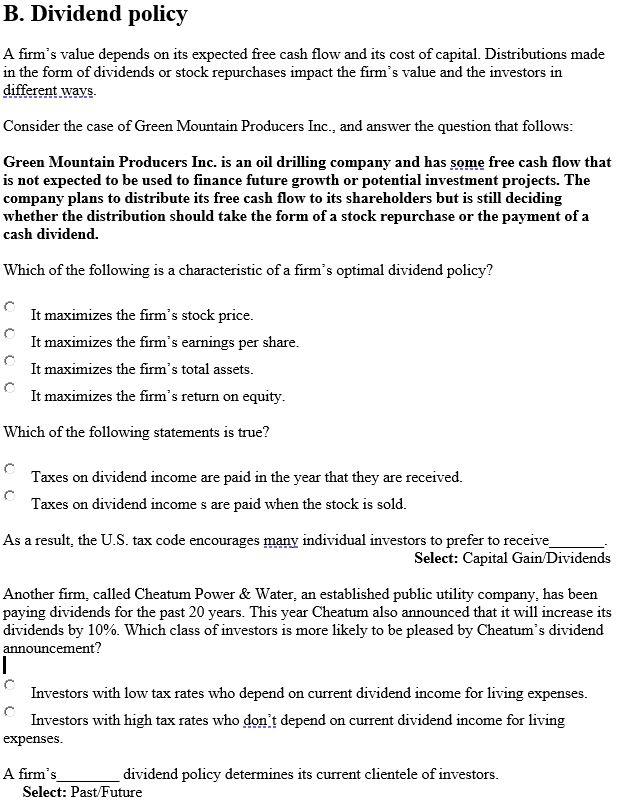

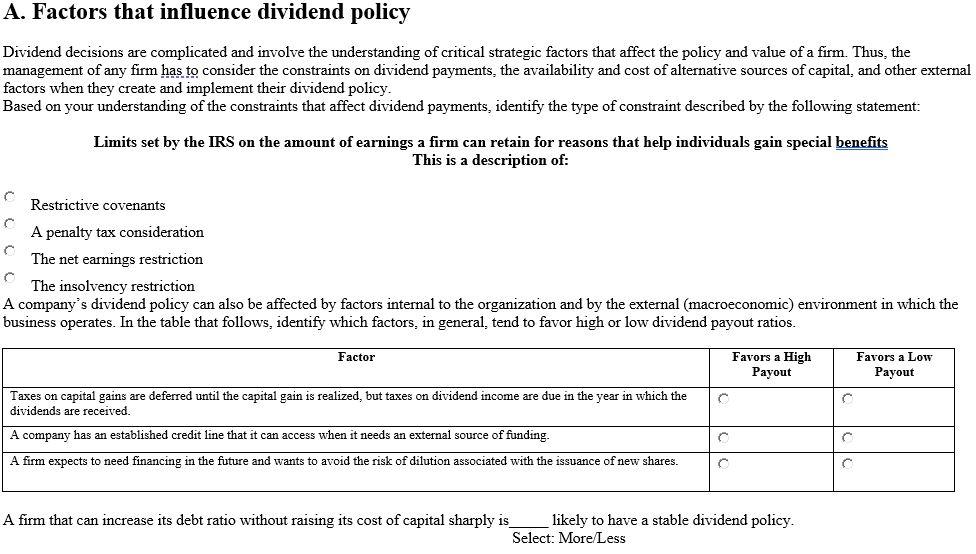

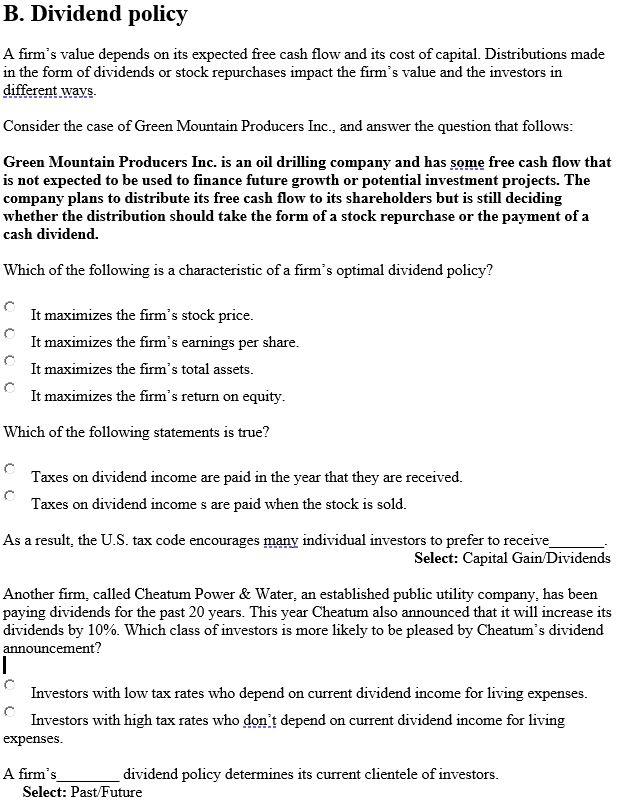

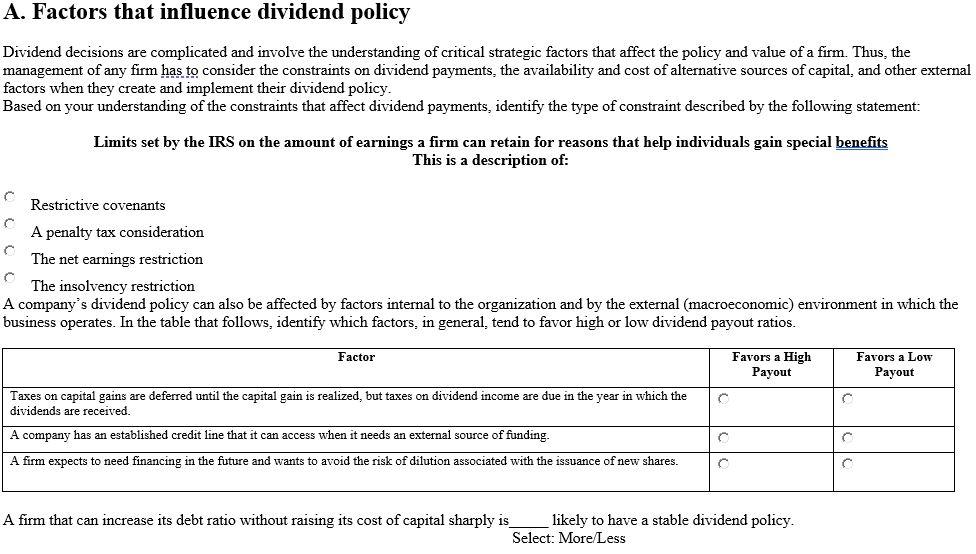

It maximizes the firm's stock price. It maximizes the firm's earnings per share. It maximizes the firm's total assets. It maximizes the firm's return on equity. Which of the following statements is true? Taxes on dividend income are paid in the year that they are received. Taxes on dividend income s are paid when the stock is sold. As a result, the U.S. tax code encourages many individual investors to prefer to receive Select: Capital Gain/Dividends Another firm, called Cheatum Power \& Water, an established public utility company, has been paying dividends for the past 20 years. This year Cheatum also announced that it will increase its dividends by 10%. Which class of investors is more likely to be pleased by Cheatum's dividend announcement? Investors with low tax rates who depend on current dividend income for living expenses. Investors with high tax rates who don't depend on current dividend income for living expenses. A firm's dividend policy determines its current clientele of investors. Select: Past/Future Factors that influence dividend policy ividend decisions are complicated and involve the understanding of critical strategic factors that affect the policy and value of a firm. Thus, the 1anagement of any firm has to consider the constraints on dividend payments, the availability and cost of alternative sources of capital, and other externz actors when they create and implement their dividend policy. ased on your understanding of the constraints that affect dividend payments, identify the type of constraint described by the following statement: Limits set by the IRS on the amount of earnings a firm can retain for reasons that help individuals gain special benefits This is a description of: Restrictive covenants A penalty tax consideration The net earnings restriction The insolvency restriction company's dividend policy can also be affected by factors internal to the organization and by the external (macroeconomic) environment in which the usiness operates. In the table that follows, identify which factors, in general, tend to favor high or low dividend payout ratios. firm that can increase its debt ratio without raising its cost of capital sharply is likely to have a stable dividend policy. Select: More/Less