Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It is March 12. You are a purchasing agent for a small spaceship manufacturer outside Spaceport America. In your executive team meeting, the company's production

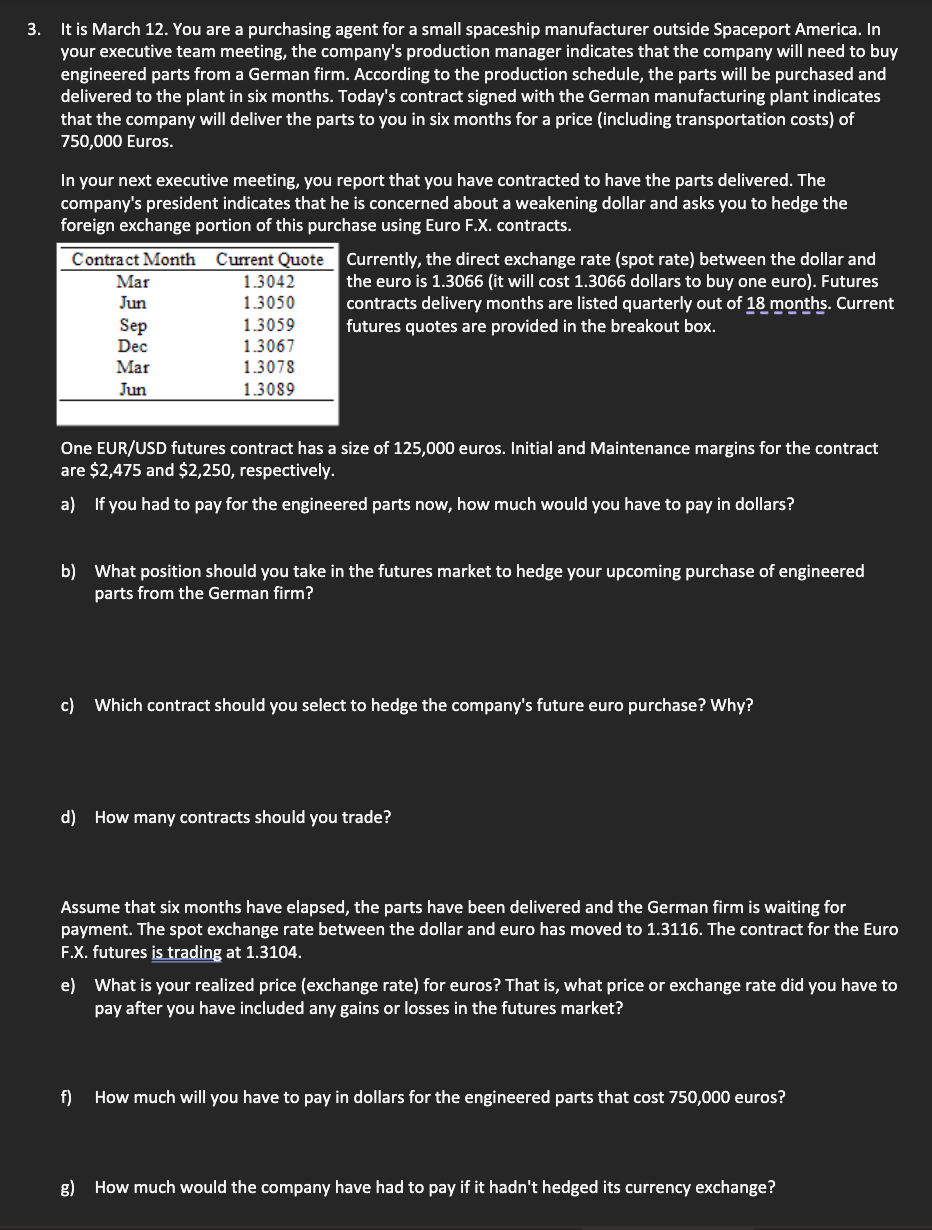

It is March 12. You are a purchasing agent for a small spaceship manufacturer outside Spaceport America. In your executive team meeting, the company's production manager indicates that the company will need to buy engineered parts from a German firm. According to the production schedule, the parts will be purchased and delivered to the plant in six months. Today's contract signed with the German manufacturing plant indicates that the company will deliver the parts to you in six months for a price (including transportation costs) of 750,000 Euros. In your next executive meeting, you report that you have contracted to have the parts delivered. The company's president indicates that he is concerned about a weakening dollar and asks you to hedge the foreign exchange portion of this purchase using Euro F.X. contracts. Currently, the direct exchange rate (spot rate) between the dollar and the euro is 1.3066 (it will cost 1.3066 dollars to buy one euro). Futures contracts delivery months are listed quarterly out of 18 months. Current futures quotes are provided in the breakout box. One EUR/USD futures contract has a size of 125,000 euros. Initial and Maintenance margins for the contract are $2,475 and $2,250, respectively. a) If you had to pay for the engineered parts now, how much would you have to pay in dollars? b) What position should you take in the futures market to hedge your upcoming purchase of engineered parts from the German firm? c) Which contract should you select to hedge the company's future euro purchase? Why? d) How many contracts should you trade? Assume that six months have elapsed, the parts have been delivered and the German firm is waiting for payment. The spot exchange rate between the dollar and euro has moved to 1.3116. The contract for the Euro F.X. futures is trading at 1.3104 . e) What is your realized price (exchange rate) for euros? That is, what price or exchange rate did you have to pay after you have included any gains or losses in the futures market? f) How much will you have to pay in dollars for the engineered parts that cost 750,000 euros? g) How much would the company have had to pay if it hadn't hedged its currency exchange? It is March 12. You are a purchasing agent for a small spaceship manufacturer outside Spaceport America. In your executive team meeting, the company's production manager indicates that the company will need to buy engineered parts from a German firm. According to the production schedule, the parts will be purchased and delivered to the plant in six months. Today's contract signed with the German manufacturing plant indicates that the company will deliver the parts to you in six months for a price (including transportation costs) of 750,000 Euros. In your next executive meeting, you report that you have contracted to have the parts delivered. The company's president indicates that he is concerned about a weakening dollar and asks you to hedge the foreign exchange portion of this purchase using Euro F.X. contracts. Currently, the direct exchange rate (spot rate) between the dollar and the euro is 1.3066 (it will cost 1.3066 dollars to buy one euro). Futures contracts delivery months are listed quarterly out of 18 months. Current futures quotes are provided in the breakout box. One EUR/USD futures contract has a size of 125,000 euros. Initial and Maintenance margins for the contract are $2,475 and $2,250, respectively. a) If you had to pay for the engineered parts now, how much would you have to pay in dollars? b) What position should you take in the futures market to hedge your upcoming purchase of engineered parts from the German firm? c) Which contract should you select to hedge the company's future euro purchase? Why? d) How many contracts should you trade? Assume that six months have elapsed, the parts have been delivered and the German firm is waiting for payment. The spot exchange rate between the dollar and euro has moved to 1.3116. The contract for the Euro F.X. futures is trading at 1.3104 . e) What is your realized price (exchange rate) for euros? That is, what price or exchange rate did you have to pay after you have included any gains or losses in the futures market? f) How much will you have to pay in dollars for the engineered parts that cost 750,000 euros? g) How much would the company have had to pay if it hadn't hedged its currency exchange

