I only need help with question 7! thank you

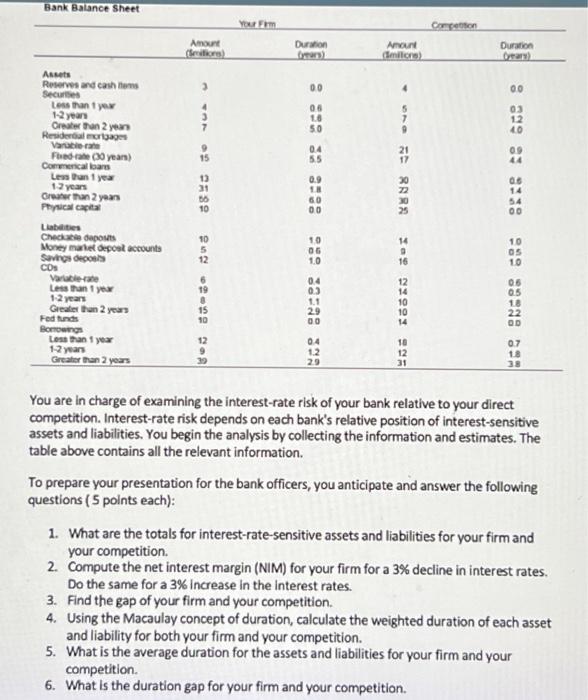

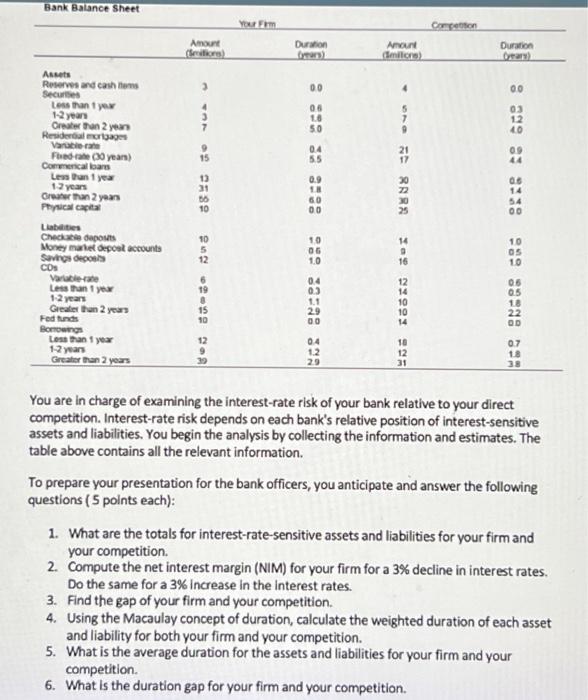

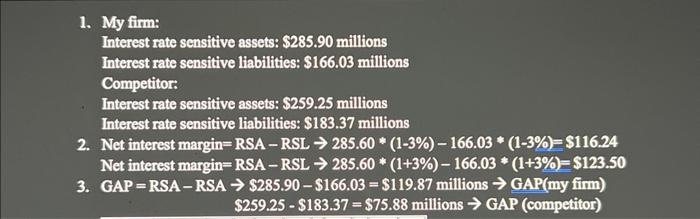

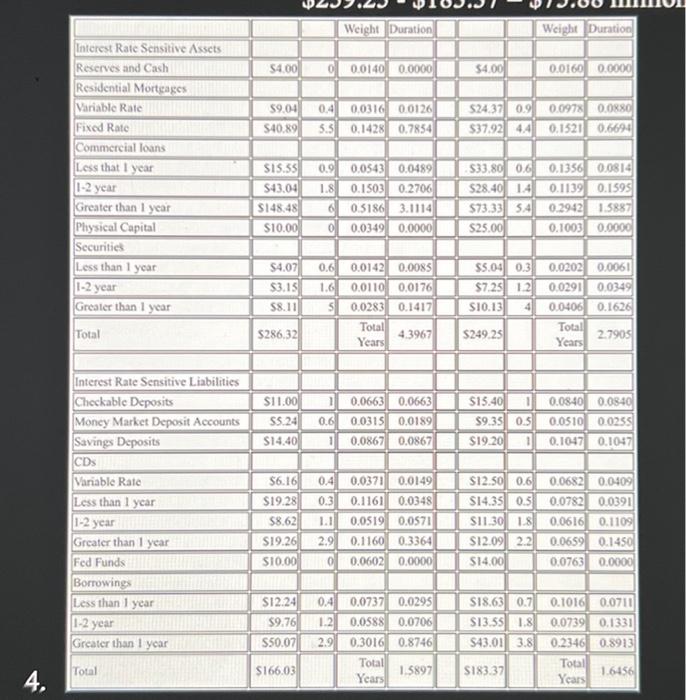

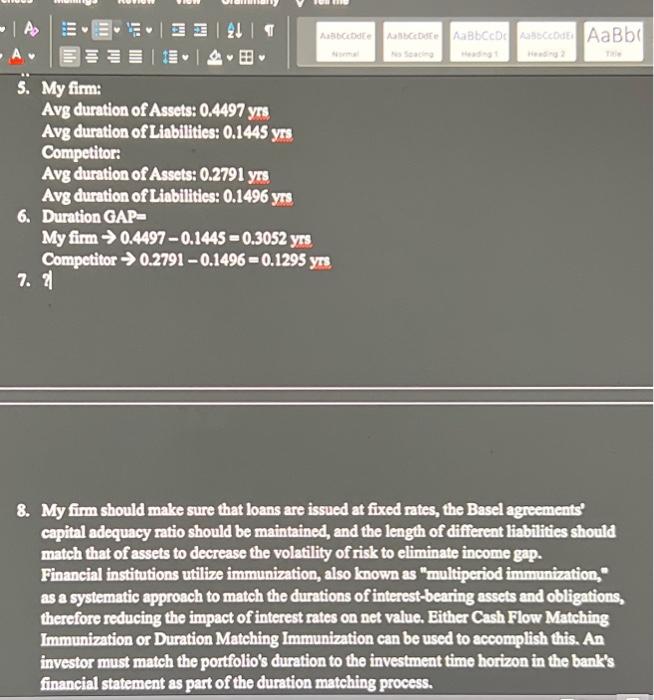

You are in charge of examining the interest-rate risk of your bank relative to your direct competition. Interest-rate risk depends on each bank's relative position of interest-sensitive assets and liabilities. You begin the analysis by collecting the information and estimates. The table above contains all the relevant information. To prepare your presentation for the bank officers, you anticipate and answer the following questions ( 5 points each): 1. What are the totals for interest-rate-sensitive assets and liabilities for your firm and your competition. 2. Compute the net interest margin (NIM) for your firm for a 3% decline in interest rates. Do the same for a 3% increase in the interest rates. 3. Find the gap of your firm and your competition. 4. Using the Macaulay concept of duration, calculate the weighted duration of each asset and liability for both your firm and your competition. 5. What is the average duration for the assets and liabilities for your firm and your competition. 6. What is the duration gap for your firm and your competition. (assume that the portion of fixed-rate mortgages that will mature within 1 year is 20%, portion of checkable deposits (10\%), portion of savings (20\%)) 7. Using the net worth formula if interest rates decline by 3%, what will be the expected change in the market value of net worth for your firm and your competition (assume a 12% initial interest rate) 1. My firm: Interest rate sensitive assets: $285.90 millions Interest rate sensitive liabilities: \$166.03 millions Competitor: Interest rate sensitive assets: $259.25 millions Interest rate sensitive liabilities: $183.37 millions 2. Net interest margin =RSARSL285.60(13%)166.03(13%)=$116.24 Net interest margin =RSARSL285.60(1+3%)166.03(1+3%)=$123.50 3. GAP=RSARSA$285.90$166.03=$119.87 millions GAP(my firm ) $259.25$183.37=$75.88 millions GAP (competitor) 5. My fim: Avg duration of Assets: 0.4497 yzs Avg duration of Liabilities: 0.144S yss Competitor: Avg duration of Assets: 0.2791 yss Avg duration of Linbilities: 0.1496 ys 6. Duration CAPa Myfirm0.44970.1445=0.3052y/sCompetitor0.27910.1496=0.1295yzs 7. if 8. My fim should make sure that loans are issued at fixed rates, the Basel agreements? capithl adequacy ratio should be maintained, and the length of difierent liabilities should match that of assets to decrease the volatility of risk to eliminate income gap. Financial institutions utilize immunization, also known as "multiperiod immunization," as a systematic approach to match the durations of interest-bearing assets and obligations, therefore reducing the impact of interest rates on net value. Bither Cash Flow Matching Immunization or Duration Matching Immunization can be used to accomplish this. An investor must match the