Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Italy Bikes Company manufactures high-performance bikes. The company plans to improve its profits by increasing sales and its market share. They are therefore analysing a

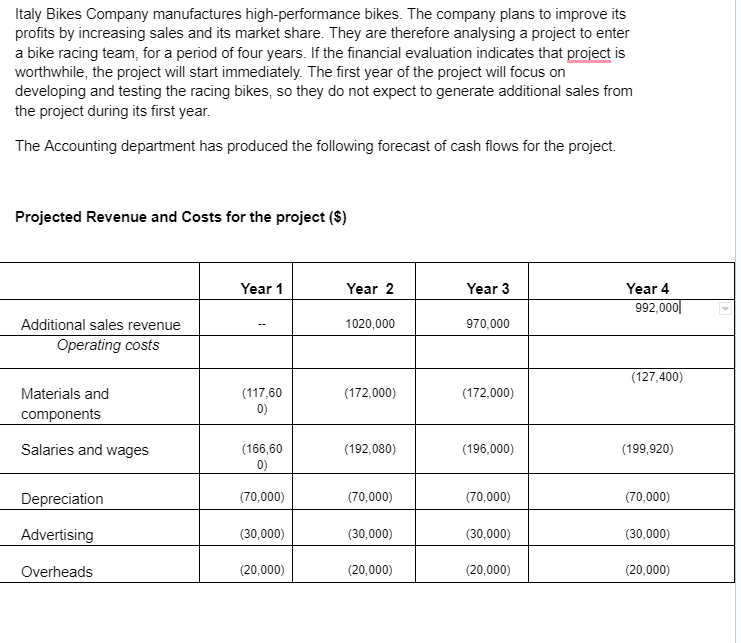

Italy Bikes Company manufactures high-performance bikes. The company plans to improve its profits by increasing sales and its market share. They are therefore analysing a project to enter a bike racing team, for a period of four years. If the financial evaluation indicates that project is worthwhile, the project will start immediately. The first year of the project will focus on developing and testing the racing bikes, so they do not expect to generate additional sales from the project during its first year. The Accounting department has produced the following forecast of cash flows for the project. Projected Revenue and Costs for the project (\$) 1. Capital Expenditure on machinery and equipment of $400,000 will be incurred on the first day of the project and this equipment is expected to be sold for $80,000 on the last day of the fourth year. 2. The expenditures on materials, advertising, and salaries and wages are all directly related to the project and would be avoided should the project not be undertaken. 3. The company spent $20,000 on market survey to determine if the market is available for increased output. 4. The depreciation charges on the manufacturing equipment arises from the company's use of straight-line method of depreciation. 5. All overheads included in the costs are a fair allocation of the head office costs, of which $6000 per year are as a result of the project. 6. The cost of capital for this type of investment is 10 per cent and the directors set a target accounting rate of return on investment of 15 per cent and a payback period of three and half years or less for all projects. 7. The company assumes that all its operating cash flows occur at the end of each year with the exception of the capital expenditure which occurs at the beginning. Ignore taxation and inflation. Required Assume that you are the newly employed graduate from College who works with the Management Accountant. You are expected to use a range of capital budgeting techniques to carry out an investment appraisal of the project and, based on your results, make recommendations to the company as to whether the project should go ahead. You are asked to present a management report, stating work done, and demonstrating critical evaluation in the robustness of your findings. You can make reference to appropriate theory in investment appraisal, cost of capital and risk

Italy Bikes Company manufactures high-performance bikes. The company plans to improve its profits by increasing sales and its market share. They are therefore analysing a project to enter a bike racing team, for a period of four years. If the financial evaluation indicates that project is worthwhile, the project will start immediately. The first year of the project will focus on developing and testing the racing bikes, so they do not expect to generate additional sales from the project during its first year. The Accounting department has produced the following forecast of cash flows for the project. Projected Revenue and Costs for the project (\$) 1. Capital Expenditure on machinery and equipment of $400,000 will be incurred on the first day of the project and this equipment is expected to be sold for $80,000 on the last day of the fourth year. 2. The expenditures on materials, advertising, and salaries and wages are all directly related to the project and would be avoided should the project not be undertaken. 3. The company spent $20,000 on market survey to determine if the market is available for increased output. 4. The depreciation charges on the manufacturing equipment arises from the company's use of straight-line method of depreciation. 5. All overheads included in the costs are a fair allocation of the head office costs, of which $6000 per year are as a result of the project. 6. The cost of capital for this type of investment is 10 per cent and the directors set a target accounting rate of return on investment of 15 per cent and a payback period of three and half years or less for all projects. 7. The company assumes that all its operating cash flows occur at the end of each year with the exception of the capital expenditure which occurs at the beginning. Ignore taxation and inflation. Required Assume that you are the newly employed graduate from College who works with the Management Accountant. You are expected to use a range of capital budgeting techniques to carry out an investment appraisal of the project and, based on your results, make recommendations to the company as to whether the project should go ahead. You are asked to present a management report, stating work done, and demonstrating critical evaluation in the robustness of your findings. You can make reference to appropriate theory in investment appraisal, cost of capital and risk Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started