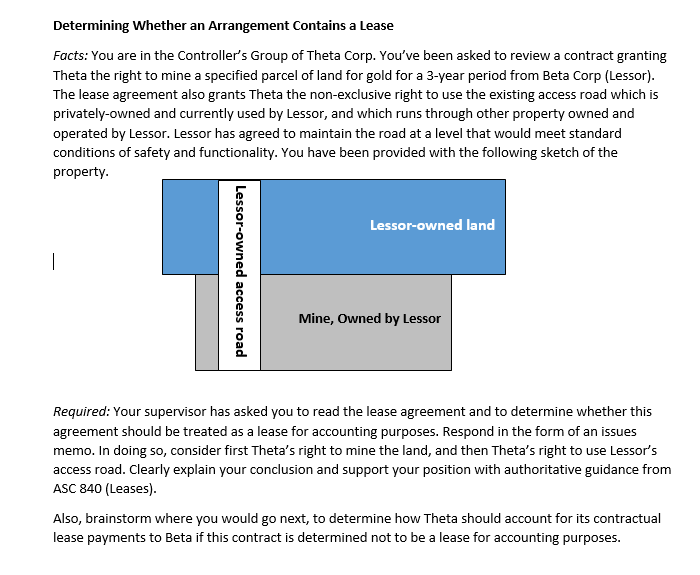

Determining whether an Arrangement Contains a Lease Facts: You are in the Controller's Group of Theta Corp. You've been asked to review a contract granting Theta the right to mine a specified parcel of land for gold for a 3-year period from Beta Corp (Lessor). The lease agreement also grants Theta the non exclusive right to use the existing access road which is privately-owned and currently used by Lessor and which runs through other property owned and operated by Lessor. Lessor has agreed to maintain the road at a level that would meet standard conditions of safety and functionality. You have been provided with the following sketch of the property Lessor-owned land Mine, owned by Lessor Required: Your supervisor has asked you to read the lease agreement and to determine whether this agreement should be treated as a lease for accounting purposes. Respond in the form of an issues memo. In doing so, consider first Theta's right to mine the land, and then Theta's right to use Lessor's access road Clearly explain your conclusion and support your position with authoritative guidance from ASC 840 (Leases). Also, brainstorm where you would go next, to determine how Theta should account for its contractual lease payments to Beta if this contract is determined not to be a lease for accounting purposesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started