potfolio's duration to the investment time horizon in the bank's financial statement as part of the duration matehing process. You are in charge of examining the interest-rate risk of your bank relative to your direct competition. Interest-rate risk depends on each bank's relative position of interest-sensitive assets and liabilities. You begin the analysis by collecting the information and estimates. The table above contains all the relevant information. To prepare your presentation for the bank officers, you anticipate and answer the following questions ( 5 points each): 1. What are the totals for interest-rate-sensitive assets and liabilities for your firm and your competition. 2. Compute the net interest margin (NIM) for your firm for a 3% decline in interest rates. Do the same for a 3% increase in the interest rates. 3. Find the gap of your firm and your competition. 4. Using the Macaulay concept of duration, calculate the weighted duration of each asset and liability for both your firm and your competition. 5. What is the average duration for the assets and liabilities for your firm and your competition. 6. What is the duration gap for your firm and your competition. (assume that the portion of fixed-rate mortgages that will mature within 1 year is 20%, portion of checkable deposits (10\%), portion of savings (20\%)) 7. Using the net worth formula if interest rates decline by 3%, what will be the expected change in the market value of net worth for your firm and your competition (assume a 12% initial interest rate) 1. My firm: Interest rate sensitive assets: $285.90 millions Interest rate sensitive liabilities: \$166.03 millions Competitor: Interest rate sensitive assets: $259.25 millions Interest rate sensitive liabilities: $183.37 millions 2. Net interest margin =RSARSL285.60(13%)166.03(13%)=$116.24 Net interest margin =RSARSL285.60(1+3%)166.03(1+3%)=$123.50 3. GAP=RSARSA$285.90$166.03=$119.87 millions GAP(my firm ) $259.25$183.37=$75.88 millions GAP (competitor) 5. My fim: Avg duration of Assets: 0.4497 yzs Avg duration of Liabilities: 0.144S yss Competitor: Avg duration of Assets: 0.2791 yss Avg duration of Linbilities: 0.1496 ys 6. Duration CAPa Myfirm0.44970.1445=0.3052y/sCompetitor0.27910.1496=0.1295yzs 7. if 8. My fim should make sure that loans are issued at fixed rates, the Basel agreements? capithl adequacy ratio should be maintained, and the length of difierent liabilities should match that of assets to decrease the volatility of risk to eliminate income gap. Financial institutions utilize immunization, also known as "multiperiod immunization," as a systematic approach to match the durations of interest-bearing assets and obligations, therefore reducing the impact of interest rates on net value. Bither Cash Flow Matching Immunization or Duration Matching Immunization can be used to accomplish this. An investor must match the potfolio's duration to the investment time horizon in the bank's financial statement as part of the duration matehing process