Answered step by step

Verified Expert Solution

Question

1 Approved Answer

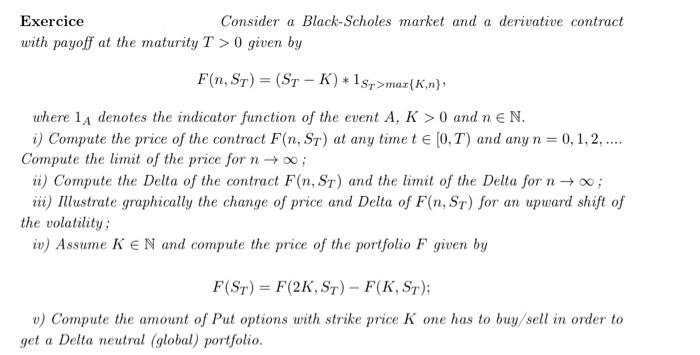

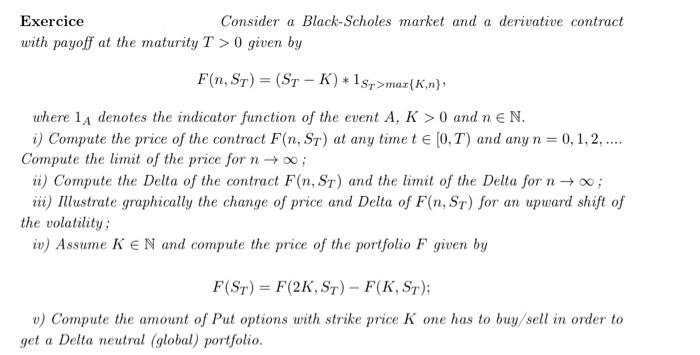

It is an Stochastics Methods for Finance question.Could you please explain it while you're solving? Exercice Consider a Black-Scholes market and a derivative contract with

It is an "Stochastics Methods for Finance" question.Could you please explain it while you're solving?

Exercice Consider a Black-Scholes market and a derivative contract with payoff at the maturity T>0 given by F(n,ST)=(STK)1ST>max{K,n}, where 1A denotes the indicator function of the event A,K>0 and nN. i) Compute the price of the contract F(n,ST) at any time t[0,T) and any n=0,1,2, Compute the limit of the price for n; ii) Compute the Delta of the contract F(n,ST) and the limit of the Delta for n; iii) Illustrate graphically the change of price and Delta of F(n,ST) for an upward shift of the volatility; iv) Assume KN and compute the price of the portfolio F given by F(ST)=F(2K,ST)F(K,ST) v) Compute the amount of Put options with strike price K one has to buy/sell in order to get a Delta neutral (global) portfolio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started