Answered step by step

Verified Expert Solution

Question

1 Approved Answer

REQUIREMENTS 3. Jim Adams completes the year-end worksheet through the income statement and balance sheet columns. See page 18 of the Reference book for

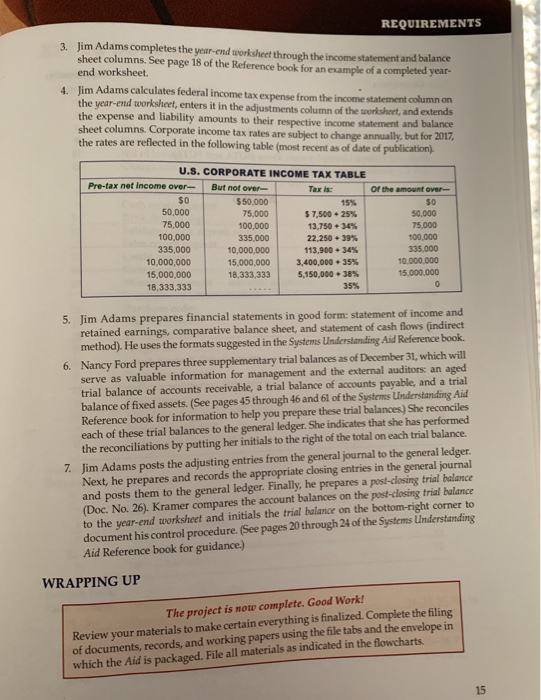

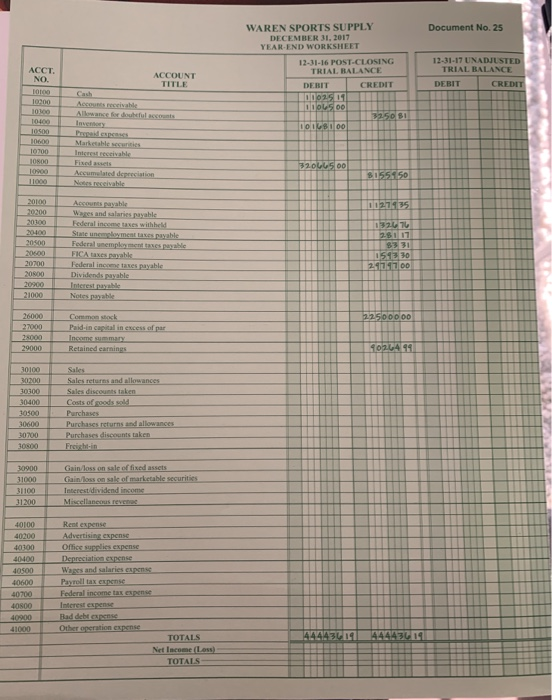

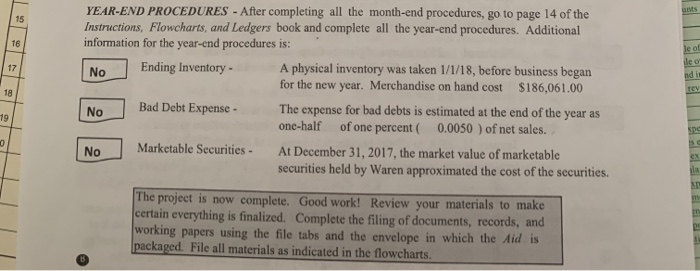

REQUIREMENTS 3. Jim Adams completes the year-end worksheet through the income statement and balance sheet columns. See page 18 of the Reference book for an example of a completed year- end worksheet. 4. Jim Adams calculates federal income tax expense from the income statement column on the year-end worksheet, enters it in the adjustments column of the worksheet, and extends the expense and liability amounts to their respective income statement and balance sheet columns. Corporate income tax rates are subject to change annually, but for 2017, the rates are reflected in the following table (most recent as of date of publication). U.S. CORPORATE INCOME TAX TABLE But not over- $50,000 Of the amount over- Pre-tax net income over- Tax is: $0 15% $0 50,000 75,000 $7,500 +25% 50,000 75,000 100,000 13,750 +34% 75,000 100,000 335,000 22,250 +39% 100,000 335,000 10,000,000 113,900 34% 335,000 10,000,000 15,000,000 3,400,000 + 35% 10,000,000 15,000,000 18,333,333 18,333,333 5,150,000 + 38% 35% 15,000,000 0 5. Jim Adams prepares financial statements in good form: statement of income and retained earnings, comparative balance sheet, and statement of cash flows (indirect method). He uses the formats suggested in the Systems Understanding Aid Reference book. 6. Nancy Ford prepares three supplementary trial balances as of December 31, which will serve as valuable information for management and the external auditors: an aged trial balance of accounts receivable, a trial balance of accounts payable, and a trial balance of fixed assets. (See pages 45 through 46 and 61 of the Systems Understanding Aid Reference book for information to help you prepare these trial balances) She reconciles each of these trial balances to the general ledger. She indicates that she has performed the reconciliations by putting her initials to the right of the total on each trial balance. 7. Jim Adams posts the adjusting entries from the general journal to the general ledger. Next, he prepares and records the appropriate closing entries in the general journal and posts them to the general ledger. Finally, he prepares a post-closing trial balance (Doc. No. 26). Kramer compares the account balances on the post-closing trial balance to the year-end worksheet and initials the trial balance on the bottom-right corner to document his control procedure. (See pages 20 through 24 of the Systems Understanding Aid Reference book for guidance.) WRAPPING UP The project is now complete. Good Work! Review your materials to make certain everything is finalized. Complete the filing of documents, records, and working papers using the file tabs and the envelope in which the Aid is packaged. File all materials as indicated in the flowcharts. 