Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It is an actuarial finance math question with swap rate Question 1 (2 points) Warren Bank and Asper Bank entered into a four year interest

It is an actuarial finance math question with swap rate

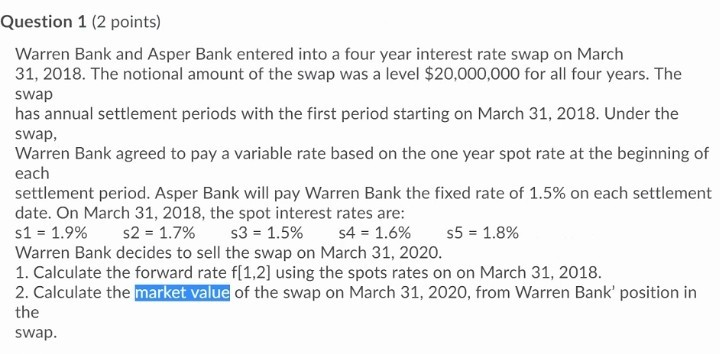

Question 1 (2 points) Warren Bank and Asper Bank entered into a four year interest rate swap on March 31, 2018. The notional amount of the swap was a level $20,000,000 for all four years. The swap has annual settlement periods with the first period starting on March 31, 2018. Under the swap, Warren Bank agreed to pay a variable rate based on the one year spot rate at the beginning of each settlement period. Asper Bank will pay Warren Bank the fixed rate of 1.5% on each settlement date. On March 31, 2018, the spot interest rates are: $1 = 1.9% s2 = 1.7% s3 = 1.5% s4 = 1.6% s5 = 1.8% Warren Bank decides to sell the swap on March 31, 2020. 1. Calculate the forward rate f[1,2] using the spots rates on on March 31, 2018. 2. Calculate the market value of the swap on March 31, 2020, from Warren Bank' position in the swap. Question 1 (2 points) Warren Bank and Asper Bank entered into a four year interest rate swap on March 31, 2018. The notional amount of the swap was a level $20,000,000 for all four years. The swap has annual settlement periods with the first period starting on March 31, 2018. Under the swap, Warren Bank agreed to pay a variable rate based on the one year spot rate at the beginning of each settlement period. Asper Bank will pay Warren Bank the fixed rate of 1.5% on each settlement date. On March 31, 2018, the spot interest rates are: $1 = 1.9% s2 = 1.7% s3 = 1.5% s4 = 1.6% s5 = 1.8% Warren Bank decides to sell the swap on March 31, 2020. 1. Calculate the forward rate f[1,2] using the spots rates on on March 31, 2018. 2. Calculate the market value of the swap on March 31, 2020, from Warren Bank' position in the swapStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started