Answered step by step

Verified Expert Solution

Question

1 Approved Answer

it is an assignment of module:- Innovation Management. please answer the question in 1500 words by reading the given case study. .Your answer should contain

it is an assignment of module:- Innovation Management. please answer the question in 1500 words by reading the given case study.

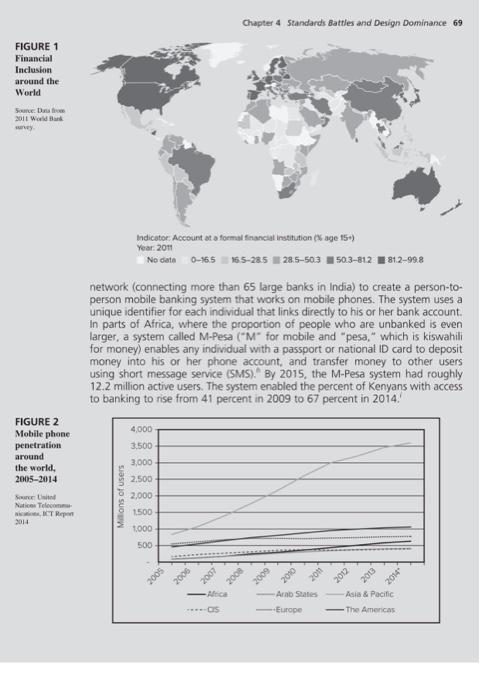

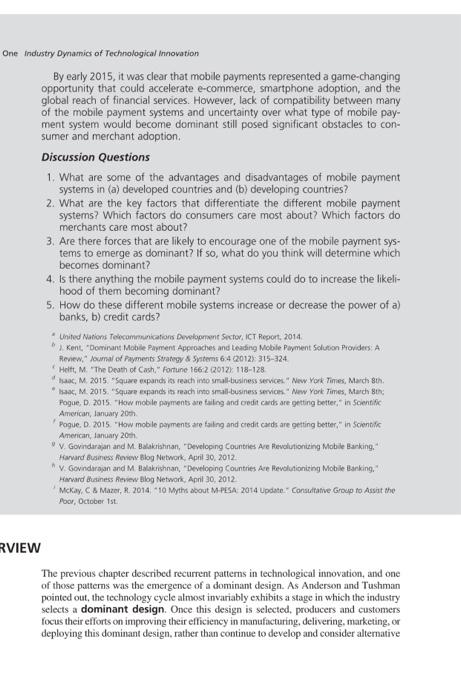

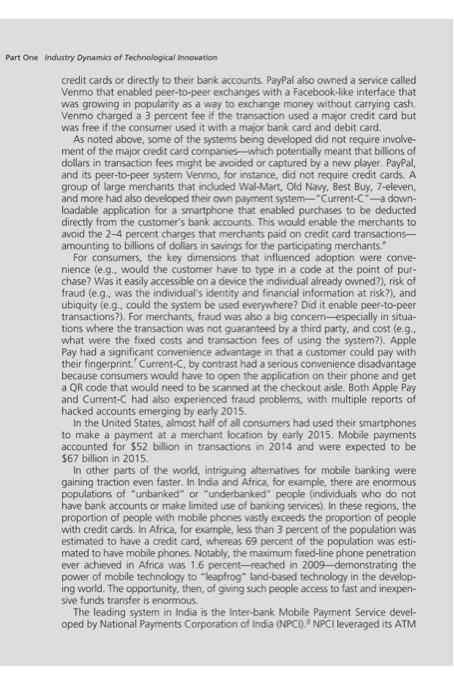

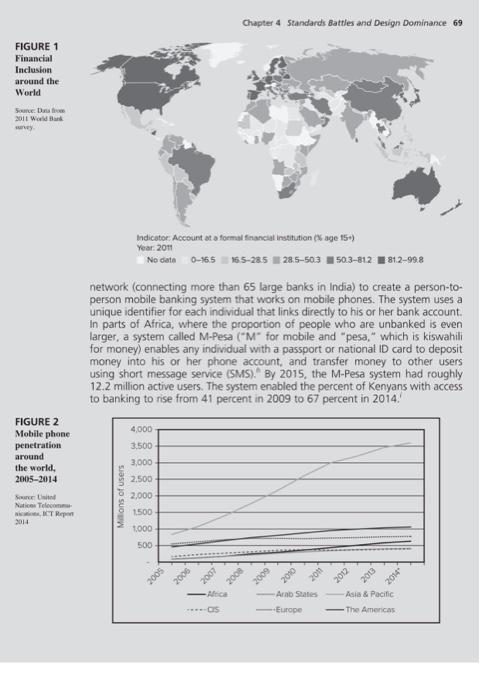

.Your answer should contain evidence of the following: r Knowledge and understanding of the key theoretical concepts related to MGT 3014 Innovation Management - Critical analysis of issues - Evidence of research using secondary sources of information - Application of the relevant theory you learnt from this module to the case study References to relevant academic articles - Accurate use of references and in-text citations Joint application of theories in explaining questions Question 1 Using 'A Battle Emerging in Mobile Payments' case study (Schilling, 2017, p67), what do you think will determine which becomes dominant? Using information in the case study and from you own research, and applying appropriate theories and analytical tools that you learnt from MGT 3014 Innovation Management, discuss the forces that are likely to encourage one of the mobile payment systems to emerge as dominant design. Standards Battles and Design Dominance A Battle Emerging in Mobile Payments By 2014, there were 6.6 billion mobile phone subscriptions in the world, and of those, 2.3 billion had active mobile broadband subscriptions that would enable users to access the mobile web. "Mobile payment systems offered the potential of enabling all of these users to perform financial transactions on their phones, similar to how they would perform those transactions using personal computers. However, in 2015, there was no dominant mobile payment system, and a battle among competing mobile payment mechanisms and standards was unfolding. In the United States, several large players, induding Apple, Samsung, and a joint venture called Softcard between Google, AT\&T, T-Mobile, and Verizon Wireless, had developed systems based on Near Field Communication (NFC) chips in smartphones. NFC chips enable communication between a mobile device and a point-of-sale sys: tem just by having the devices in close proximity. The systems being developed by Apple, Samsung, and Softcard transferred the customer's information wirelessly and then used merchant banks and credit card systems such as Visa or MasterCard to complete the transaction. These systems were thus very much like existing ways of using credit cards but enabled completion of the purchase without contact. Other competitors, such as Square (with Square Wallet) and PayPal, did not require a smartphone with an NFC chip but instead used a downloadable application and the Web to transmit a customer's information. Square had gained early fame by offering small, free, credit card readers that could be plugged into the audio jack of a smartphone. These readers enabled vendors that would normally only take cash (street vendors, babysitters, etc.) to accept major credit cards." Square processed $30 billion in payments in 2014, making the company one of the fastest growing tech start-ups in Silicon Valley. Square takes about 2.75 to 3 percent from each transaction it processes but must split that with credit card companies and other financial institutions. In terms of installed base, however, Paypal had the clear advantage, with over 161 million active registered accounts. With PayPal, customers could complete purchases simply by entering their phone numbers and a pin number or