Question

It is common practice for retail outlets to lease their store locations and distribution centers. Walmart is no exception. Note 11 to Walmarts consolidated financial

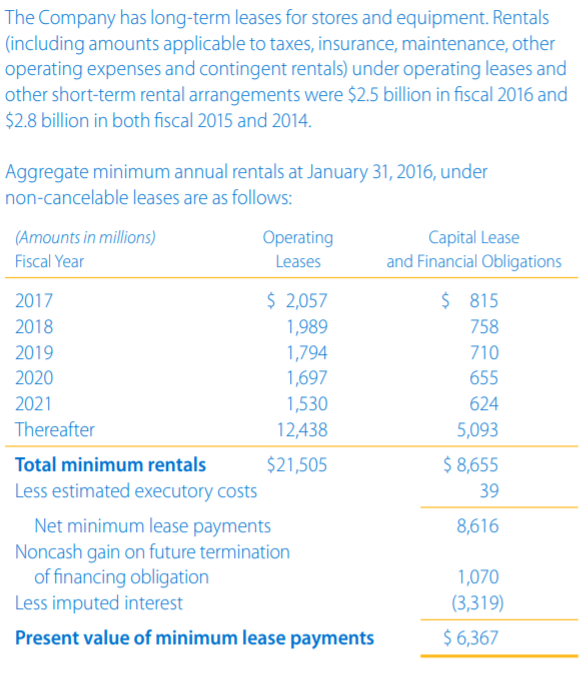

It is common practice for retail outlets to lease their store locations and distribution centers. Walmart is no exception. Note 11 to Walmarts consolidated financial statements for the fiscal year ending January 31, 2016 (found online at the text website or available for download in the investor relations section of Walmarts website), provides information on future operating lease commitments. REQUIRED a. Effectively capitalize the operating lease obligations. You must first choose and justify an interest rate. Assume that all cash flows occur at the end of each year. b. Recompute the long-term debt to long-term capital ratio (see Chapter 5) using your capi- talized operating leases. Comment on the results.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started