Question

It is January 2nd and senior management of Baldwin meets to determine their investment plan for the year. They decide to fully fund a plant

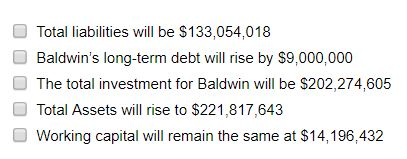

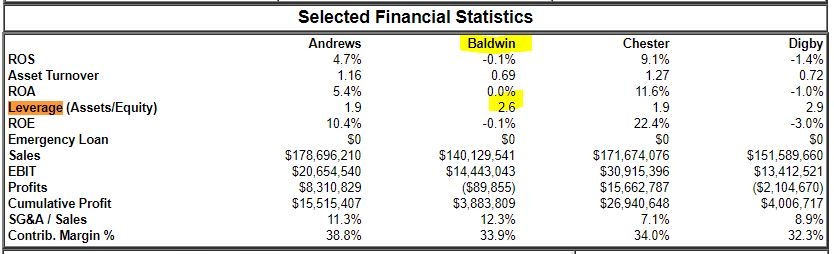

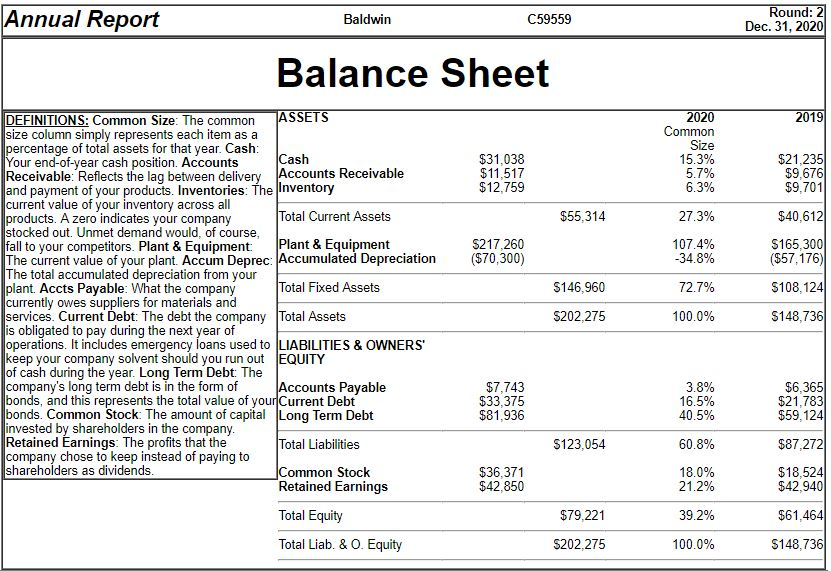

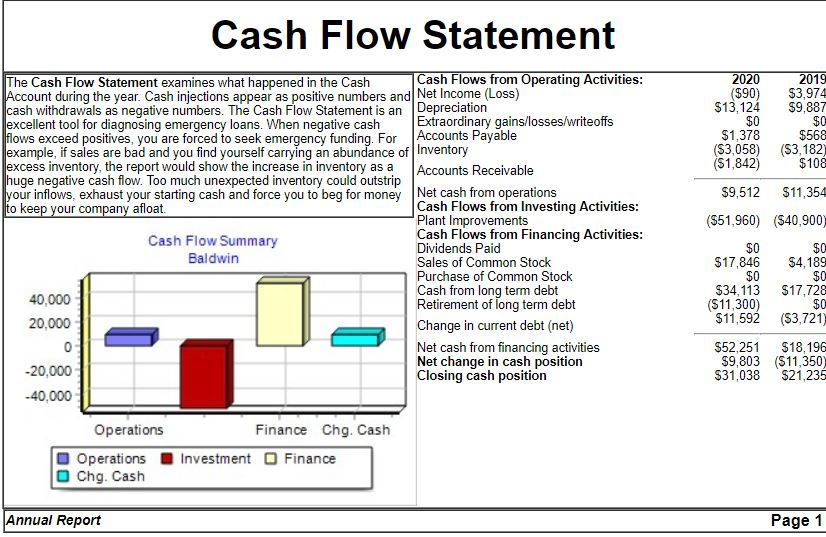

It is January 2nd and senior management of Baldwin meets to determine their investment plan for the year. They decide to fully fund a plant and equipment purchase by issuing $10,000,000 in bonds. Assume the bonds are issued at face value and leverage changes to 2.8. Which of the following statements are true? Select all that apply. Select 3 answers Total liabilities will be $133,054,018 Baldwins long-term debt will rise by $9,000,000 The total investment for Baldwin will be $202,274,605 Total Assets will rise to $221,817,643 Working capital will remain the same at $14,196,432

