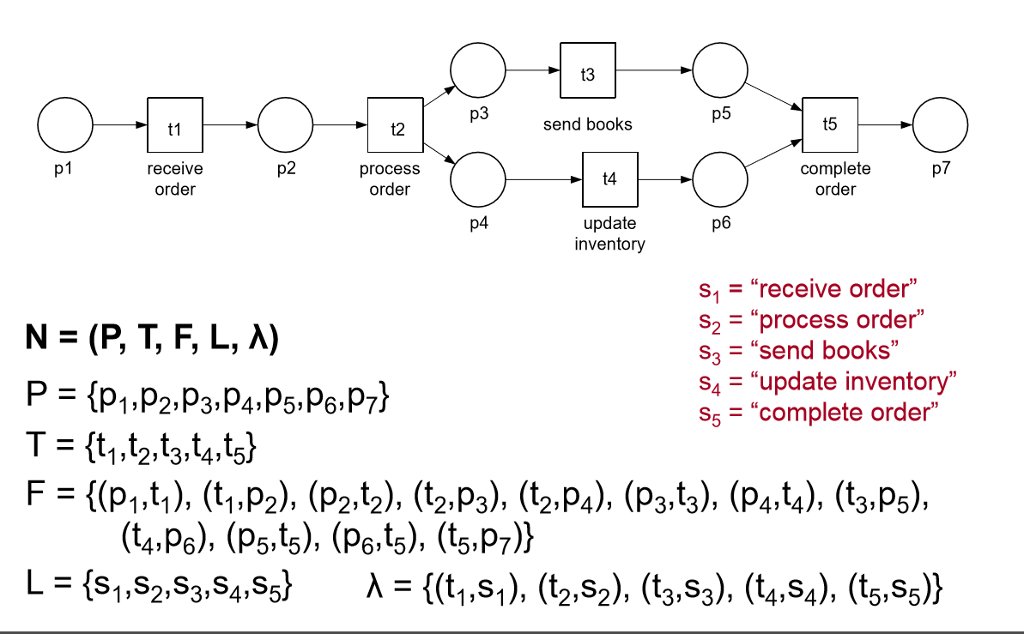

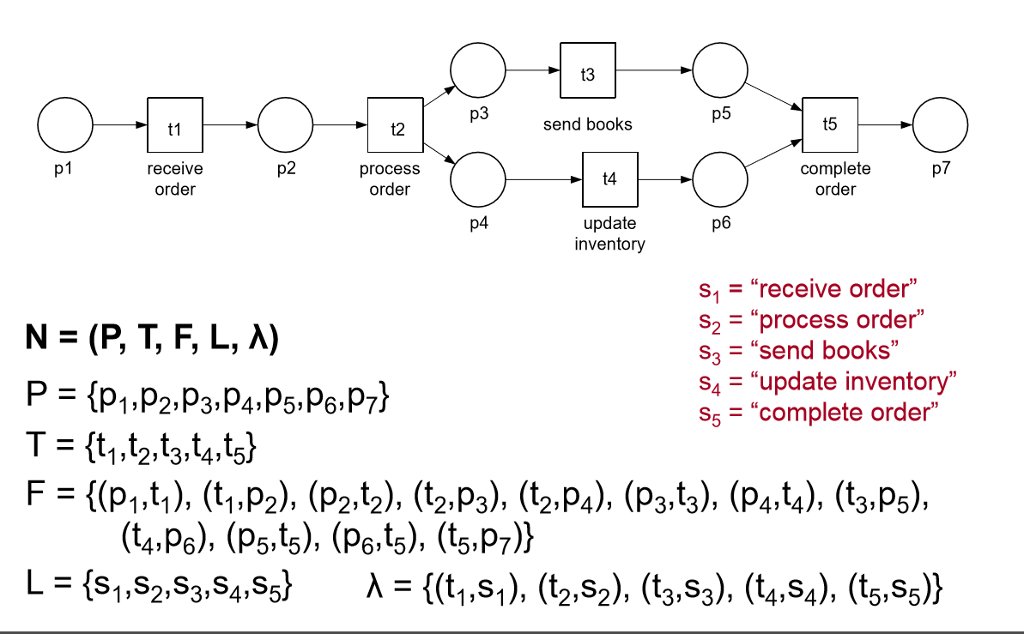

ITD122 - Assignment 2 - Process Modelling with Petri Nets (Semester 3, 2018) SCENARIO: MYBANK In the following, the process of MyBank handling a customer's mortgage request is described. It is assumed that an initial mortgage request has been received from the customer. At the beginning MyBank receives the initial mortgage request of the customer, which is stored in the bank's information system. Afterwards, the bank's information system calculates the available funds for the client, her annual income as well as the required funds in order to buy the property. These computations are all independent of each other and can be done in parallel. Once all computations are completed the system queries a central database for additional mortgages the customer might have. If the central database is not available due to a downtime, the query is repeated after waiting for an hour. If the customer has more than one active mortgage, a rejection letter is sent by the clerk and the application is closed. This ends the mortgage process Otherwise, the mortgage application is registered locally by the system. If the customer already has a single active mortgage, the headquarters need to be informed afterwards in addition to registering the mortgage application locally. Then, a clerk and a risk analyst evaluate the mortgage application in parallel. Afterwards they meet to make a decision. If they cannot agree on approving the mortgage, a rejection letter is sent by the clerk and the application is closed. If the mortgage request is approved the clerk sends a mortgage offer to the customer. If the customer accepts the conditions presented to him in the mortgage offer, the money is made availahle through a deposit and the mortgage application is closed. If the customer does not accept thoe conditions, the clerk contacts the customer to inquire for the reasons for not accepting the offer and the application is stored for further processing, which ends the process. If the customer does not respond within two months after sending an offer, the mortgage application is closed TASK (20 Marks) You are a process consultant at MyBank. Model all the processes captured in the proposed scenario as a Workflow net. As this Workflow net will be used as a basis for implementing an information system to support MyBank's business, it must reflect the proposed scenario as close as possible. Ensure that your model is free of syntax errors and that every occurrence sequence in the resulting Workflow net can be extended to an occurrence sequence that leads to the marking that puts one token in the only terminal place of the Workflow net and no tokens elsewhere. Since the staffs at MyBank are not process experts, there may be some open points in the description. For those cases, take assumptions that seem to be appropriate against the background of optimally supporting MyBanks's business. Please support assumptions (if any) that you introduce with clear textual descriptions (to be submitted together with the developed Workflow net). Make sure that your Workflow net is semantically valid and complete as per the proposed scenario description and all the introduced assumptions t3 p3 p5 t1 t2 send books t5 p1 p2 7 receiv order process order complete order t4 update inventory p6 S1 "receive order s2- "process order" S "send books" S4 "update