Answered step by step

Verified Expert Solution

Question

1 Approved Answer

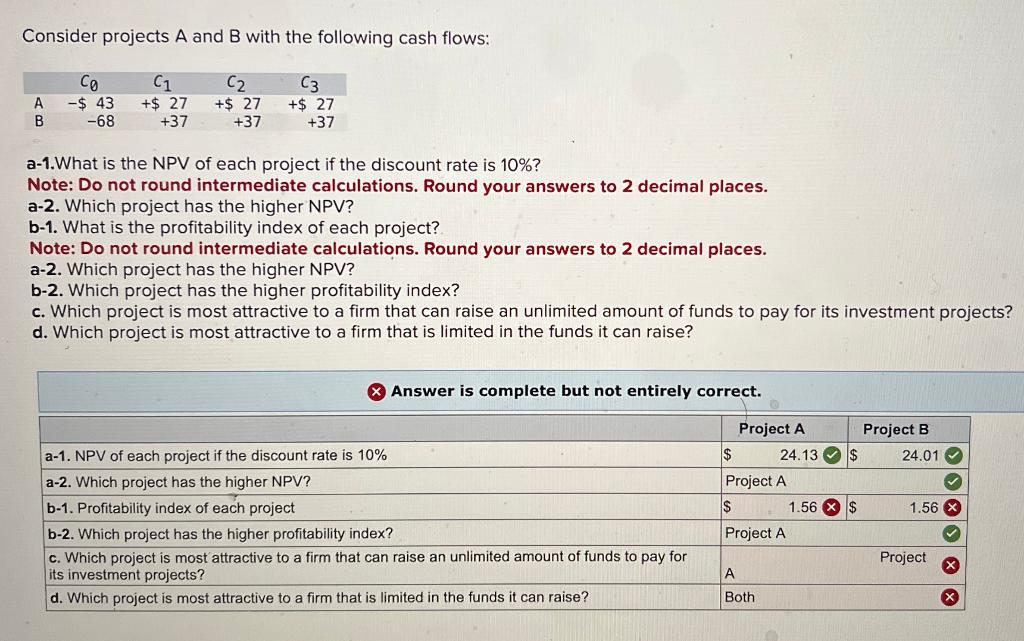

Consider projects A and B with the following cash flows: C +$ 27 +37 A B Co -$43 -68 C2 +$ 27 +37 C3

Consider projects A and B with the following cash flows: C +$ 27 +37 A B Co -$43 -68 C2 +$ 27 +37 C3 +$ 27 +37 a-1.What is the NPV of each project if the discount rate is 10%? Note: Do not round intermediate calculations. Round your answers to 2 decimal places. a-2. Which project has the higher NPV? b-1. What is the profitability index of each project? Note: Do not round intermediate calculations. Round your answers to 2 decimal places. a-2. Which project has the higher NPV? b-2. Which project has the higher profitability index? c. Which project is most attractive to a firm that can raise an unlimited amount of funds to pay for its investment projects? d. Which project is most attractive to a firm that is limited in the funds it can raise? Answer is complete but not entirely correct. a-1. NPV of each project if the discount rate is 10% a-2. Which project has the higher NPV? b-1. Profitability index of each project b-2. Which project has the higher profitability index? c. Which project is most attractive to a firm that can raise an unlimited amount of funds to pay for its investment projects? d. Which project is most attractive to a firm that is limited in the funds it can raise? Project A 24.13 $ Project A $ Project A A Both $ 1.56 $ Project B 24.01 >> * * * Project 1.56 X

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a1 NPV of project A 43 27110 27110 2 27110 3 43 24545452231404 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started