Select 3

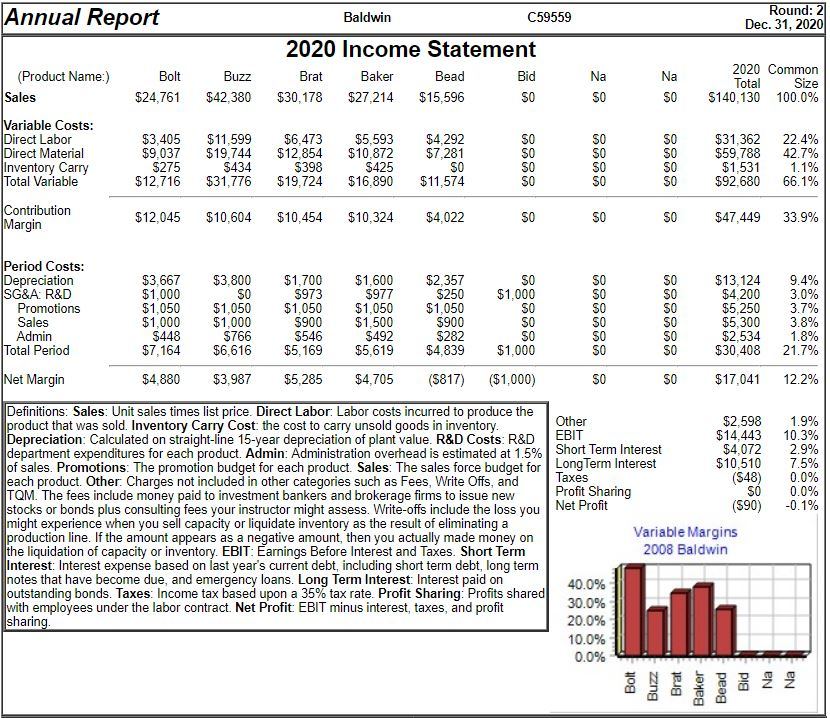

Total liabilities will be $133,054,018 Baldwin's long-term debt will rise by S9,000,000 The total investment for Baldwin will be $202,274,605 Total Assets will rise to $221,817,643 Working capital will remain the same at $14,196,432 Selected Financial Statistics Digby Andrews 47% 1.16 5.4% 1.9 10.4% S0 $178,696,210 $20,654,540 $8,310,829 $15,515,407 11.3% 38.8% Baldwin Chester 9.1% 1.27 11.6% 1.9 22.4% 50 $171,674,076 $30,915,396 $15,662,787 $26,940,648 71% 34.0% ROS Asset Turnover ROA Leverage (Assets/Equity) ROE Emergency Loan Sales EBIT Profits Cumulative Profit SG8A I Sales Contrib. Margin % 0.72 0.69 0.0% 2.6 2.9 -30% 50 $151,589,660 $13,412,521 ($2,104,670) $4,006,717 8.9% 323% S0 $140,129,541 $14,443,043 (589,855) $3,883,809 12.3% 33.9% Round: 2 Dec. 31, 2020 Annual Report Baldwin 59559 Balance Sheet 2019 ASSETS 2020 Common DEFINITIONS: Common Size: The common size column simply represent percentage of total assets for that year. Cash s each item as a $31,038 $11,517 $12,759 ash 15.3% 5.7% 6.3% $21,235 $9,676 $9,701 our end-of-year cash position. Acc Receivable: Reflects the lag between and payment of your products. Inventories: The nventory current value of your inventory across all products. A zero indicates your company stocked out. Unmet demand would, of course fall to your competitors. Plant & Equipment Plant & Equipment The current value of your plant. Accum Deprec: Accumulated Depreciation 70,300) The total accumulated depreciation from your plant. Accts Payable: What the company currently owes suppliers for materials and services. Current Debt: The debt the c is obligated to pay during the next year of operations. It includes emergency loans used to LIABILITIES & OWNERS keep your company solvent should you run out EQUITY of cash during the year. Long Term Debt The company's long term debt is in the form of bonds, and this represents the total value of younCurrent Debt bonds. Common Stock: The amount of capital Long Term Debt invested by shareholders in the company Retained Earnings: The profits that the company chose to keep instead of paying to shareholders as dividends ounts delivery Accounts Receivable $55,314 Total Current Assets 273% $40,612 S217,260 107.4% 34.8% $165,300 ($57,176) Total Fixed Assets $146,960 727% S108, 124 ompany Total Assets 202,275 100.0% 148,736 $7,743 $33,375 $81,936 Accounts Payable 3.8% 16.5% 40.5% $6,365 $21,783 $59,124 Total Liabilities $123,054 60.8% $87,272 $18,524 $42,940 Common Stock $36,371 $42,850 18.0% 21.2% Retained Earnings Total Equity Total Liab. & O. Equity $79,221 39.2% $61,464 S202,275 100.0% $148,736 Cash Flow Statement ash Flows from Operating Activities: 020 The Cash Flow Statement examines what happened in the Cash ($90) $3,974 $13,124 $9,887 $0 $568 (S3,058) (S3,182) nt during the vear. Cash iniections appear as positive numbers and Net Income (Loss) cash withdrawals as negative numbers. The Cash Flow Statement is an Depreciation excellent tool for diagnosing emergency loans ows exceed positives, you are forced to seek emergency funding. For example, if sales are bad and you find yourself carrying an abundance of excess inventory, the report would show the increase in inventory as a Accounts Receivable huge negative cash flow. Too much unexpected inventory could outstrip our inflows. exhaust your