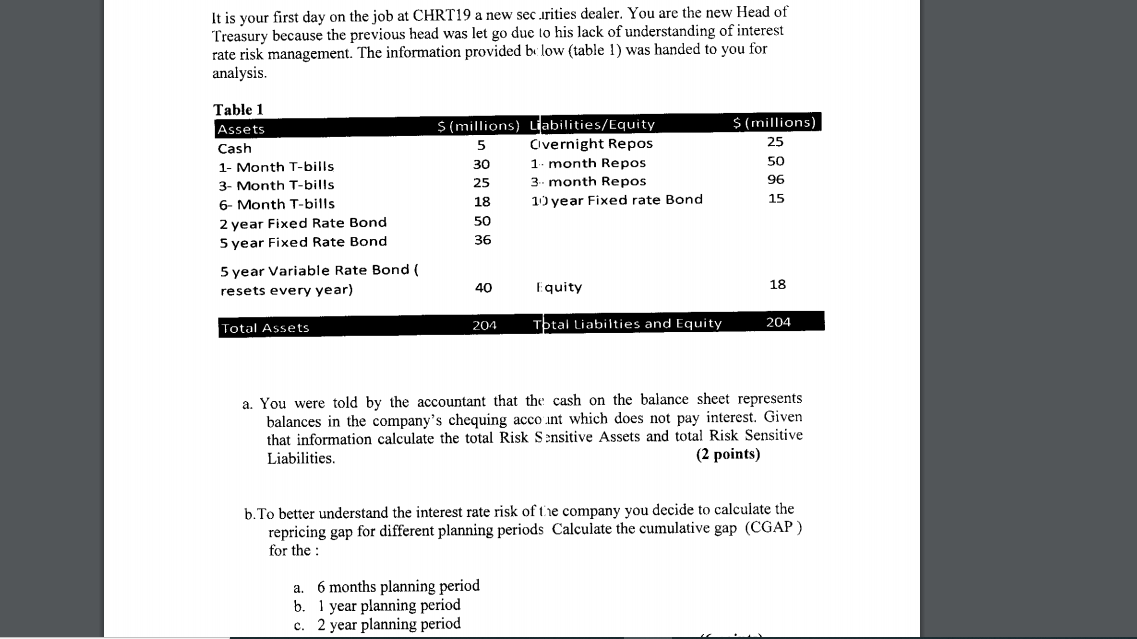

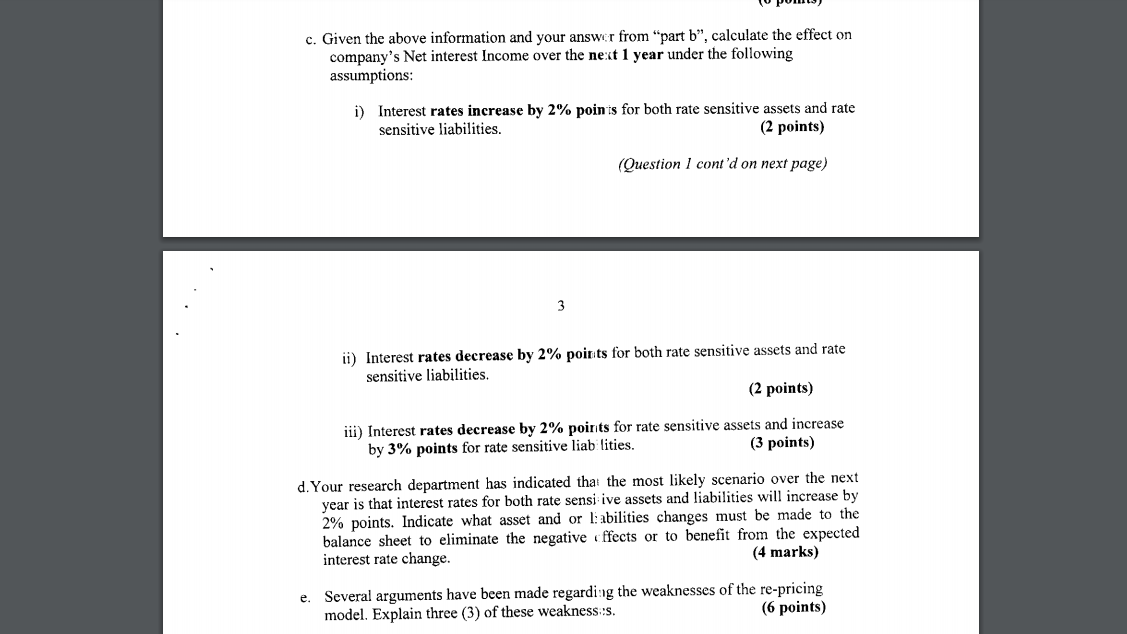

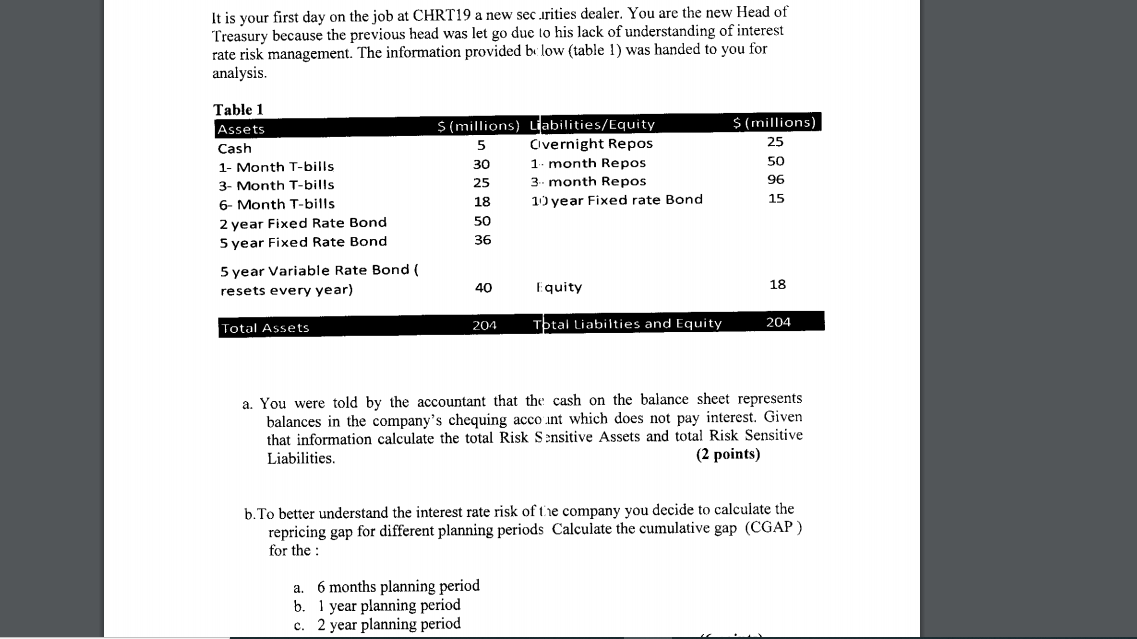

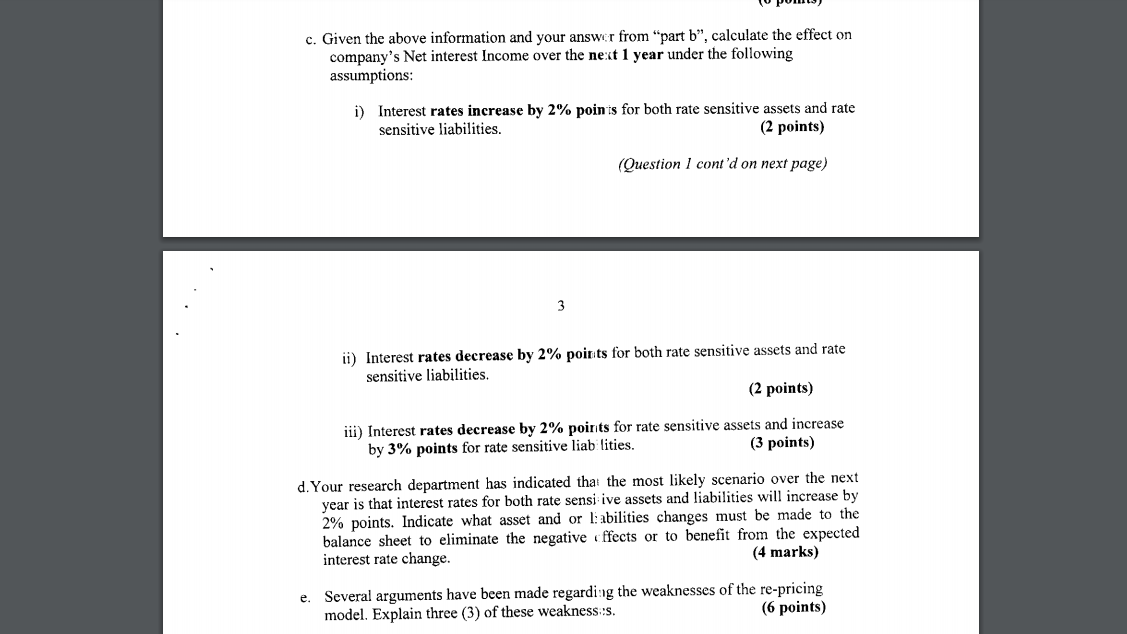

It is your first day on the job at CHRT19 a new securities dealer. You are the new Head of Treasury because the previous head was let go due to his lack of understanding of interest rate risk management. The information provided by low (table 1) was handed to you for analysis. Table 1 Assets Cash 1- Month T-bills 3- Month T-bills 6- Month T-bills 2 year Fixed Rate Bond 5 year Fixed Rate Bond $(millions) Liabilities/Equity 5 Overnight Repos 30 1-month Repos 25 3. month Repos 18 10) year Fixed rate Bond 50 36 $ (millions) 25 50 96 15 5 year Variable Rate Bond ( resets every year) 40 Equity 18 204 Total Assets 204 Total Liabilties and Equity a. You were told by the accountant that the cash on the balance sheet represents balances in the company's chequing account which does not pay interest. Given that information calculate the total Risk Sensitive Assets and total Risk Sensitive Liabilities. (2 points) b. To better understand the interest rate risk of the company you decide to calculate the repricing gap for different planning periods Calculate the cumulative gap (CGAP) for the : a. 6 months planning period b. 1 year planning period c. 2 year planning period c. Given the above information and your answer from "part b", calculate the effect on company's Net interest Income over the next 1 year under the following assumptions: i) Interest rates increase by 2% points