It is a question about CAPM

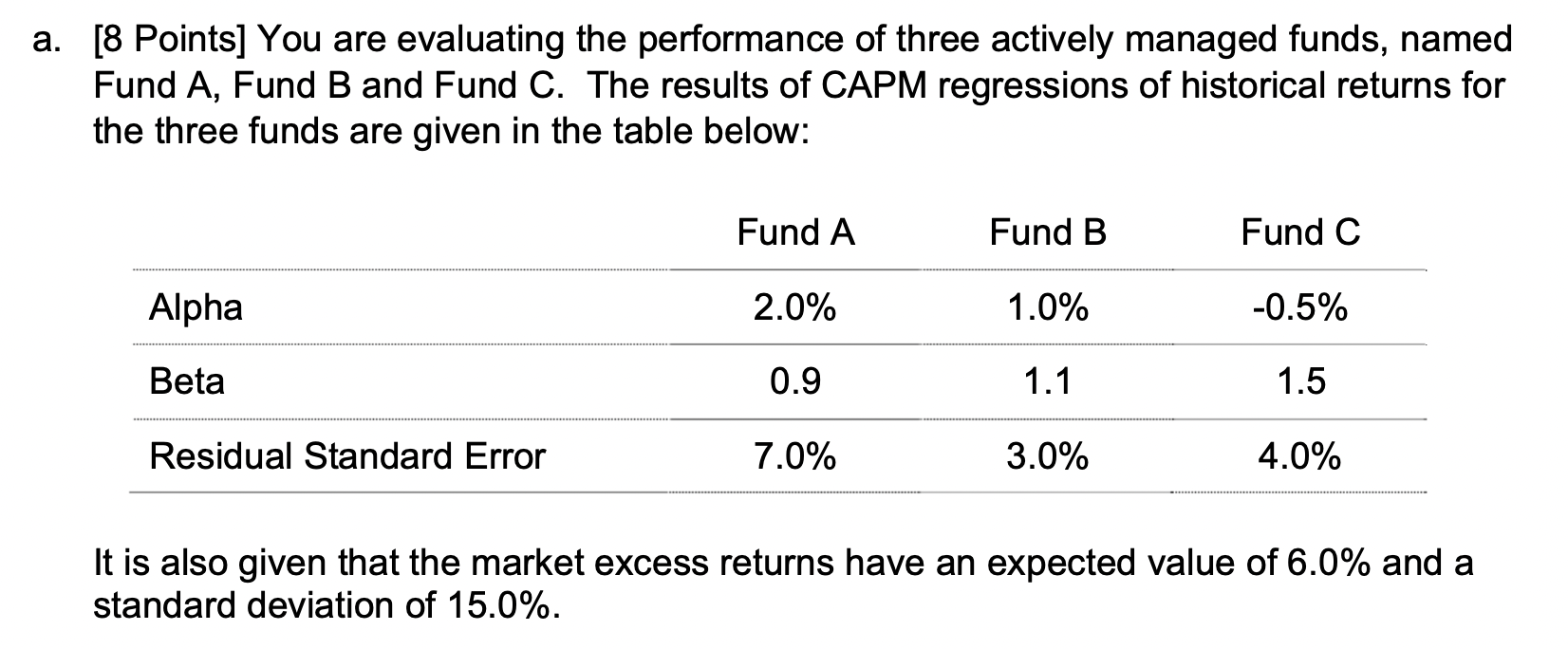

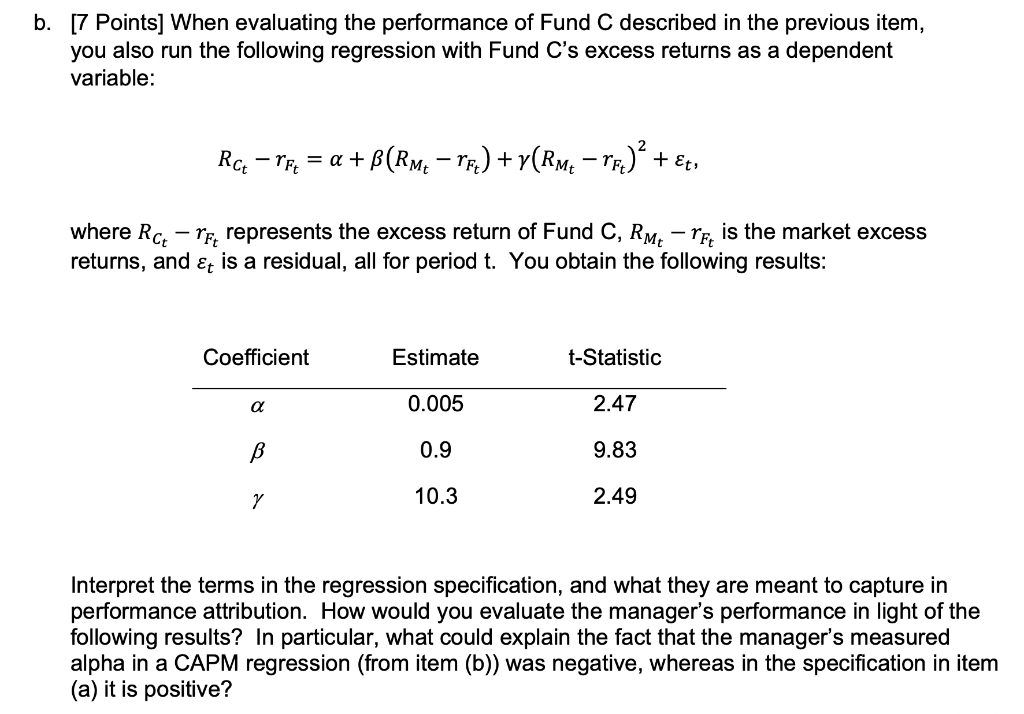

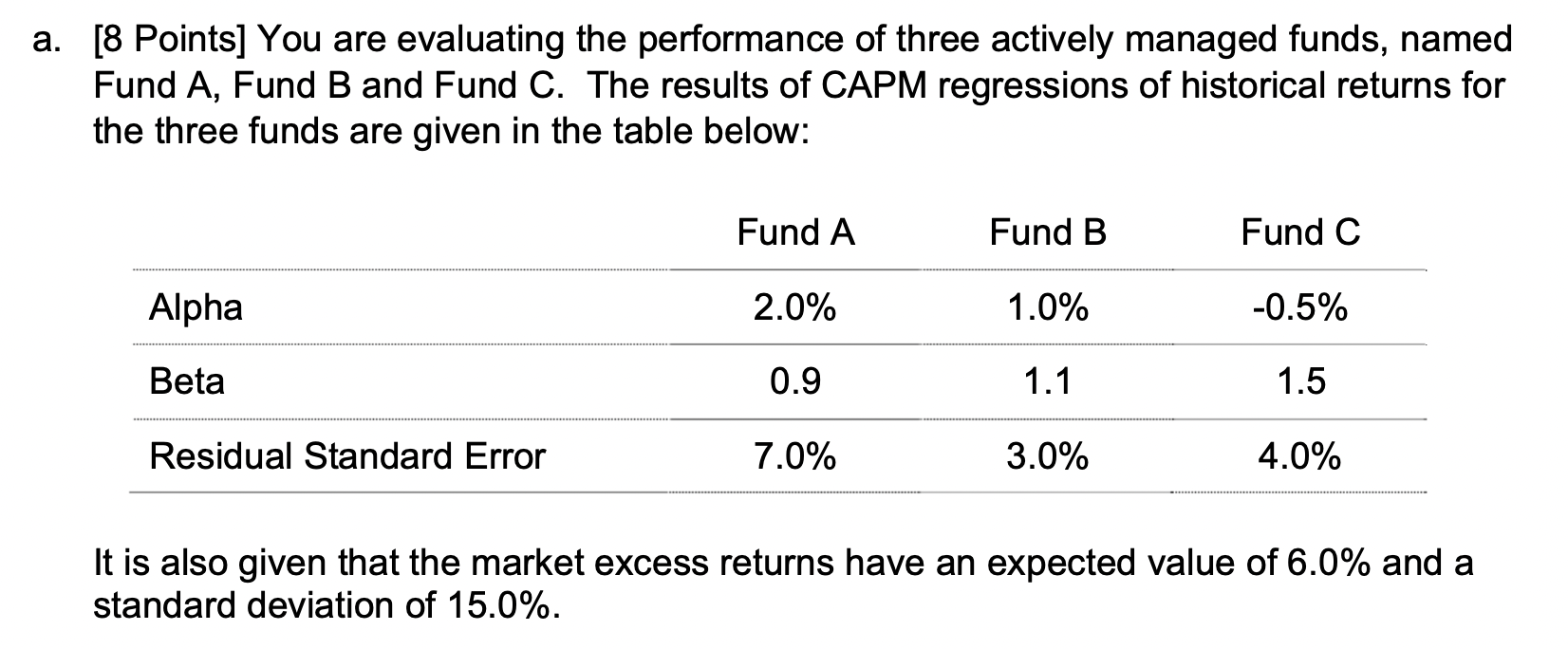

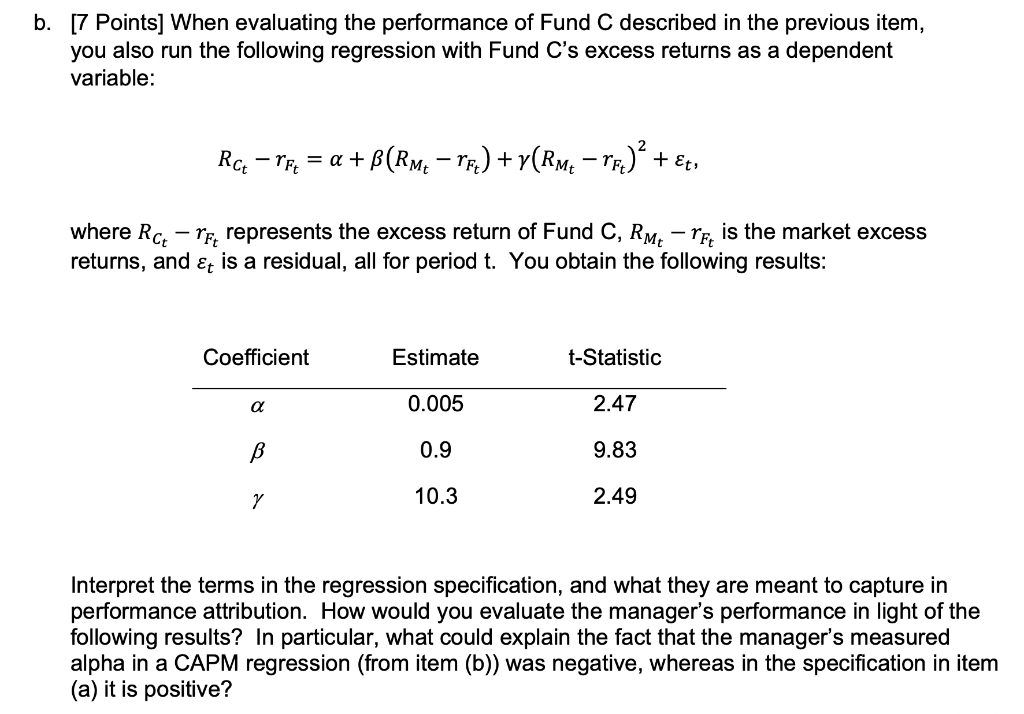

a. [8 Points] You are evaluating the performance of three actively managed funds, named Fund A, Fund B and Fund C. The results of CAPM regressions of historical returns for the three funds are given in the table below: Fund A Fund B Fund C Alpha 2.0% 1.0% -0.5% Beta 0.9 1.1 1.5 Residual Standard Error 7.0% 3.0% 4.0% It is also given that the market excess returns have an expected value of 6.0% and a standard deviation of 15.0%. b. [7 Points] When evaluating the performance of Fund C described in the previous item, you also run the following regression with Fund C's excess returns as a dependent variable: RG - NEE = a +B(Rm raz) +v(Rme rp)? +t, Ft - where Rct rey represents the excess return of Fund C, RME re