starting cash and force you to beg for money Net cash from operations o keep vour company afloat Extraordinary gains/losses/writeoffs Accounts Payable $0 $1,378 . When negative cash (S1,842 $10 9,512 S11,354 Cash Flows from Investing Activities: Plant Improvements Cash Flows from Financing Activities: Dividends Paid Sales of Common Stock Purchase of Common Stock Cash from long term debt Retirement of long term debt ($51,960) ($40,900) Cash Flow Summary Baldwin $0 $0 ($11,300) $0 $17,846 $4,189 $0 $34,113 $17,728 $0 $11,592 (53,721) 40,000 20,000 Change in current debt (net) Net cash from financing activities Net change in cash position Closing cash position $52,251 $18,196 59,803 (S11,350) 31,038 $21,235 -20,000 .40.000 Operations Finance Chg. Cash InvestmentFinance Operations D Chg. Cash Page 1 Annual Report Round: 2 Dec. 31, 2020 59559 Annual Report Baldwin 2020 Income Statement 2020 Common (Product Name:) Sales Bolt Baker $24,76 $42,380 $30,178 $27,214 $15,596 so $140,130 100.0% Variable Costs: Direct Labor Direct Material Inventory Carry Total Variable $3,405 $11,599 $6,473 $5,593 $4,292 S0 S0 $31,362 $59.788 $1.531 $92.680 22.4% 42.7% 1.1% 66.1% $9,037 $19,744 $12,854 $10,872 $7,281 $12,716 $31,776 $19,724 $16,890 $11,574 $12,045 $10,604 $10,454 $10,324 $4,022 $275 $434 $398 $425 50 Contribution Margin $47.449 33.9% S0 Period Costs: Depreciation SG&A: R&D $3,667 $3,800 $1,700 $1,600 $2,357 $1,000 $1,050 $1,050 $1,050 $1,050 $1,050 $1,000 $13,124 $4.200 $5.250 $5.300 $2.534 $30.408 9.4% 3.0% 3.7% 3.8% 1.8% 21.7% $973 $977 $250$1,000 Promotions $900 $282 Sales Admin Total Period $1,000 $766 $900 $1,500 $546 S0 S0 $492 $7,164 $6,616 $5,169 $5,619 $4,839$1,000 $17.041 12.2% $4,880 $3,987 $5,285 $4,705 (5817) ($1,000) S0 Defintions: Sales: Unit sales times list price. Direct Labor: Labor costs incurred to produce the product that was sold. Inventory Carry Cost: the cost to carry unsold goods in inventory Depreciation: Calculated on straight-line 15-year depreciation of plant value. R&D Costs: R&D department expenditures for each product. Admin. Administration overhead is estimated at 1.5% of sales. Promotions: The promotion budget for each product. Sales: The sales force budget for Long lerm Interest each product. Other Charges not included in other categories such as Fees, Write Offs, and TQM. The fees include money paid to investment bankers and brokerage firms to issue new stocks or bonds plus consulting fees your instructor might assess. Write-offs include the loss you might experience when you sell capacity or liquidate inventory as the result of eliminating a production line. If the amount appears as a negative amount, then you actually made money on the liquidation of capacity or inventory. EBIT: Earnings Before Intstand Taxes. Short Term Interest: Interest expense based on last years current debt, including short term debt, long term notes that have become due, and emergency loans. Long Term Interest: Interest paid on outstanding bonds. Taxes: Income tax based upon a 35% tax rate. Profit Sharing: Profits shared with employees under the labor contract. Net Profit EBIT minus interest, taxes, and profit sharin $2.598 $14.443 $4.072 $10.510 (S48) $0 ($90) 1.9% 10.3% 2.9% 7.5% 0.0% 0.0% -0.1% EBIT Short Term Interest Taxes Profit Sharing Net Profit Variable Margins 2008 Baldwin 40.0% 300% 20.0% 10.0% 0.0% Total