Answered step by step

Verified Expert Solution

Question

1 Approved Answer

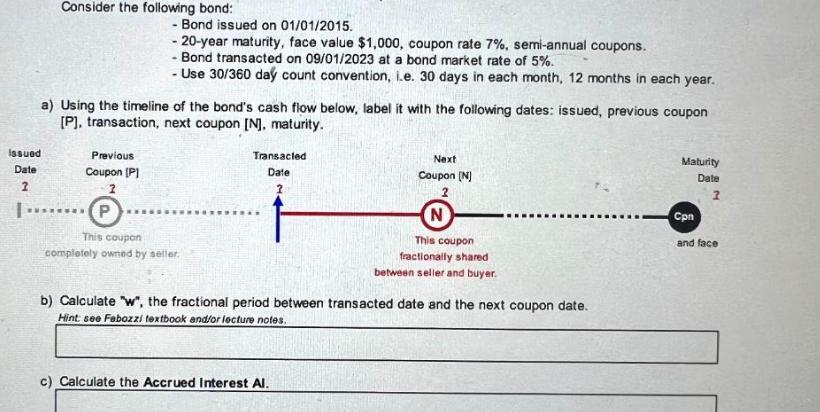

Issued Date 2 Consider the following bond: - Bond issued on 01/01/2015. - 20-year maturity, face value $1,000, coupon rate 7%, semi-annual coupons. -

![d) Calculate the Dirty [Full] Price of this bond. e) Calculate the Clean [Flat] Price of this bond.](https://dsd5zvtm8ll6.cloudfront.net/questions/2023/12/6573ecd95ddcf_1702142893297.jpg)

Issued Date 2 Consider the following bond: - Bond issued on 01/01/2015. - 20-year maturity, face value $1,000, coupon rate 7%, semi-annual coupons. - Bond transacted on 09/01/2023 at a bond market rate of 5%. - Use 30/360 day count convention, i.e. 30 days in each month, 12 months in each year. a) Using the timeline of the bond's cash flow below, label it with the following dates: issued, previous coupon [P], transaction, next coupon [N], maturity. Previous Coupon [P] P This coupon completely owned by seller. Transacted Date 2 Next Coupon (N) 2 N c) Calculate the Accrued Interest Al. This coupon fractionally shared between seller and buyer. b) Calculate "w", the fractional period between transacted date and the next coupon date. Hint: see Fabozzi textbook and/or lecture notes. Maturity Date 2 Cpn and face d) Calculate the Dirty [Full] Price of this bond. e) Calculate the Clean [Flat] Price of this bond.

Step by Step Solution

★★★★★

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Using the timeline of the bonds cash flow we can label the dates as follows Issued date 01012015 I...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started