15 WAREN SPORTS SUPPLY DECEMBER 31, 2017 YEAR-END WORKSHEET 12-31-16 POST-CLOSING TRIAL BALANCE Document No. 25 12-31-17 UNADJUSTED TRIAL BALANCE ACCT. NO. ACCOUNT TITLE 10100 Cash 10200 10300 10400 10500 Prepaid expenses 10600 Accounts receivable Allowance for doubtful accounts Inventory Marketable securities DEBIT 1102519 1104500 3250 $1 10168100 CREDIT 10700 Interest receivable 10800 Fixed assets 10900 Accumulated depreciation 11000 Notes receivable 20100 Accounts payable 32066500 $155150 0127935 20200 Wages and salaries payable 20300 Federal income taxes withheld 20400 20500 State unemployment taxes payable Federal unemployment taxes payable 20600 FICA taxes payable 20700 Federal income taxes payable 132676 281 17 8331 05130 2474700 20800 Dividends payable 20900 Interest payable 21000 Notes payable 26000 Common stock 22500000 27000 Paid-in capital in excess of par 28000 Income summary 29000 Retained earnings 9026499 30100 Sales 30200 Sales returns and allowances 30300 Sales discounts taken 30400 Costs of goods sold 30500 Purchases 30600 Purchases returns and allowances 30700 Purchases discounts taken 30800 Freight-in 30900 31000 31100 31200 Gain/loss on sale of fixed assets Gain/loss on sale of marketable securities Interest/dividend income Miscellaneous revenue 40100 Rent expense 40200 40300 Advertising expense Office supplies expense 40400 Depreciation expense 40500 Wages and salaries expense 40600 Payroll tax expense 40700 Federal income tax expense 40800 Interest expense 40900 Bad debt expense 41000 Other operation expense TOTALS 44443019 444430 19 Net Income (Loss) TOTALS DEBIT CREDIT 15 YEAR-END PROCEDURES - After completing all the month-end procedures, go to page 14 of the Instructions, Flowcharts, and Ledgers book and complete all the year-end procedures. Additional information for the year-end procedures is: 16 17 No Ending Inventory - 18 Bad Debt Expense- No 19. 0 No Marketable Securities - A physical inventory was taken 1/1/18, before business began for the new year. Merchandise on hand cost $186,061.00 The expense for bad debts is estimated at the end of the year as one-half of one percent ( 0.0050) of net sales. At December 31, 2017, the market value of marketable securities held by Waren approximated the cost of the securities. The project is now complete. Good work! Review your materials to make certain everything is finalized. Complete the filing of documents, records, and working papers using the file tabs and the envelope in which the Aid is packaged. File all materials as indicated in the flowcharts. unts Je of ile of nd in rev

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To complete the yearend procedures for Waren Sports Supply follow these detailed steps Step 1 Prepare the Unadjusted Trial Balance 1 Record all Decemb...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started