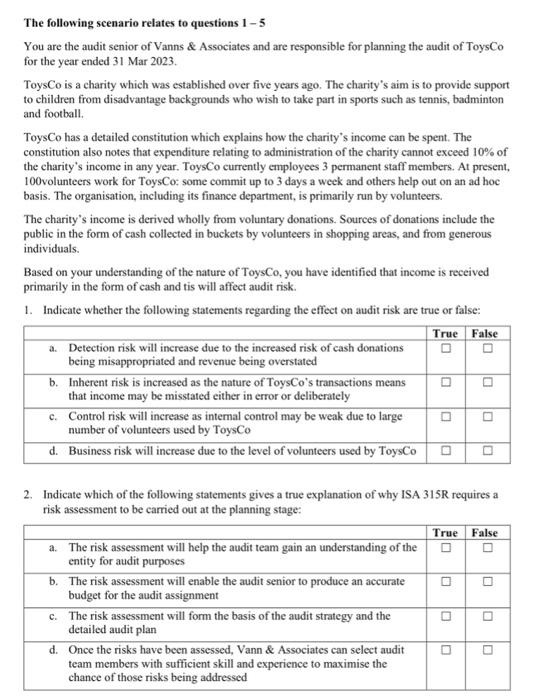

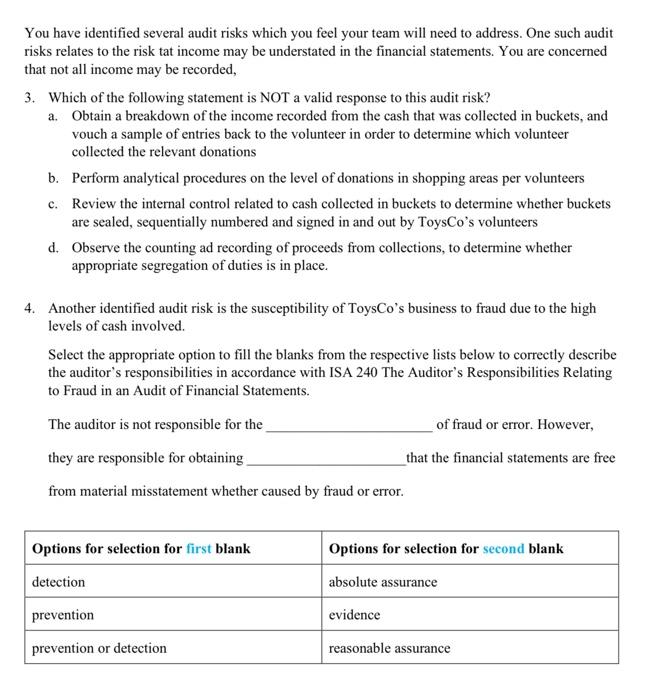

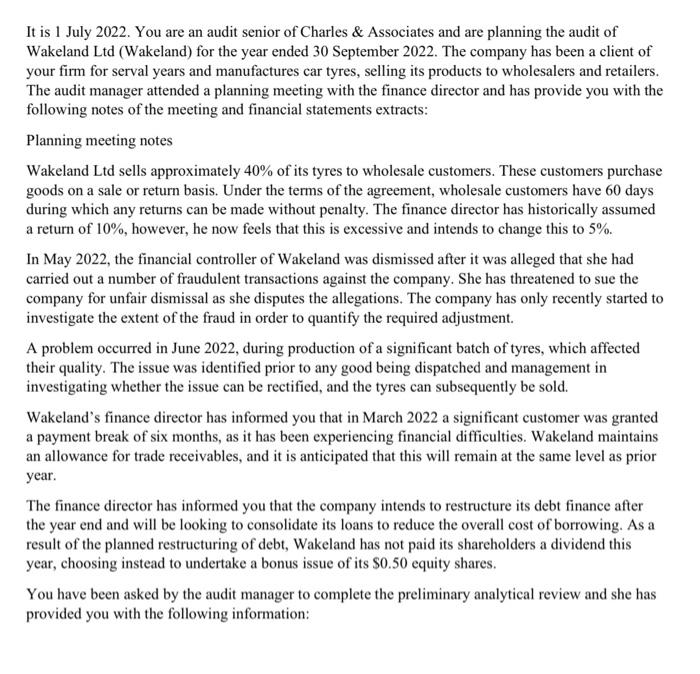

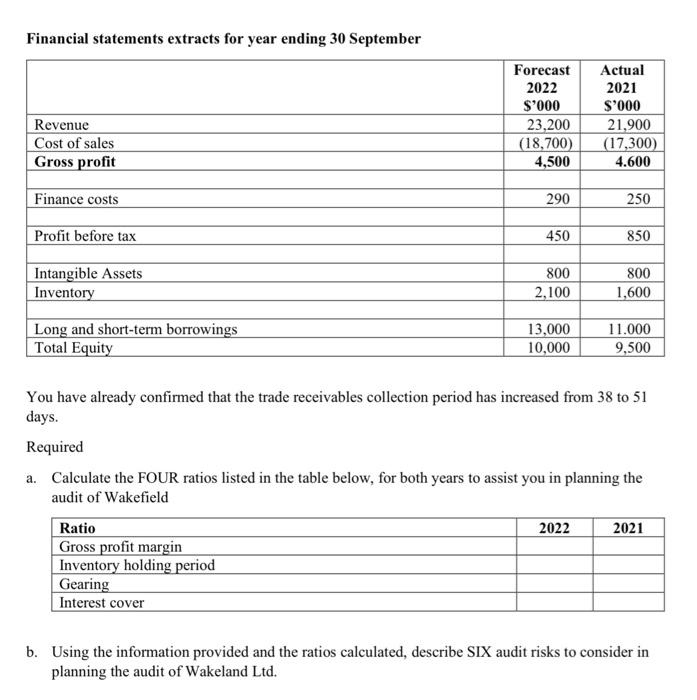

It is 1 July 2022. You are an audit senior of Charles \& Associates and are planning the audit of Wakeland Ltd (Wakeland) for the year ended 30 September 2022. The company has been a client of your firm for serval years and manufactures car tyres, selling its products to wholesalers and retailers. The audit manager attended a planning meeting with the finance director and has provide you with the following notes of the meeting and financial statements extracts: Planning meeting notes Wakeland Ltd sells approximately 40% of its tyres to wholesale customers. These customers purchase goods on a sale or return basis. Under the terms of the agreement, wholesale customers have 60 days during which any returns can be made without penalty. The finance director has historically assumed a return of 10%, however, he now feels that this is excessive and intends to change this to 5%. In May 2022, the financial controller of Wakeland was dismissed after it was alleged that she had carried out a number of fraudulent transactions against the company. She has threatened to sue the company for unfair dismissal as she disputes the allegations. The company has only recently started to investigate the extent of the fraud in order to quantify the required adjustment. A problem occurred in June 2022, during production of a significant batch of tyres, which affected their quality. The issue was identified prior to any good being dispatched and management in investigating whether the issue can be rectified, and the tyres can subsequently be sold. Wakeland's finance director has informed you that in March 2022 a significant customer was granted a payment break of six months, as it has been experiencing financial difficulties. Wakeland maintains an allowance for trade receivables, and it is anticipated that this will remain at the same level as prior year. The finance director has informed you that the company intends to restructure its debt finance after the year end and will be looking to consolidate its loans to reduce the overall cost of borrowing. As a result of the planned restructuring of debt, Wakeland has not paid its shareholders a dividend this year, choosing instead to undertake a bonus issue of its $0.50 equity shares. You have been asked by the audit manager to complete the preliminary analytical review and she has provided you with the following information: You have identified several audit risks which you feel your team will need to address. One such audit risks relates to the risk tat income may be understated in the financial statements. You are concerned that not all income may be recorded, 3. Which of the following statement is NOT a valid response to this audit risk? a. Obtain a breakdown of the income recorded from the cash that was collected in buckets, and vouch a sample of entries back to the volunteer in order to determine which volunteer collected the relevant donations b. Perform analytical procedures on the level of donations in shopping areas per volunteers c. Review the internal control related to cash collected in buckets to determine whether buckets are sealed, sequentially numbered and signed in and out by ToysCo's volunteers d. Observe the counting ad recording of proceeds from collections, to determine whether appropriate segregation of duties is in place. 