use a PayPal-issued magnetic stripe cards linked to their PayPal accounts. Users could opt to link their PayPal accounts to their 67 industry Dynamies of Technological innovation credit cards or directly to their bank accounts. Paypal also owned a service called Venmo that enabled peer-to-peer exchanges with a Facebook-like interface that was growing in popularity as a way to exchange money without carrying cash. Venmo charged a 3 percent fee if the transaction used a major credit card but was free if the consumer used it with a major bank card and debit card. As noted above, some of the systems being developed did not require involvement of the major credit card companies_which potentially meant that billions of dollars in transaction fees might be avcided or captured by a new player, Pay?al, and its peer-to-peer system. Venmo, for instance, did not require credit cards. A group of large merchants that included Wal-Mart, Old Navy, Best Buy, 7-eleven, and more had also developed their ovn payment system- Current- " - - downloadable application for a smartphone that enabled purchases to be deducted directly from the customer's bank accounts. This would enable the merchants to avoid the 2-4 percent charges that merchants paid on credit card transactionsamounting to billions of dollars in savings for the participating merchants." For consumers, the key dimensions that influenced adoption were convenience (e.9. would the customer have to type in a code at the point of purchase? Was it easily accessible on a device the individual already owned?), risk of fraud (e.9., was the individual's identity and financial information at risk?), and ubiquity (e.g. could the system be ysed everywhere? Did it enable peer-to-peer transactions?). For merchants, fraud was also a big concern-especially in situations where the transaction was not guaranteed by a third party, and cost (e.g.what were the foxed costs and transaction fees of using the system?). Apple Pay had a significant convenience advantage in that a customer could pay with their fingerprint.' Current- C, by contrast had a serious convenience disadvantage because consumers would have to open the application on their phone and get a QR code that would need to be scanned at the checkout aisle. Both Apple Pay and Current-C had also experienced fraud problems, with multiple reports of hacked accounts emerging by early 2015. In the. United States, almost half of all consumers had used their smartphones to make a payment at a merchant location by early 2015 . Mobile payments accounted for $52 bilion in transactions in 2014 and were expected to be $67 billion in 2015 . In other parts of the world, intriguing alternatives for-mobile banking were gaining traction even faster. In India and Africa, for example, there are enormous populations of "unbanked" or "underbanked" people findividuals who do not have bank accounts or make limited use of banking services). In these regions, the proportion of people with mobile phanes vastly exceeds the proportion of people with credit cards. In Africa, for example, less than 3 percent of the population was estimated to have a credit card, whereas 69 percent of the population was esti= mated to have mobile phones. Notably, the maximum foxed-line phone penetration ever achieved in Africa was 1.6 percent-reached in 2009 -demonstrating the power of mobile technology to "leaplrog" land-based technology in the developing world. The opportunity. then, of giving such people access to fast and inexpensive funds transfer is enormous. The leading system in India is the Inter-bank. Mobile Payment Service developed by National Payments Corporation of india (NPCl). NPCl leveraged its ATIM Chapter 4 5tandards battles and Design Dominance 69 FIGt Fina