Question

It is a simulation in which you are the tax dictator for a mythical country. You must collect enough revenuebut not too muchfor your government

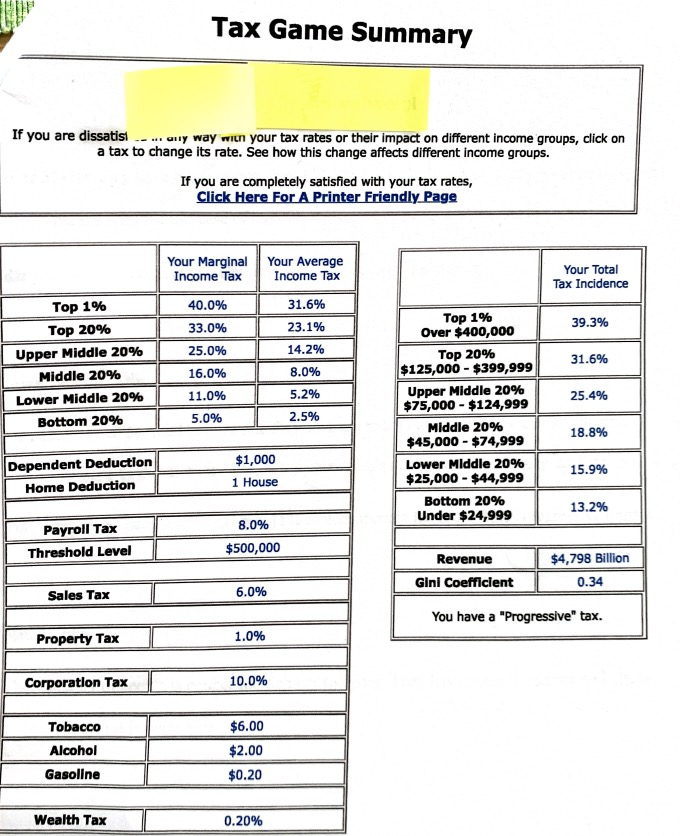

It is a simulation in which you are the tax dictator for a mythical country. You must collect enough revenuebut not too muchfor your government by adjusting a number of different tax rates, caps and deductions. When you collected sufficient revenue, the game will tell you the tax incidence. That is the impact of your tax choices on different income groups ranging from the bottom 20% to the top 1%. And, the program will estimate your Gini coefficient.

You will be asked to readjust you tax choices so that you are satisfied with your tax incidence. There is no correct answer to the game; each of you will differ in your political perspective and how you choose your tax rates.,

After you complete the Tax Game answer the following:

A.. What were your choices for the personal income marginal tax rates? How do your rates compare with current US rates (see them at the end of the tan book)? Why did you raise or lower the rates compared to the US?

B. What was your choice for the payroll tax (the rate and the threshold)? Why did you make this decision? Will it make the tax more progressive, less progressive, more regressive or less regressive? Why?

C. For the remaining taxes, which choice made the system more progressive? Why?

D. For the remaining taxes, which choice made the system more regressive? Why?

E. What was your final Gini coefficient? Is it higher or lower than the current US 0.4? What does this tell you about your tax choices?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started