inventory" S"complete order" N-(, , F, L' ) ITD122 - Assignment 2 - Process Modelling with Petri Nets (Semester 3, 2018) SCENARIO: MYBANK In the following, the process of MyBank handling a customer's mortgage request is described. It is assumed that an initial mortgage request has been received from the customer. At the beginning MyBank receives the initial mortgage request of the customer, which is stored in the bank's information system. Afterwards, the bank's information system calculates the available funds for the client, her annual income as well as the required funds in order to buy the property. These computations are all independent of each other and can be done in parallel. Once all computations are completed the system queries a central database for additional mortgages the customer might have. If the central database is not available due to a downtime, the query is repeated after waiting for an hour. If the customer has more than one active mortgage, a rejection letter is sent by the clerk and the application is closed. This ends the mortgage process Otherwise, the mortgage application is registered locally by the system. If the customer already has a single active mortgage, the headquarters need to be informed afterwards in addition to registering the mortgage application locally. Then, a clerk and a risk analyst evaluate the mortgage application in parallel. Afterwards they meet to make a decision. If they cannot agree on approving the mortgage, a rejection letter is sent by the clerk and the application is closed. If the mortgage request is approved the clerk sends a mortgage offer to the customer. If the customer accepts the conditions presented to him in the mortgage offer, the money is made availahle through a deposit and the mortgage application is closed. If the customer does not accept thoe conditions, the clerk contacts the customer to inquire for the reasons for not accepting the offer and the application is stored for further processing, which ends the process. If the customer does not respond within two months after sending an offer, the mortgage application is closed TASK (20 Marks) You are a process consultant at MyBank. Model all the processes captured in the proposed scenario as a Workflow net. As this Workflow net will be used as a basis for implementing an information system to support MyBank's business, it must reflect the proposed scenario as close as possible. Ensure that your model is free of syntax errors and that every occurrence sequence in the resulting Workflow net can be extended to an occurrence sequence that leads to the marking that puts one token in the only terminal place of the Workflow net and no tokens elsewhere. Since the staffs at MyBank are not process experts, there may be some open points in the description. For those cases, take assumptions that seem to be appropriate against the background of optimally supporting MyBanks's business. Please support assumptions (if any) that you introduce with clear textual descriptions (to be submitted together with the developed Workflow net). Make sure that your Workflow net is semantically valid and complete as per the proposed scenario description and all the introduced assumptions t3 p3 p5 t1 t2 send books t5 p1 p2 7 receiv order process order complete order t4 update inventory p6 S1 "receive order s2- "process order" S "send books" S4 "update inventory" S"complete order" N-(, , F, L' )