It will be clearer if you can answer with a form.The title is uploaded with the original picture, without any changes.

It will be clearer if you can answer with a form.The title is uploaded with the original picture, without any changes.

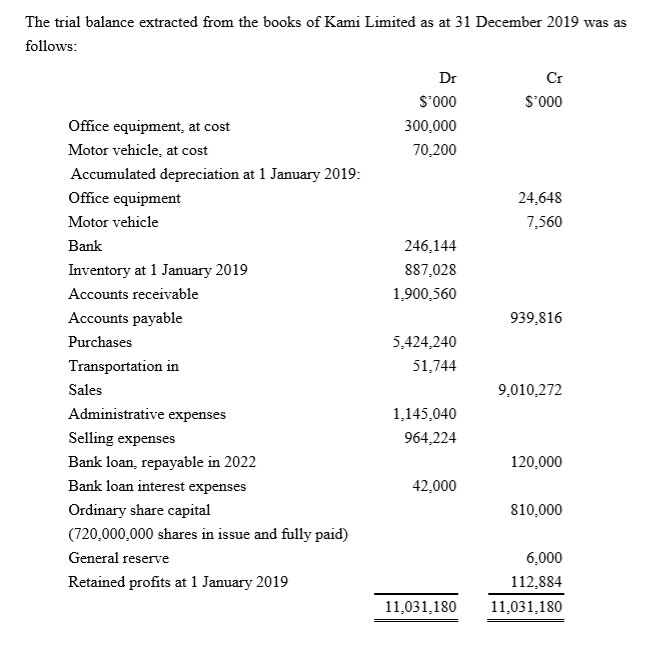

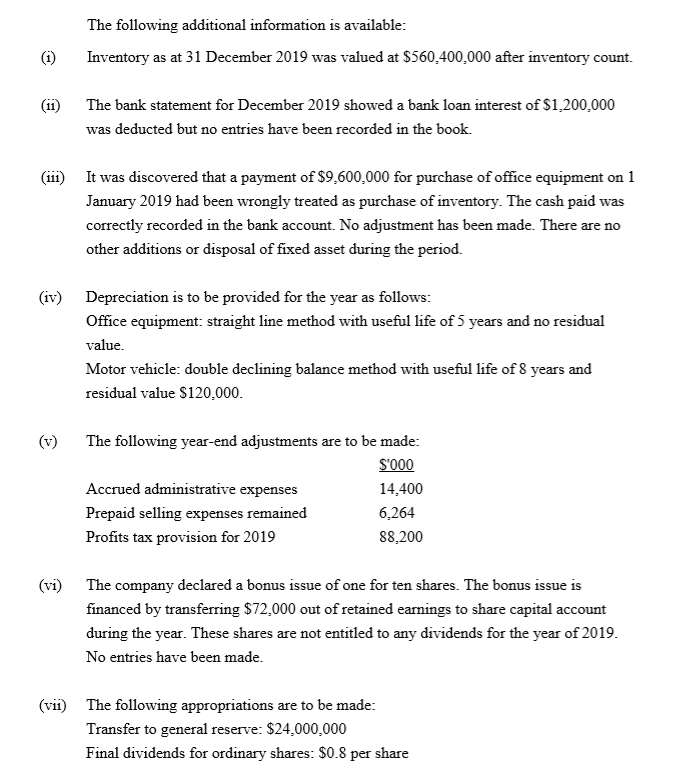

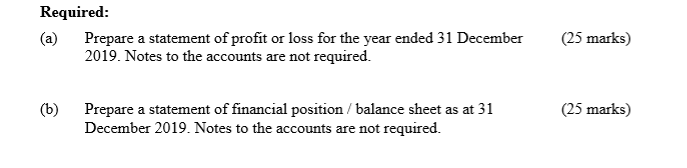

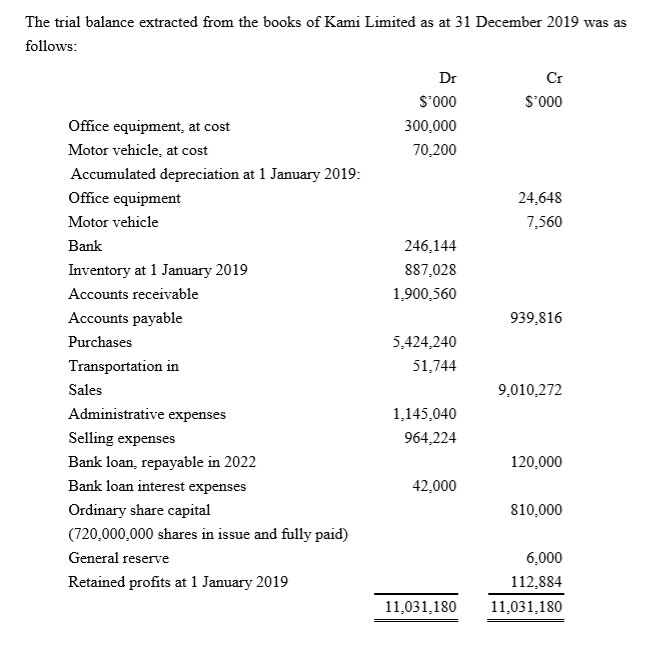

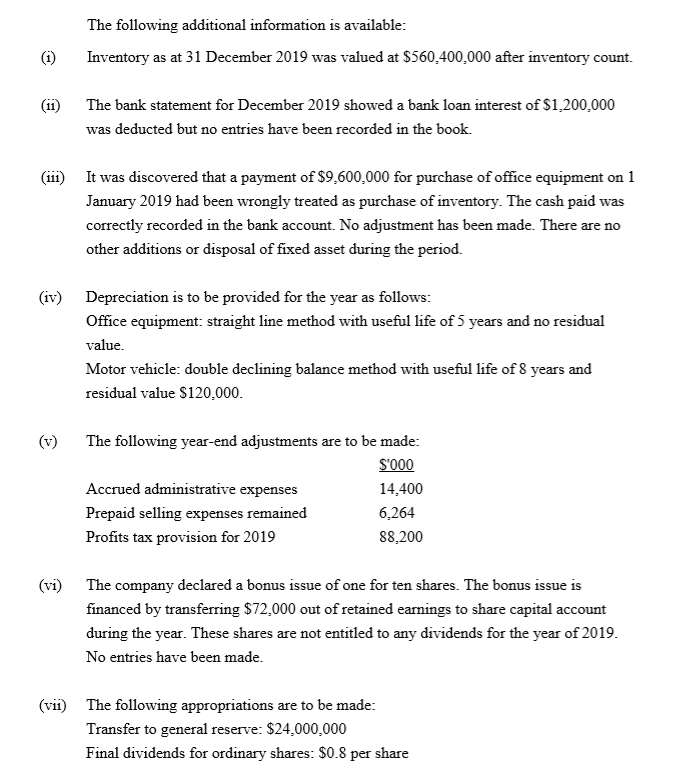

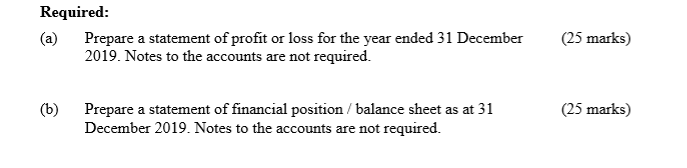

The trial balance extracted from the books of Kami Limited as at 31 December 2019 was as follows: Cr S'000 Dr S'000 300,000 70.200 24,648 7,560 246,144 887,028 1,900,560 939.816 Office equipment, at cost Motor vehicle, at cost Accumulated depreciation at 1 January 2019: Office equipment Motor vehicle Bank Inventory at 1 January 2019 Accounts receivable Accounts payable Purchases Transportation in Sales Administrative expenses Selling expenses Bank loan repayable in 2022 Bank loan interest expenses Ordinary share capital (720,000,000 shares in issue and fully paid) General reserve Retained profits at 1 January 2019 5,424,240 51,744 9.010.272 1,145,040 964.224 120,000 42.000 810.000 6,000 112.884 11,031,180 11,031,180 The following additional information is available: (1) Inventory as at 31 December 2019 was valued at $560,400,000 after inventory count. (11) The bank statement for December 2019 showed a bank loan interest of $1,200.000 was deducted but no entries have been recorded in the book. (111) It was discovered that a payment of $9,600,000 for purchase of office equipment on 1 January 2019 had been wrongly treated as purchase of inventory. The cash paid was correctly recorded in the bank account. No adjustment has been made. There are no other additions or disposal of fixed asset during the period. (iv) Depres Depreciation is to be provided for the year as follows: