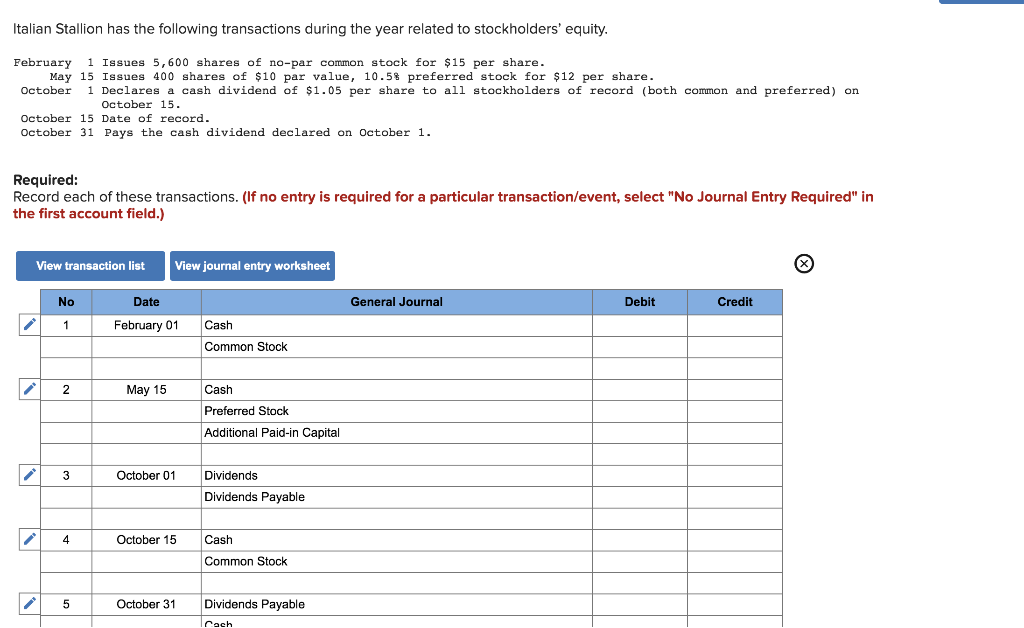

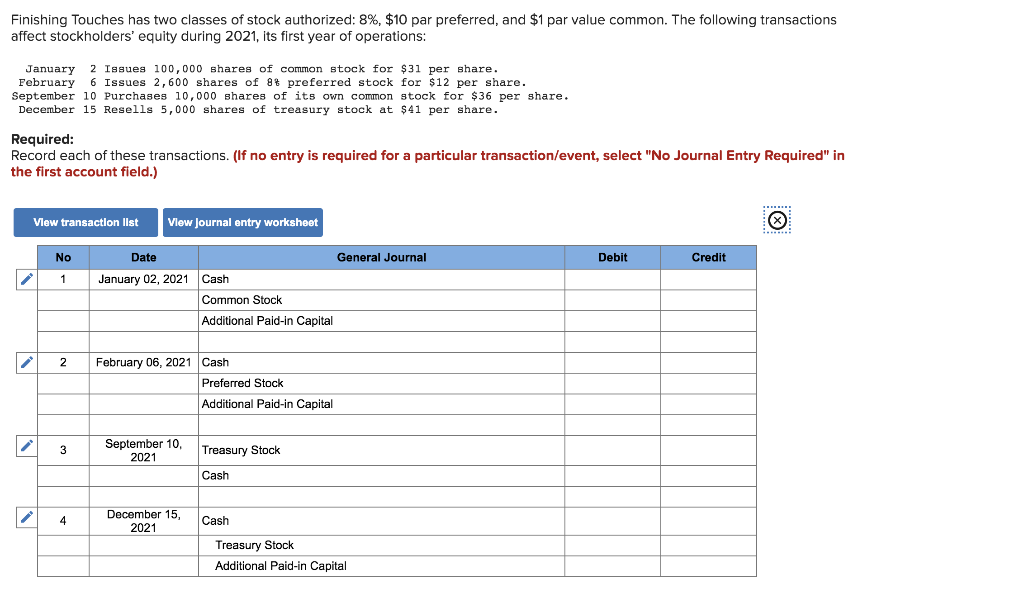

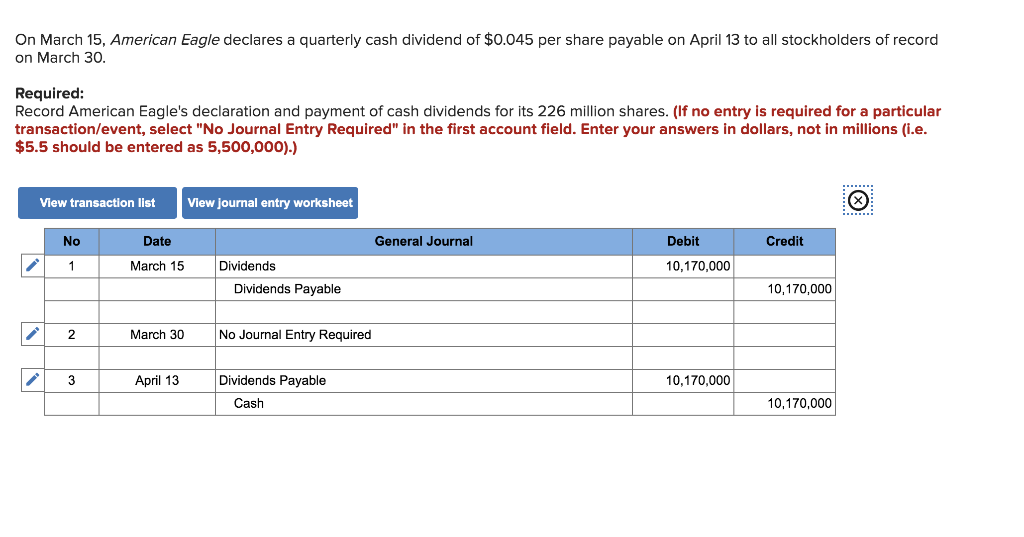

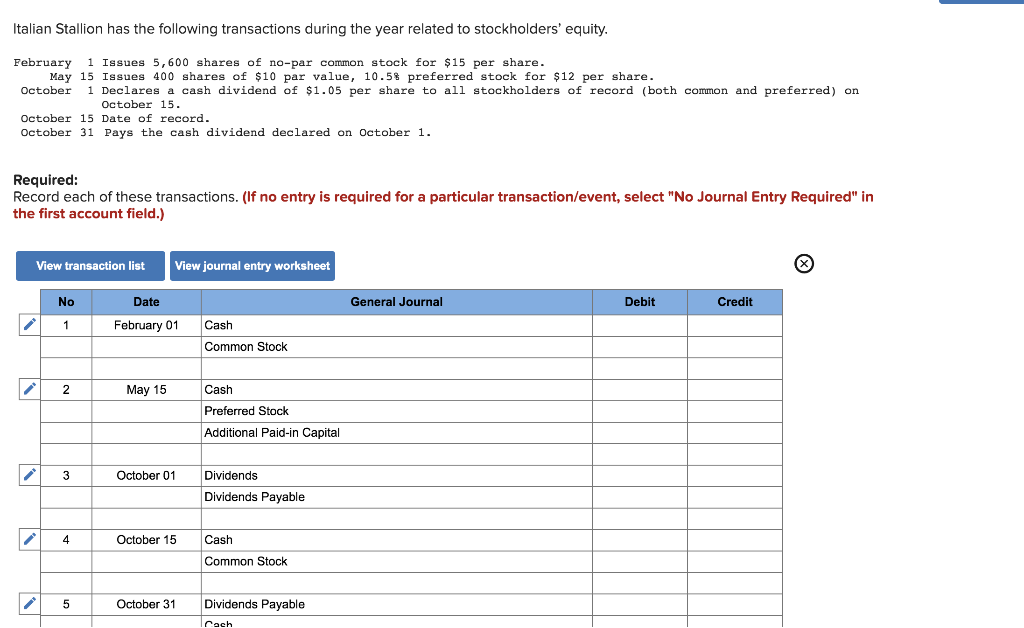

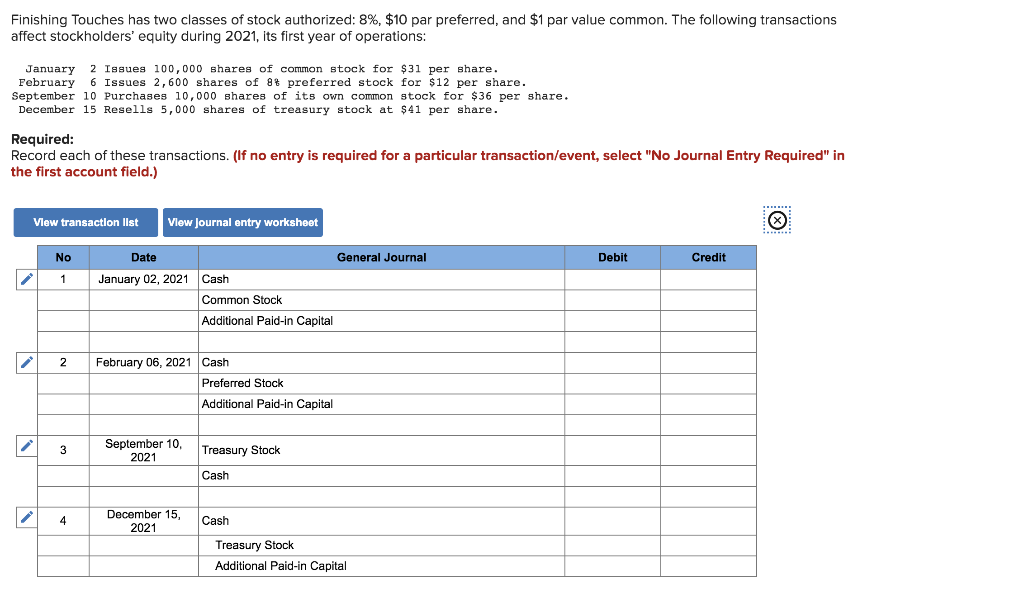

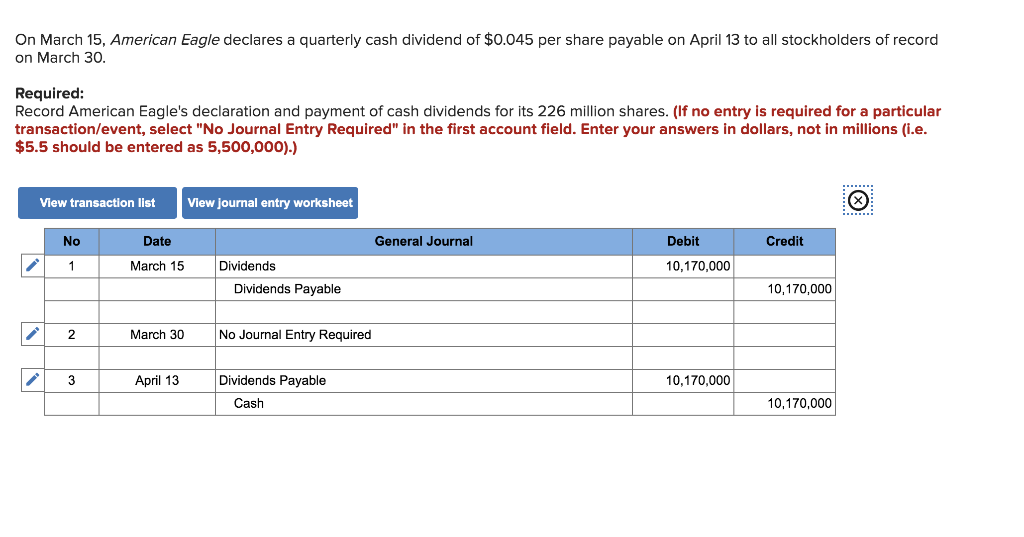

Italian Stallion has the following transactions during the year related to stockholders' equity. February 1 Issues 5,600 shares of no-par common stock for $15 per share. May 15 Issues 400 shares of $10 par value, 10.5% preferred stock for $12 per share October 1 Declares a cash dividend of $1.05 per share to all stockholders of record (both common and preferred) on October 15. October 15 Date of record. October 31 Pays the cash dividend declared on October 1. Required: Record each of these transactions. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list View journal entry worksheet No Date General Journal Debit Credit 1 February 01 Cash Common Stock 2 May 15 Cash Preferred Stock Additional Paid-in Capital 3 October 01 Dividends Dividends Payable 4 October 15 Cash Common Stock 5 October 31 Dividends Payable Cach Finishing Touches has two classes of stock authorized: 8%, $10 par preferred, and $1 par value common. The following transactions affect stockholders' equity during 2021, its first year of operations: January 2 Issues 100,000 shares of common stock for $31 per share. February 6 Issues 2,600 shares of 8t preferred stock for $12 per share. September 10 Purchases 10,000 shares of its own common stock for $36 per share. December 15 Resells 5,000 shares of treasury stock at $41 per share. Required: Record each of these transactions. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list View Journal entry worksheet X No Debit Credit 1 Date General Journal January 02, 2021 Cash Common Stock Additional Paid-in Capital 2 February 06, 2021 Cash Preferred Stock Additional Paid-in Capital 3 September 10, 2021 Treasury Stock Cash 4 December 15, 2021 Cash Treasury Stock Additional Paid-in Capital On March 15, American Eagle declares a quarterly cash dividend of $0.045 per share payable on April 13 to all stockholders of record on March 30. Required: Record American Eagle's declaration and payment of cash dividends for its 226 million shares. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions (ie. $5.5 should be entered as 5,500,000).) View transaction list View journal entry worksheet No Date General Journal Debit Credit 1 March 15 10,170,000 Dividends Dividends Payable 10,170,000 2 March 30 No Journal Entry Required 3 April 13 10,170,000 Dividends Payable Cash 10,170,000