4. Another identified audit risk is the susceptibility of ToysCo's business to fraud due to the high levels of cash involved. Select the appropriate option to fill the blanks from the respective lists below to correctly describe the auditor's responsibilities in accordance with ISA 240 The Auditor's Responsibilities Relating to Fraud in an Audit of Financial Statements. The auditor is not responsible for the of fraud or error. However, they are responsible for obtaining that the financial statements are free from material misstatement whether caused by fraud or error. The following scenario relates to questions 15 You are the audit senior of Vanns \& Associates and are responsible for planning the audit of ToysCo for the year ended 31 Mar 2023. ToysCo is a charity which was established over five years ago. The charity's aim is to provide support to children from disadvantage backgrounds who wish to take part in sports such as tennis, badminton and football. ToysCo has a detailed constitution which explains how the charity's income can be spent. The constitution also notes that expenditure relating to administration of the charity cannot exceed 10% of the charity's income in any year. ToysCo currently employees 3 permanent staff members. At present, 100volunteers work for ToysCo: some commit up to 3 days a week and others help out on an ad hoc basis. The organisation, including its finance department, is primarily run by volunteers. The charity's income is derived wholly from voluntary donations. Sources of donations include the public in the form of cash collected in buckets by volunteers in shopping areas, and from generous individuals. Based on your understanding of the nature of Toys Co, you have identified that income is received primarily in the form of cash and tis will affect audit risk. 1. Indicate whether the following statements regarding the effect on audit risk are true or false: 2. Indicate which of the following statements gives a true explanation of why ISA 315R requires a risk assessment to be carried out at the planning stage: Financial statements extracts for year ending 30 September You have already confirmed that the trade receivables collection period has increased from 38 to 51 days. Required a. Calculate the FOUR ratios listed in the table below, for both years to assist you in planning the audit of Wakefield b. Using the information provided and the ratios calculated, describe SIX audit risks to consider in planning the audit of Wakeland Ltd. It is 1 July 2022. You are an audit senior of Charles \& Associates and are planning the audit of Wakeland Ltd (Wakeland) for the year ended 30 September 2022. The company has been a client of your firm for serval years and manufactures car tyres, selling its products to wholesalers and retailers. The audit manager attended a planning meeting with the finance director and has provide you with the following notes of the meeting and financial statements extracts: Planning meeting notes Wakeland Ltd sells approximately 40% of its tyres to wholesale customers. These customers purchase goods on a sale or return basis. Under the terms of the agreement, wholesale customers have 60 days during which any returns can be made without penalty. The finance director has historically assumed a return of 10%, however, he now feels that this is excessive and intends to change this to 5%. In May 2022, the financial controller of Wakeland was dismissed after it was alleged that she had carried out a number of fraudulent transactions against the company. She has threatened to sue the company for unfair dismissal as she disputes the allegations. The company has only recently started to investigate the extent of the fraud in order to quantify the required adjustment. A problem occurred in June 2022, during production of a significant batch of tyres, which affected their quality. The issue was identified prior to any good being dispatched and management in investigating whether the issue can be rectified, and the tyres can subsequently be sold. Wakeland's finance director has informed you that in March 2022 a significant customer was granted a payment break of six months, as it has been experiencing financial difficulties. Wakeland maintains an allowance for trade receivables, and it is anticipated that this will remain at the same level as prior year. The finance director has