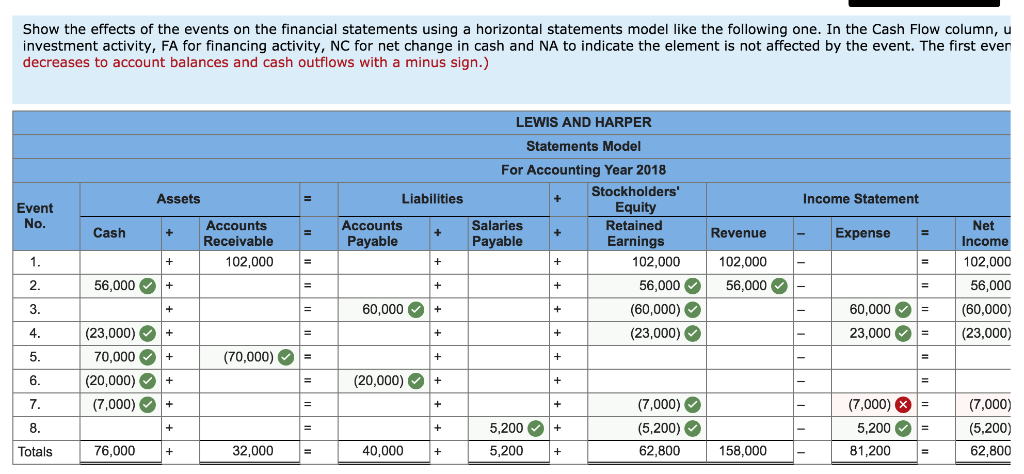

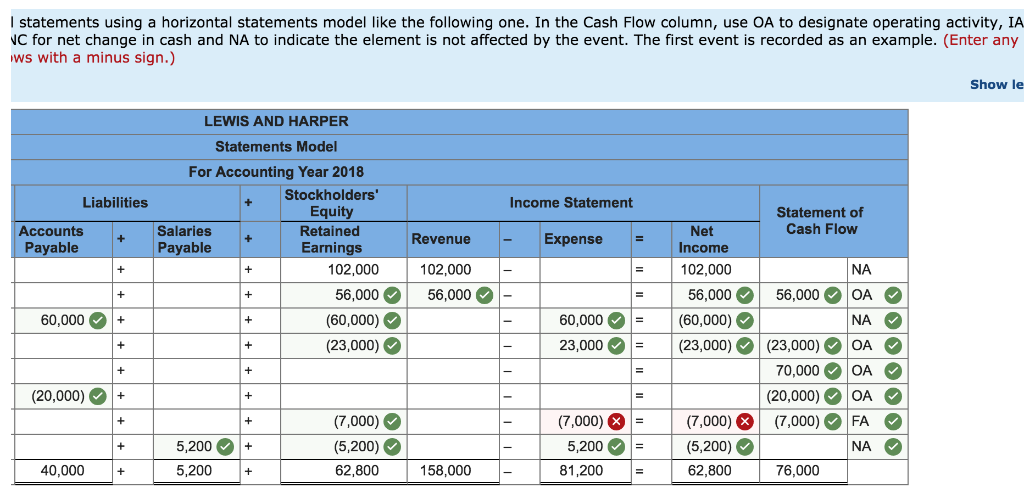

It says my answer is incomplete, but i'm not understanding why. I changed the 7000s marked in red to be positive, and it is still counted wrong. Can anyone please help me figure out why its still considered incomplete?

It says my answer is incomplete, but i'm not understanding why. I changed the 7000s marked in red to be positive, and it is still counted wrong. Can anyone please help me figure out why its still considered incomplete?

