Question

It is common practice for companies to make two allowances for doubtful accounts: 1. The specific allowance is based on accounts the company has reason

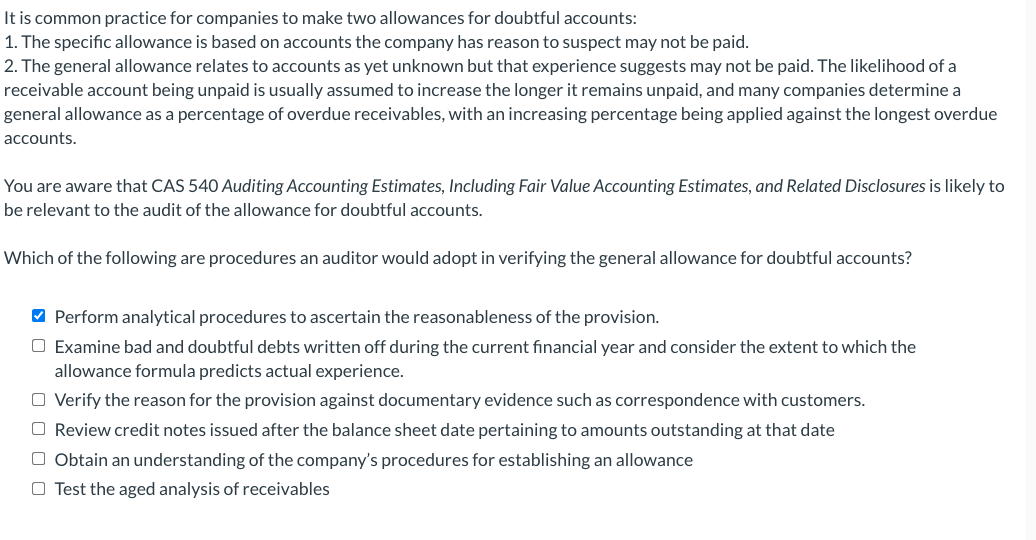

It is common practice for companies to make two allowances for doubtful accounts: 1. The specific allowance is based on accounts the company has reason to suspect may not be paid. 2. The general allowance relates to accounts as yet unknown but that experience suggests may not be paid. The likelihood of a receivable account being unpaid is usually assumed to increase the longer it remains unpaid, and many companies determine a general allowance as a percentage of overdue receivables, with an increasing percentage being applied against the longest overdue accounts. You are aware that CAS 540 Auditing Accounting Estimates, Including Fair Value Accounting Estimates, and Related Disclosures is likely to be relevant to the audit of the allowance for doubtful accounts. Which of the following are procedures an auditor would adopt in verifying the general allowance for doubtful accounts?

-Perform analytical procedures to ascertain the reasonableness of the provision.

-Examine bad and doubtful debts written off during the current financial year and consider the extent to which the allowance formula predicts actual experience.

-Verify the reason for the provision against documentary evidence such as correspondence with customers.

-Review credit notes issued after the balance sheet date pertaining to amounts outstanding at that date

-Obtain an understanding of the companys procedures for establishing an allowance

- Test the aged analysis of receivables

Test the aged analysis of receivables

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started