liabilities will be $133,054,018 Baldwin's long-term debt will rise by S9,000,000 The total investment for Baldwin will be $202,274,605 Total Assets will rise to $221,817,643 Working capital will remain the same at $14,196,432 Selected Financial Statistics Digby Andrews 47% 1.16 5.4% 1.9 10.4% S0 $178,696,210 $20,654,540 $8,310,829 $15,515,407 11.3% 38.8% Baldwin Chester 9.1% 1.27 11.6% 1.9 22.4% 50 $171,674,076 $30,915,396 $15,662,787 $26,940,648 71% 34.0% ROS Asset Turnover ROA Leverage (Assets/Equity) ROE Emergency Loan Sales EBIT Profits Cumulative Profit SG8A I Sales Contrib. Margin % 0.72 0.69 0.0% 2.6 2.9 -30% 50 $151,589,660 $13,412,521 ($2,104,670) $4,006,717 8.9% 323% S0 $140,129,541 $14,443,043 (589,855) $3,883,809 12.3% 33.9% Round: 2 Dec. 31, 2020 Annual Report Baldwin 59559 Balance Sheet 2019 ASSETS 2020 Common DEFINITIONS: Common Size: The common size column simply represent percentage of total assets for that year. Cash s each item as a $31,038 $11,517 $12,759 ash 15.3% 5.7% 6.3% $21,235 $9,676 $9,701 our end-of-year cash position. Acc Receivable: Reflects the lag between and payment of your products. Inventories: The nventory current value of your inventory across all products. A zero indicates your company stocked out. Unmet demand would, of course fall to your competitors. Plant & Equipment Plant & Equipment The current value of your plant. Accum Deprec: Accumulated Depreciation 70,300) The total accumulated depreciation from your plant. Accts Payable: What the company currently owes suppliers for materials and services. Current Debt: The debt the c is obligated to pay during the next year of operations. It includes emergency loans used to LIABILITIES & OWNERS keep your company solvent should you run out EQUITY of cash during the year. Long Term Debt The company's long term debt is in the form of bonds, and this represents the total value of younCurrent Debt bonds. Common Stock: The amount of capital Long Term Debt invested by shareholders in the company Retained Earnings: The profits that the company chose to keep instead of paying to shareholders as dividends ounts delivery Accounts Receivable $55,314 Total Current Assets 273% $40,612 S217,260 107.4% 34.8% $165,300 ($57,176) Total Fixed Assets $146,960 727% S108, 124 ompany Total Assets 202,275 100.0% 148,736 $7,743 $33,375 $81,936 Accounts Payable 3.8% 16.5% 40.5% $6,365 $21,783 $59,124 Total Liabilities $123,054 60.8% $87,272 $18,524 $42,940 Common Stock $36,371 $42,850 18.0% 21.2% Retained Earnings Total Equity Total Liab. & O. Equity $79,221 39.2% $61,464 S202,275 100.0% $148,736 Cash Flow Statement ash Flows from Operating Activities: 020 The Cash Flow Statement examines what happened in the Cash ($90) $3,974 $13,124 $9,887 $0 $568 (S3,058) (S3,182) nt during the vear. Cash iniections appear as positive numbers and Net Income (Loss) cash withdrawals as negative numbers. The Cash Flow Statement is an Depreciation excellent tool for diagnosing emergency loans ows exceed positives, you are forced to seek emergency funding. For example, if sales are bad and you find yourself carrying an abundance of excess inventory, the report would show the increase in inventory as a Accounts Receivable huge negative cash flow. Too much unexpected inventory could outstrip our inflows. exhaust your starting cash and force you to beg for money Net cash