for both rate sensitive assets and rate sensitive liabilities. (2 points) (Question I cont'd on next page) ii) Interest rates decrease by 2% points for both rate sensitive assets and rate sensitive liabilities. (2 points) iii) Interest rates decrease by 2% points for rate sensitive assets and increase by 3% points for rate sensitive liab lities. (3 points) d. Your research department has indicated that the most likely scenario over the next year is that interest rates for both rate sensi ive assets and liabilities will increase by 2% points. Indicate what asset and or liabilities changes must be made to the balance sheet to eliminate the negative effects or to benefit from the expected interest rate change. (4 marks) e. Several arguments have been made regarding the weaknesses of the re-pricing model. Explain three (3) of these weakness:s. (6 points) It is your first day on the job at CHRT19 a new securities dealer. You are the new Head of Treasury because the previous head was let go due to his lack of understanding of interest rate risk management. The information provided by low (table 1) was handed to you for analysis. Table 1 Assets Cash 1- Month T-bills 3- Month T-bills 6- Month T-bills 2 year Fixed Rate Bond 5 year Fixed Rate Bond $(millions) Liabilities/Equity 5 Overnight Repos 30 1-month Repos 25 3. month Repos 18 10) year Fixed rate Bond 50 36 $ (millions) 25 50 96 15 5 year Variable Rate Bond ( resets every year) 40 Equity 18 204 Total Assets 204 Total Liabilties and Equity a. You were told by the accountant that the cash on the balance sheet represents balances in the company's chequing account which does not pay interest. Given that information calculate the total Risk Sensitive Assets and total Risk Sensitive Liabilities. (2 points) b. To better understand the interest rate risk of the company you decide to calculate the repricing gap for different planning periods Calculate the cumulative gap (CGAP) for the : a. 6 months planning period b. 1 year planning period c. 2 year planning period c. Given the above information and your answer from "part b", calculate the effect on company's Net interest Income over the next 1 year under the following assumptions: i) Interest rates increase by 2% points for both rate sensitive assets and rate sensitive liabilities. (2 points) (Question I cont'd on next page) ii) Interest rates decrease by 2% points for both rate sensitive assets and rate sensitive liabilities. (2 points) iii) Interest rates decrease by 2% points for rate sensitive assets and increase by 3% points for rate sensitive liab lities. (3 points) d. Your research department has indicated that the most likely scenario over the next year is that interest rates for both rate sensi ive assets and liabilities will increase by 2% points. Indicate what asset and or liabilities changes must be made to the balance sheet to eliminate the negative effects or to benefit from the expected interest rate change. (4 marks) e. Several arguments have been made regarding the weaknesses of the re-pricing model. Explain three (3) of these weakness:s. (6 points)