Office equipment: straight line method with useful life of 5 years and no residual value. Motor vehicle: double declining balance method with useful life of 8 years and residual value $120,000. (v) The following year-end adjustments are to be made: $'000 Accrued administrative expenses 14,400 Prepaid selling expenses remained 6,264 Profits tax provision for 2019 88,200 (vi) The company declared a bonus issue of one for ten shares. The bonus issue is financed by transferring $72,000 out of retained earnings to share capital account during the year. These shares are not entitled to any dividends for the year of 2019. No entries have been made. (vii) The following appropriations are to be made: Transfer to general reserve: $24,000,000 Final dividends for ordinary shares: $0.8 per share Required: (a) Prepare a statement of profit or loss for the year ended 31 December 2019. Notes to the accounts are not required. (25 marks) (b) Prepare a statement of financial position / balance sheet as at 31 December 2019. Notes to the accounts are not required. (25 marks) The trial balance extracted from the books of Kami Limited as at 31 December 2019 was as follows: Cr S'000 Dr S'000 300,000 70.200 24,648 7,560 246,144 887,028 1,900,560 939.816 Office equipment, at cost Motor vehicle, at cost Accumulated depreciation at 1 January 2019: Office equipment Motor vehicle Bank Inventory at 1 January 2019 Accounts receivable Accounts payable Purchases Transportation in Sales Administrative expenses Selling expenses Bank loan repayable in 2022 Bank loan interest expenses Ordinary share capital (720,000,000 shares in issue and fully paid) General reserve Retained profits at 1 January 2019 5,424,240 51,744 9.010.272 1,145,040 964.224 120,000 42.000 810.000 6,000 112.884 11,031,180 11,031,180 The following additional information is available: (1) Inventory as at 31 December 2019 was