informed you that the company intends to restructure its debt finance after the year end and will be looking to consolidate its loans to reduce the overall cost of borrowing. As a result of the planned restructuring of debt, Wakeland has not paid its shareholders a dividend this year, choosing instead to undertake a bonus issue of its $0.50 equity shares. You have been asked by the audit manager to complete the preliminary analytical review and she has provided you with the following information: You have identified several audit risks which you feel your team will need to address. One such audit risks relates to the risk tat income may be understated in the financial statements. You are concerned that not all income may be recorded, 3. Which of the following statement is NOT a valid response to this audit risk? a. Obtain a breakdown of the income recorded from the cash that was collected in buckets, and vouch a sample of entries back to the volunteer in order to determine which volunteer collected the relevant donations b. Perform analytical procedures on the level of donations in shopping areas per volunteers c. Review the internal control related to cash collected in buckets to determine whether buckets are sealed, sequentially numbered and signed in and out by ToysCo's volunteers d. Observe the counting ad recording of proceeds from collections, to determine whether appropriate segregation of duties is in place. 4. Another identified audit risk is the susceptibility of ToysCo's business to fraud due to the high levels of cash involved. Select the appropriate option to fill the blanks from the respective lists below to correctly describe the auditor's responsibilities in accordance with ISA 240 The Auditor's Responsibilities Relating to Fraud in an Audit of Financial Statements. The auditor is not responsible for the of fraud or error. However, they are responsible for obtaining that the financial statements are free from material misstatement whether caused by fraud or error. The following scenario relates to questions 15 You are the audit senior of Vanns \& Associates and are responsible for planning the audit of ToysCo for the year ended 31 Mar 2023. ToysCo is a charity which was established over five years ago. The charity's aim is to provide support to children from disadvantage backgrounds who wish to take part in sports such as tennis, badminton and football. ToysCo has a detailed constitution which explains how the charity's income can be spent. The constitution also notes that expenditure relating to administration of the charity cannot exceed 10% of the charity's income in any year. ToysCo currently employees 3 permanent staff members. At present, 100volunteers work for ToysCo: some commit up to 3 days a week and others help out on an ad hoc basis. The organisation, including its finance department, is primarily run by volunteers. The charity's income is derived wholly from voluntary donations. Sources of donations include the public in the form of cash collected in buckets by volunteers in shopping areas, and from generous individuals. Based on your understanding of the nature of Toys Co, you have identified that income is received primarily in the form of cash and tis will affect audit risk. 1. Indicate whether the following statements regarding the effect on audit risk are true or false: 2. Indicate which of the following statements gives a true explanation of why ISA 315R requires a risk assessment to be carried out at the planning stage: Financial statements extracts for year ending 30 September You have already confirmed that the trade receivables collection period has increased from 38 to 51 days. Required a. Calculate the FOUR ratios listed in the table below, for both years to assist you in planning the audit of Wakefield b. Using the information provided and the ratios calculated, describe SIX audit risks to consider in planning the audit of Wakeland Ltd