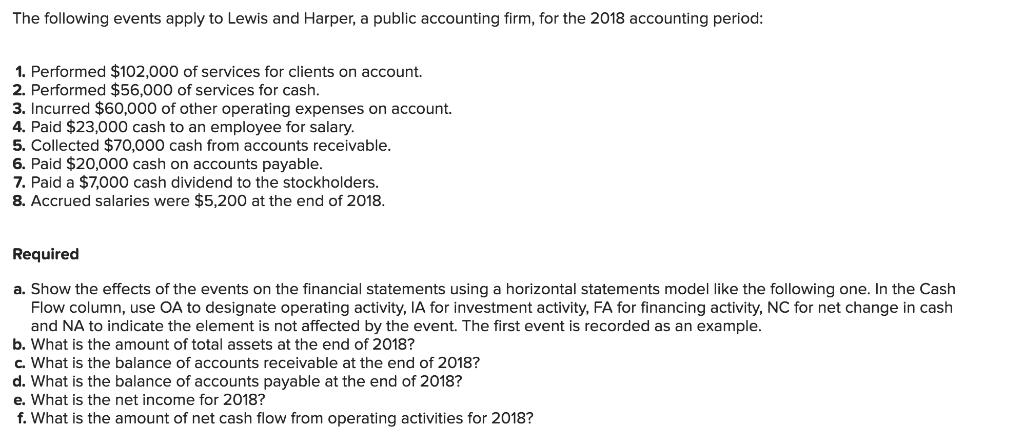

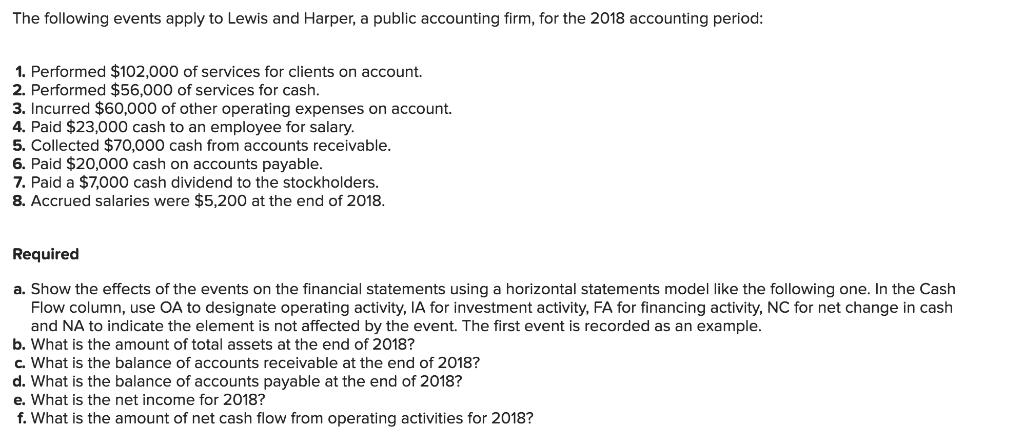

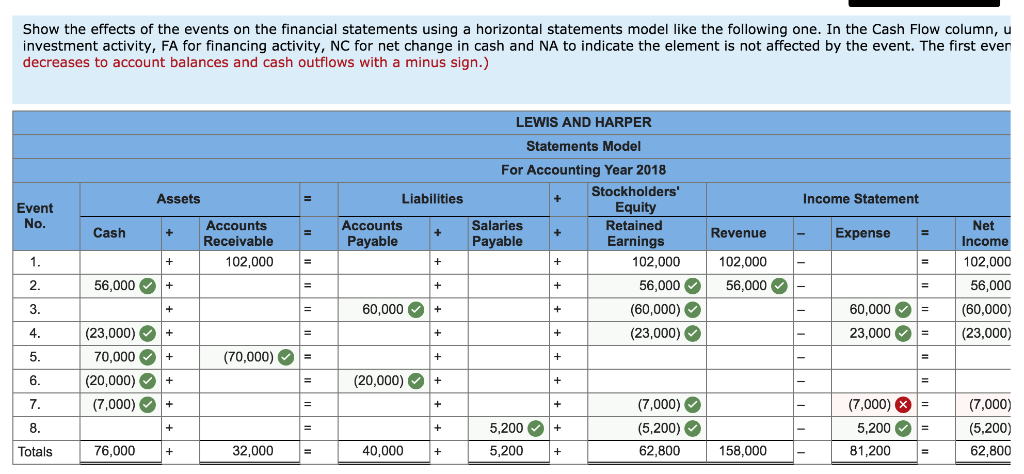

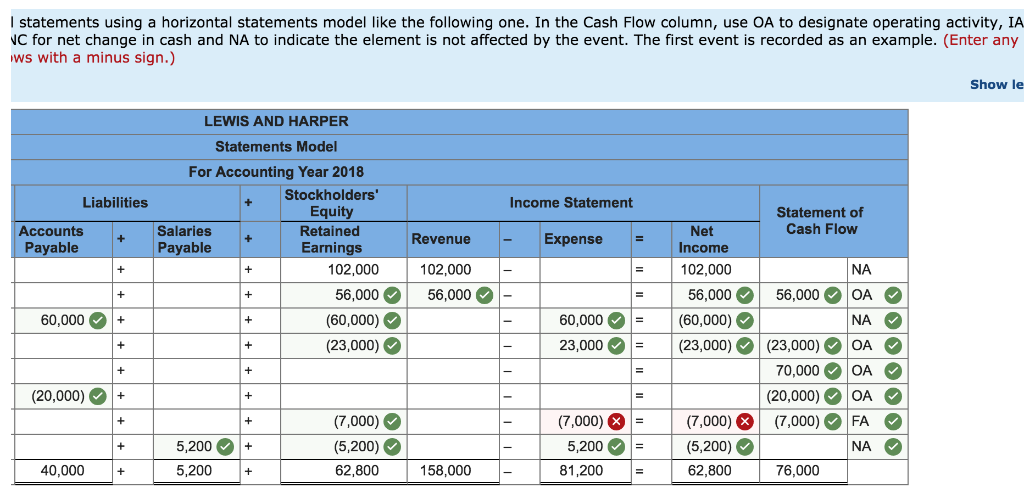

The following events apply to Lewis and Harper, a public accounting firm, for the 2018 accounting period: 1. Performed $102,000 of services for clients on account. 2. Performed $56,000 of services for cash. 3. Incurred $60,000 of other operating expenses on account. 4. Paid $23,000 cash to an employee for salary. 5. Collected $70,000 cash from accounts receivable. 6. Paid $20,000 cash on accounts payable. 7. Paid a $7,000 cash dividend to the stockholders. 8. Accrued salaries were $5,200 at the end of 2018. Required a. Show the effects of the events on the financial statements using a horizontal statements model like the following one. In the Cash Flow column, use OA to designate operating activity, IA for investment activity, FA for financing activity, NC for net change in cash and NA to indicate the element is not affected by the event. The first event is recorded as an example. b. What is the amount of total assets at the end of 2018? c. What is the balance of accounts receivable at the end of 2018? d. What is the balance of accounts payable at the end of 2018? e. What is the net income for 2018? f. What is the amount of net cash flow from operating activities for 2018? Show the effects of the events on the financial statements using a horizontal statements model like the following one. In the Cash Flow column, u investment activity, FA for financing activity, NC for net change in cash and NA to indicate the element is not affected by the event. The first even decreases to account balances and cash outflows with a minus sign.) LEWIS AND HARPER Statements Model For Accounting Year 2018 Stockholders Equity Retained Earnings Assets Liabilities Income Statement Event Salaries Payable Net Accounts Receivable Accounts Payable Cash Revenue- ue Expense Income 102,000 56,000 (60,000) (23,000) 102,000 102,000 02,000 2. 