Inck arou Wor Saine iurvey Indicater: Acceunt at a formal financiat institution (2o age f54) Year. 2011 network (connecting more than 65 large banks in India) to create a person-toperson mobile banking system that works on mobile phones. The system uses a unique identifier for each individual that links directly to his or her bank account. In parts of Africa, where the proportion of people who are unbanked is even larger, a system called M-Pesa ("M" for mobile and "pesa," which is kiswahili for money) enables any individual with a passport or national ID card to deposit money into his or her phone account, and transfer money to other users using short message service (5MS)." By 2015, the M-Pesa system had roughly 12.2 million active users. The system enabled the percent of Kenyans with access. to banking to rise from 41 percent in 2009 to 67 percent in 2014.' Industry Dynamics of Technological Innovation By early 2015, it was clear that mobile payments represented a game-changing opportunity that could accelerate e-commerce, smartphone adoption, and the global reach of financial services. However, lack of compatibility between many of the mobile payment systems and uncertainty over what type of mobile payment system would become dominant still posed significant obstacles to consumer and merchant adoption. Discussion Questions 1. What are some of the advantages and disadvantages of mobile payment systems in (a) developed countries and (b) developing countries? 2. What are the key factors that differentiate the different mobile payment systems? Which factors do consumers care most about? Which factors do merchants care most about? 3. Are there forces that are likely to encourage one of the mobile payment systems to emerge as dominant? If so, what do you think will determine which becomes dominant? 4. Is there anything the mobile payment systems could do to increase the likelihood of them becoming dominant? 5. How do these different mobile systems increase or decrease the power of a) banks, b) credit cards? * Linited Naions Telcominnisators Dewedoprnent Sictor, ICT Report, 2014. 6. I. Kent, "Dominant Moble Pigrent Approaches and teiding Mobile Payment Solution Providees: A Renew," Acumal of Payments Strategy S. Systeens 6.4 2.012) 315-32.4. Heitt, M. "The Death of Cach," Fortune 1662 (2012): 118-128. thaac, M. 2015. "Square eupandi is reach ino smali-business sevice." New York-Rines, March 8th. " Hax, M. 2015. "Square expands its reach into small-business semior." New York Times, Mardy 8 th: Fogae, D. 2015. 'How moble payments are taing and oedit cards are getting better," in Soientific: American, lanuary 20th. 'Pogue. D. 2015. "How moble payments are faing and credit cards are getting better." in scientifc American, lanuary 20ch. V. v. Govindarajan and M. Balakeiatinan, "Developing Countries Ace Revelutionteng Mobile Earking." Havard Guaness foveve biog Network, Aprit 30, 2012. ". V. Govindarajan and M Ealakrishnan, "Developing Countries Ace Revblutionizng Moble Barking." Havard obatiness feview blog Network, April 30, 2012 Mckay. C s Mazer, 8. 2014 " 10 Myth about M.PEAA. 20t4 Update- Corsutative Group to Assit the Poor, October 1st. The previots chapter described recurrent patterns in technological innovation, and one of those patterns was the emergence of a dominant design. As Anderson and Tushman pointed out, the technology cycle almost invariably exhibits a stage in which the industry selects a dominant design. Once this design is selected, producers and customers focus their efforts on improving their efficiency in manufacturing, delivering, marketing, or deploying this dominant design, rather than continue to develop and consider alternative

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started