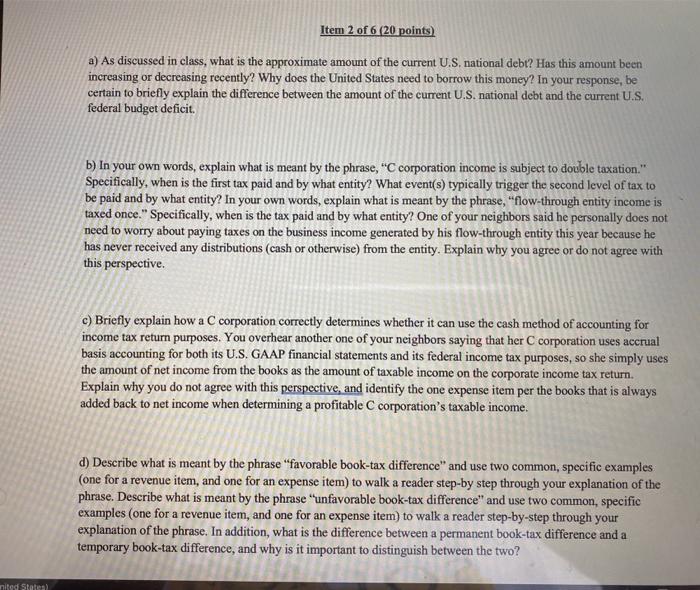

Item 2 of 6 (20 points) a) As discussed in class, what is the approximate amount of the current U.S. national debt? Has this amount been increasing or decreasing recently? Why does the United States need to borrow this money? In your response, be certain to briefly explain the difference between the amount of the current U.S. national debt and the current U.S. federal budget deficit. b) In your own words, explain what is meant by the phrase, "C corporation income is subject to double taxation." Specifically, when is the first tax paid and by what entity? What event(s) typically trigger the second level of tax to be paid and by what entity? In your own words, explain what is meant by the phrase, "flow-through entity income is taxed once." Specifically, when is the tax paid and by what entity? One of your neighbors said he personally does not need to worry about paying taxes on the business income generated by his flow-through entity this year because he has never received any distributions (cash or otherwise) from the entity. Explain why you agree or do not agree with this perspective. c) Briefly explain how a C corporation correctly determines whether it can use the cash method of accounting for income tax return purposes. You overhear another one of your neighbors saying that her C corporation uses accrual basis accounting for both its U.S. GAAP financial statements and its federal income tax purposes, so she simply uses the amount of net income from the books as the amount of taxable income on the corporate income tax return. Explain why you do not agree with this perspective, and identify the one expense item per the books that is always added back to net income when determining a profitable C corporation's taxable income. d) Describe what is meant by the phrase "favorable book-tax difference" and use two common, specific examples (one for a revenue item, and one for an expense item) to walk a reader step-by step through your explanation of the phrase. Describe what is meant by the phrase "unfavorable book-tax difference" and use two common, specific examples (one for a revenue item, and one for an expense item) to walk a reader step-by-step through your explanation of the phrase. In addition, what is the difference between a permanent book-tax difference and a temporary book-tax difference, and why is it important to distinguish between the two? nited States Item 2 of 6 (20 points) a) As discussed in class, what is the approximate amount of the current U.S. national debt? Has this amount been increasing or decreasing recently? Why does the United States need to borrow this money? In your response, be certain to briefly explain the difference between the amount of the current U.S. national debt and the current U.S. federal budget deficit. b) In your own words, explain what is meant by the phrase, "C corporation income is subject to double taxation." Specifically, when is the first tax paid and by what entity? What event(s) typically trigger the second level of tax to be paid and by what entity? In your own words, explain what is meant by the phrase, "flow-through entity income is taxed once." Specifically, when is the tax paid and by what entity? One of your neighbors said he personally does not need to worry about paying taxes on the business income generated by his flow-through entity this year because he has never received any distributions (cash or otherwise) from the entity. Explain why you agree or do not agree with this perspective. c) Briefly explain how a C corporation correctly determines whether it can use the cash method of accounting for income tax return purposes. You overhear another one of your neighbors saying that her C corporation uses accrual basis accounting for both its U.S. GAAP financial statements and its federal income tax purposes, so she simply uses the amount of net income from the books as the amount of taxable income on the corporate income tax return. Explain why you do not agree with this perspective, and identify the one expense item per the books that is always added back to net income when determining a profitable C corporation's taxable income. d) Describe what is meant by the phrase "favorable book-tax difference" and use two common, specific examples (one for a revenue item, and one for an expense item) to walk a reader step-by step through your explanation of the phrase. Describe what is meant by the phrase "unfavorable book-tax difference" and use two common, specific examples (one for a revenue item, and one for an expense item) to walk a reader step-by-step through your explanation of the phrase. In addition, what is the difference between a permanent book-tax difference and a temporary book-tax difference, and why is it important to distinguish between the two? nited States