Answered step by step

Verified Expert Solution

Question

1 Approved Answer

it should be on excel Fursa. Prest should he whowes Furn Afirae PN methodf. 7 Consider four plastic presses. Suppose that each press is capable

it should be on excel

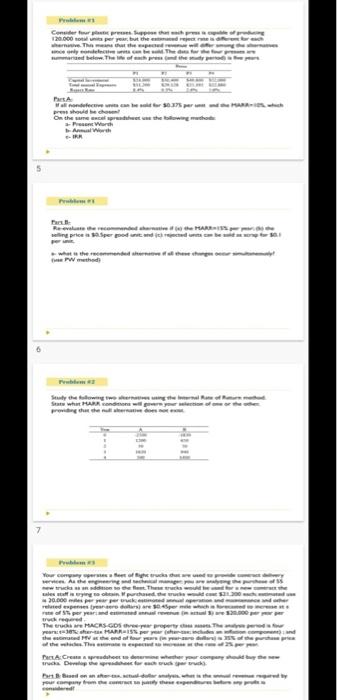

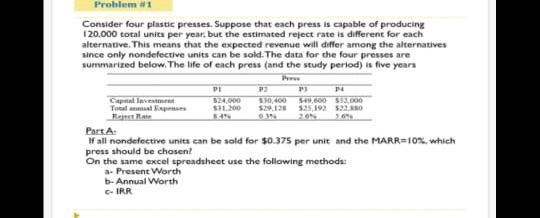

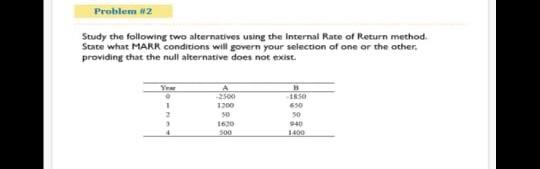

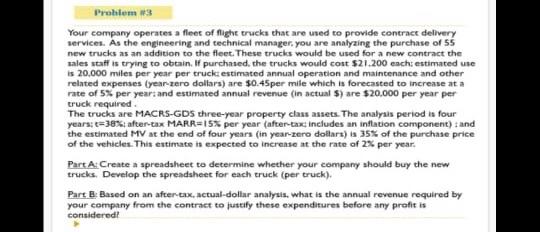

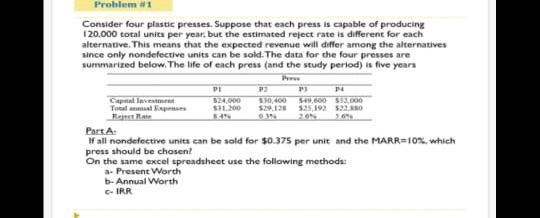

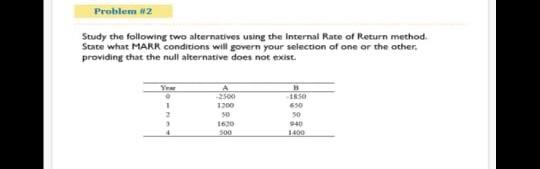

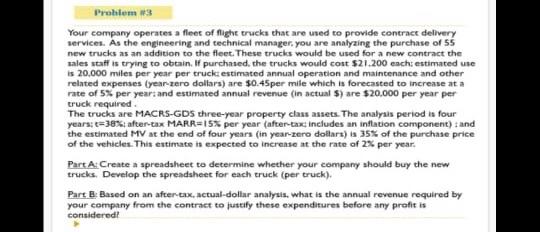

Fursa. Prest should he whowes Furn Afirae PN methodf. 7 Consider four plastic presses. Suppose that each press is capable of producing 120,000 total unica per year but the estimated reject rate is different for each alternative. This means that the expected revenue will differ among the alternatives unce only nondefective units can be soid. The data for the four presses are sumrmarized below. The lafe of each press (arid the study period) is five years Part A: If all nondefective units can be sold for $0.375 per unit and the MARR=10\%. which press should be chosen? On the same excel spreaduheet use the following methods: a- Present Worth b- Annual Worth c-IRR Part B- Re-evaluate the recommended alternative if (a) the MAAR =15% per year: (b) the selling price is \$0.5per good unit, and (c) rejected unita can be sold as scrap for 50.1 per unit. a- what is the recommended alternative if all these changes occur simultaneoutly? (use PVN method) Study the following two alternatives using the Internal Rate of Return mechod. Scace what MARR condirions will govern your selection of one or the ocher. providing that the null alternative does not exist. Your company operates a fleet of flight trucks that are used to provide contract delivery services. As the engineering and technical manager, you are analyzing the purchase of 55 new trucks as an addition to the fleet. These trucks would be used for a new contract the sales staff is trying to obtain. If purchased, the trucks would cost \$21,200 eacht estimated use is 20,000 milen per year per truck estimated annual operation and maintenance and other related expenses (year-zero dollars) are 90.45 per mile which is forecasted to increase at a rate of 5% per year: and estimated annual revenue (in actual \$) are $20.000 per year per truck required . The trucks are MACAS-GDS three-year property class assets. The analyas period is four years; t=38%; after-tax MARR=15\% per year (after-taxt includes an inflation component) fand the estimated MV at the end of four years (in year-zero dollars) is 35% of the purchase price of the vehieles. This entimate is expected to increase at the rate of 2% per year: Parc A:Create a spreadaheet to determine whether your company ahould buy the new trucks. Develop the spreadsheet for each truck (per truck). Part B: Based on an after-cox, actual-dollar analyais, what is the annual revenue required by your company from the contract to justify these expenditures before any praft is corisideredt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started