56,000 56,000 56,000 - (60,000) (23,000) 60,000 + 60,000 4. (23,000)+ 23,000 (70,000) 70,000 (20,000)+ (7,000)+ 6 (20,000) 5,200 + 5,200 + (7,000) (5,200) 62,800 (7,000) X ,200 81,200 (7,000) (5,200) 62,800 Totals 76,000 + 32,000 - 40,000 58,000 - I statements using a horizontal statements model like the following one. In the Cash Flow column, use OA to designate operating activity, IA NC for net change in cash and NA to indicate the element is not affected by the event. The first event is recorded as an example. (Enter any ws with a minus sign.) Show le LEWIS AND HARPER Statements Model For Accounting Year 2018 Stockholders Equity Retained Earnings Liabilities Income Statement Statement of Cash Flow Accounts Payable Salaries Payable Net Income 102,000 Revenue Expense 102,000 56,000 (60,000) (23,000) 102,000 NA 56,000- 56,00056,000 OA 60,000 + l (60,000) 01 60,000 23,000.= |(23,000) (23,000) OAO 70,0000 OA (20,000) OA (7,000) (7,000) FA NA (20,000) (7,000) (5,200) 62,800 (7,000) 5,200 + 5,200+ 5,200 81,200 - (5,200) 62,800 40,000 + 158,000 76,000

It says my answer is incomplete, but i'm not understanding why. I changed the 7000s marked in red to be positive, and it is still counted wrong. Can anyone please help me figure out why its still considered incomplete?

It says my answer is incomplete, but i'm not understanding why. I changed the 7000s marked in red to be positive, and it is still counted wrong. Can anyone please help me figure out why its still considered incomplete?