from operations o keep vour company afloat Extraordinary gains/losses/writeoffs Accounts Payable $0 $1,378 . When negative cash (S1,842 $10 9,512 S11,354 Cash Flows from Investing Activities: Plant Improvements Cash Flows from Financing Activities: Dividends Paid Sales of Common Stock Purchase of Common Stock Cash from long term debt Retirement of long term debt ($51,960) ($40,900) Cash Flow Summary Baldwin $0 $0 ($11,300) $0 $17,846 $4,189 $0 $34,113 $17,728 $0 $11,592 (53,721) 40,000 20,000 Change in current debt (net) Net cash from financing activities Net change in cash position Closing cash position $52,251 $18,196 59,803 (S11,350) 31,038 $21,235 -20,000 .40.000 Operations Finance Chg. Cash InvestmentFinance Operations D Chg. Cash Page 1 Annual Report Round: 2 Dec. 31, 2020 59559 Annual Report Baldwin 2020 Income Statement 2020 Common (Product Name:) Sales Bolt Baker $24,76 $42,380 $30,178 $27,214 $15,596 so $140,130 100.0% Variable Costs: Direct Labor Direct Material Inventory Carry Total Variable $3,405 $11,599 $6,473 $5,593 $4,292 S0 S0 $31,362 $59.788 $1.531 $92.680 22.4% 42.7% 1.1% 66.1% $9,037 $19,744 $12,854 $10,872 $7,281 $12,716 $31,776 $19,724 $16,890 $11,574 $12,045 $10,604 $10,454 $10,324 $4,022 $275 $434 $398 $425 50 Contribution Margin $47.449 33.9% S0 Period Costs: Depreciation SG&A: R&D $3,667 $3,800 $1,700 $1,600 $2,357 $1,000 $1,050 $1,050 $1,050 $1,050 $1,050 $1,000 $13,124 $4.200 $5.250 $5.300 $2.534 $30.408 9.4% 3.0% 3.7% 3.8% 1.8% 21.7% $973 $977 $250$1,000 Promotions $900 $282 Sales Admin Total Period $1,000 $766 $900 $1,500 $546 S0 S0 $492 $7,164 $6,616 $5,169 $5,619 $4,839$1,000 $17.041 12.2% $4,880 $3,987 $5,285 $4,705 (5817) ($1,000) S0 Defintions: Sales: Unit sales times list price. Direct Labor: Labor costs incurred to produce the product that was sold. Inventory Carry Cost: the cost to carry unsold goods in inventory Depreciation: Calculated on straight-line 15-year depreciation of plant value. R&D Costs: R&D department expenditures for each product. Admin. Administration overhead is estimated at 1.5% of sales. Promotions: The promotion budget for each product. Sales: The sales force budget for Long lerm Interest each product. Other Charges not included in other categories such as Fees, Write Offs, and TQM. The fees include money paid to investment bankers and brokerage firms to issue new stocks or bonds plus consulting fees your instructor might assess. Write-offs include the loss you might experience when you sell capacity or liquidate inventory as the result of eliminating a production line. If the amount appears as a negative amount, then you actually made money on the liquidation of capacity or inventory. EBIT: Earnings Before Intstand Taxes. Short Term Interest: Interest expense based on last years current debt, including short term debt, long term notes that have become due, and emergency loans. Long Term Interest: Interest paid on outstanding bonds. Taxes: Income tax based upon a 35% tax rate. Profit Sharing: Profits shared with employees under the labor contract. Net Profit EBIT minus interest, taxes, and profit sharin $2.598 $14.443 $4.072 $10.510 (S48) $0 ($90) 1.9% 10.3% 2.9% 7.5% 0.0% 0.0% -0.1% EBIT Short Term Interest Taxes Profit Sharing Net Profit Variable Margins 2008 Baldwin 40.0% 300% 20.0% 10.0% 0.0%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started