valued at $560,400,000 after inventory count. (11) The bank statement for December 2019 showed a bank loan interest of $1,200.000 was deducted but no entries have been recorded in the book. (111) It was discovered that a payment of $9,600,000 for purchase of office equipment on 1 January 2019 had been wrongly treated as purchase of inventory. The cash paid was correctly recorded in the bank account. No adjustment has been made. There are no other additions or disposal of fixed asset during the period. (iv) Depres Depreciation is to be provided for the year as follows: Office equipment: straight line method with useful life of 5 years and no residual value. Motor vehicle: double declining balance method with useful life of 8 years and residual value $120,000. (v) The following year-end adjustments are to be made: $'000 Accrued administrative expenses 14,400 Prepaid selling expenses remained 6,264 Profits tax provision for 2019 88,200 (vi) The company declared a bonus issue of one for ten shares. The bonus issue is financed by transferring $72,000 out of retained earnings to share capital account during the year. These shares are not entitled to any dividends for the year of 2019. No entries have been made. (vii) The following appropriations are to be made: Transfer to general reserve: $24,000,000 Final dividends for ordinary shares: $0.8 per share Required: (a) Prepare a statement of profit or loss for the year ended 31 December 2019. Notes to the accounts are not required. (25 marks) (b) Prepare a statement of financial position / balance sheet as at 31 December 2019. Notes to the accounts are not required. (25 marks)

It will be clearer if you can answer with a form.The title is uploaded with the original picture, without any changes.

It will be clearer if you can answer with a form.The title is uploaded with the original picture, without any changes.