It is March 12. You are a purchasing agent for a small spaceship manufacturer outside Spaceport America. In your executive team meeting, the company's production manager indicates that the company will need to buy engineered parts from a German firm. According to the production schedule, the parts will be purchased and delivered to the plant in six months. Today's contract signed with the German manufacturing plant indicates that the company will deliver the parts to you in six months for a price (including transportation costs) of 750,000 Euros. In your next executive meeting, you report that you have contracted to have the parts delivered. The company's president indicates that he is concerned about a weakening dollar and asks you to hedge the foreign exchange portion of this purchase using Euro F.X. contracts. Currently, the direct exchange rate (spot rate) between the dollar and the euro is 1.3066 (it will cost 1.3066 dollars to buy one euro). Futures contracts delivery months are listed quarterly out of 18 months. Current futures quotes are provided in the breakout box. One EUR/USD futures contract has a size of 125,000 euros. Initial and Maintenance margins for the contract are $2,475 and $2,250, respectively. a) If you had to pay for the engineered parts now, how much would you have to pay in dollars? b) What position should you take in the futures market to hedge your upcoming purchase of engineered parts from the German firm? c) Which contract should you select to hedge the company's future euro purchase? Why? d) How many contracts should you trade? Assume that six months have elapsed, the parts have been delivered and the German firm is waiting for payment. The spot exchange rate between the dollar and euro has moved to 1.3116. The contract for the Euro F.X. futures is trading at 1.3104 . e) What is your realized price (exchange rate) for euros? That is, what price or exchange rate did you have to pay after you have included any gains or losses in the futures market? f) How much will you have to pay in dollars for the engineered parts that cost 750,000 euros? g) How much would the company have had to pay if it hadn't hedged its currency exchange? It is March 12. You are a purchasing agent for a small spaceship manufacturer outside Spaceport America. In your executive team meeting, the company's production manager indicates that the company will need to buy engineered parts from a German firm. According to the production schedule, the parts will be purchased and delivered to the plant in six months. Today's contract signed with the German manufacturing plant indicates that the company will deliver the parts to you in six months for a price (including transportation costs) of 750,000 Euros. In your next executive meeting, you report that you have contracted to have the parts delivered. The company's president indicates that he is concerned about a weakening dollar and asks you to hedge the foreign exchange portion of this purchase using Euro F.X. contracts. Currently, the direct exchange rate (spot rate) between the dollar and the euro is 1.3066 (it will cost 1.3066 dollars to buy one euro). Futures contracts delivery months are listed quarterly out of 18 months. Current futures quotes are provided in the breakout box. One EUR/USD futures contract has a size of 125,000 euros. Initial and Maintenance margins for the contract are $2,475 and $2,250, respectively. a) If you had to pay for the engineered parts now, how much would you have to pay in dollars? b) What position should you take in the futures market to hedge your upcoming purchase of engineered parts from the German firm? c) Which contract should you select to hedge the company's future euro purchase? Why? d) How many contracts should you trade? Assume that six months have elapsed, the parts have been delivered and the German firm is waiting for payment. The spot exchange rate between the dollar and euro has moved to 1.3116. The contract for the Euro F.X. futures is trading at 1.3104 . e) What is your realized price (exchange rate) for euros? That is, what price or exchange rate did you have to pay after you have included any gains or losses in the futures market? f) How much will you have to pay in dollars for the engineered parts that cost 750,000 euros? g) How much would the company have had to pay if it hadn't hedged its currency exchange Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started