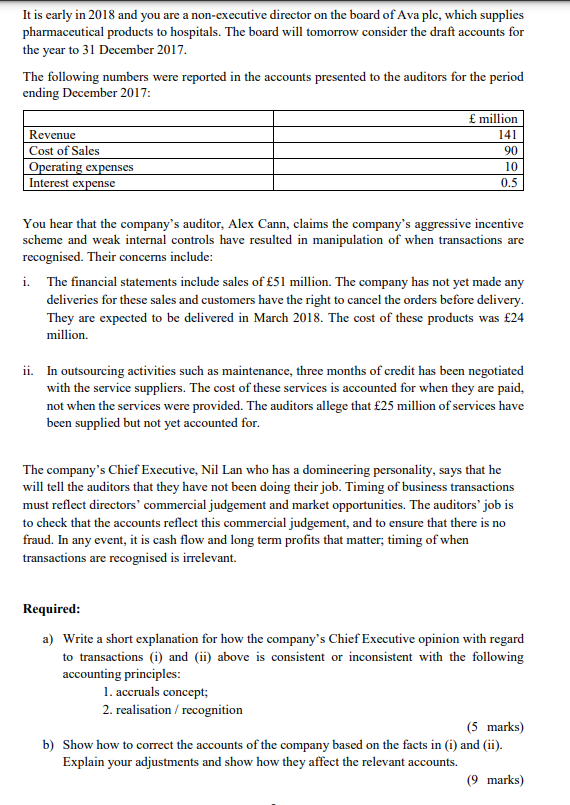

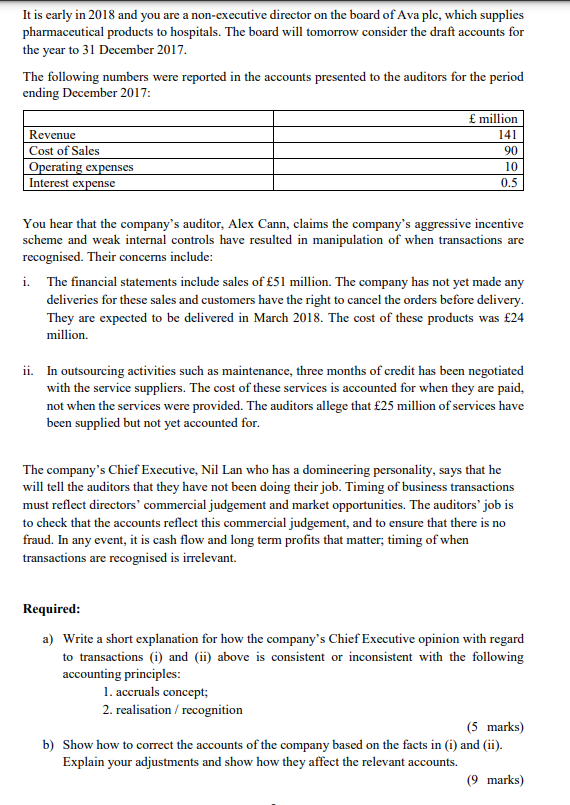

It is early in 2018 and you are a non-executive director on the board of Ava plc, which supplies pharmaceutical products to hospitals. The board will tomorrow consider the draft accounts for the year to 31 December 2017. The following numbers were reported in the accounts presented to the auditors for the period ending December 2017: million Revenue 141 Cost of Sales 90 10 Operating expenses Interest expense 0.5 You hear that the company's auditor, Alex Cann, claims the company's aggressive incentive scheme and weak internal controls have resulted in manipulation of when transactions are recognised. Their concerns include: i. The financial statements include sales of 51 million. The company has not yet made any deliveries for these sales and customers have the right to cancel the orders before delivery. They are expected to be delivered in March 2018. The cost of these products was 24 million. ii. In outsourcing activities such as maintenance, three months of credit has been negotiated with the service suppliers. The cost of these services is accounted for when they are paid, not when the services were provided. The auditors allege that 25 million of services have been supplied but not yet accounted for. The company's Chief Executive, Nil Lan who has a domineering personality, says that he will tell the auditors that they have not been doing their job. Timing of business transactions must reflect directors' commercial judgement and market opportunities. The auditors' job is to check that the accounts reflect this commercial judgement, and to ensure that there is no fraud. In any event, it is cash flow and long term profits that matter; timing of when transactions are recognised is irrelevant. Required: a) Write a short explanation for how the company's Chief Executive opinion with regard to transactions (i) and (ii) above is consistent or inconsistent with the following accounting principles: 1. accruals concept; 2. realisation / recognition (5 marks) b) Show how to correct the accounts of the company based on the facts in (i) and (ii). Explain your adjustments and show how they affect the relevant accounts. (9 marks) c) Calculate gross profit, operating profit and net profit for the company for the period to December 2017, using the correct balances on the accounts after making the adjustments in b) above. (3 marks) d) Identify three possible different categories of intangible assets and indicate the appropriate accounting treatment for each category. (7 marks) It is early in 2018 and you are a non-executive director on the board of Ava plc, which supplies pharmaceutical products to hospitals. The board will tomorrow consider the draft accounts for the year to 31 December 2017. The following numbers were reported in the accounts presented to the auditors for the period ending December 2017: million Revenue 141 Cost of Sales 90 10 Operating expenses Interest expense 0.5 You hear that the company's auditor, Alex Cann, claims the company's aggressive incentive scheme and weak internal controls have resulted in manipulation of when transactions are recognised. Their concerns include: i. The financial statements include sales of 51 million. The company has not yet made any deliveries for these sales and customers have the right to cancel the orders before delivery. They are expected to be delivered in March 2018. The cost of these products was 24 million. ii. In outsourcing activities such as maintenance, three months of credit has been negotiated with the service suppliers. The cost of these services is accounted for when they are paid, not when the services were provided. The auditors allege that 25 million of services have been supplied but not yet accounted for. The company's Chief Executive, Nil Lan who has a domineering personality, says that he will tell the auditors that they have not been doing their job. Timing of business transactions must reflect directors' commercial judgement and market opportunities. The auditors' job is to check that the accounts reflect this commercial judgement, and to ensure that there is no fraud. In any event, it is cash flow and long term profits that matter; timing of when transactions are recognised is irrelevant. Required: a) Write a short explanation for how the company's Chief Executive opinion with regard to transactions (i) and (ii) above is consistent or inconsistent with the following accounting principles: 1. accruals concept; 2. realisation / recognition (5 marks) b) Show how to correct the accounts of the company based on the facts in (i) and (ii). Explain your adjustments and show how they affect the relevant accounts. (9 marks) c) Calculate gross profit, operating profit and net profit for the company for the period to December 2017, using the correct balances on the accounts after making the adjustments in b) above. (3 marks) d) Identify three possible different categories of intangible assets and indicate the appropriate accounting treatment for each category. (7 marks)