is the market excess returns, and et is a residual, all for period t. You obtain the following results: Coefficient Estimate t-Statistic a 0.005 2.47 0.9 9.83 7 10.3 2.49 Interpret the terms in the regression specification, and what they are meant to capture in performance attribution. How would you evaluate the manager's performance in light of the following results? In particular, what could explain the fact that the manager's measured alpha in a CAPM regression (from item (b)) was negative, whereas in the specification in item (a) it is positive? a. [8 Points] You are evaluating the performance of three actively managed funds, named Fund A, Fund B and Fund C. The results of CAPM regressions of historical returns for the three funds are given in the table below: Fund A Fund B Fund C Alpha 2.0% 1.0% -0.5% Beta 0.9 1.1 1.5 Residual Standard Error 7.0% 3.0% 4.0% It is also given that the market excess returns have an expected value of 6.0% and a standard deviation of 15.0%. b. [7 Points] When evaluating the performance of Fund C described in the previous item, you also run the following regression with Fund C's excess returns as a dependent variable: RG - NEE = a +B(Rm raz) +v(Rme rp)? +t, Ft - where Rct rey represents the excess return of Fund C, RME re is the market excess returns, and et is a residual, all for period t. You obtain the following results: Coefficient Estimate t-Statistic a 0.005 2.47 0.9 9.83 7 10.3 2.49 Interpret the terms in the regression specification, and what they are meant to capture in performance attribution. How would you evaluate the manager's performance in light of the following results? In particular, what could explain the fact that the manager's measured alpha in a CAPM regression (from item (b)) was negative, whereas in the specification in item (a) it is positive