Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you buy a straddle by purchasing one Facebook $290 call option contract quoted at $5 and also purchasing one Facebook $280 put option contract

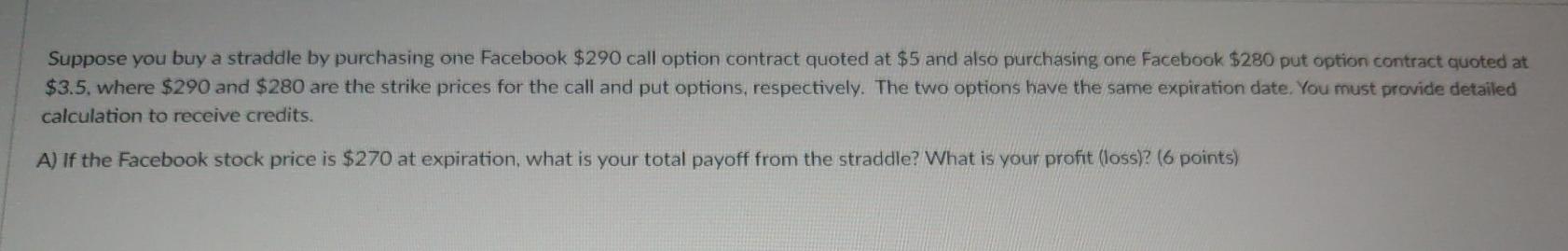

Suppose you buy a straddle by purchasing one Facebook $290 call option contract quoted at $5 and also purchasing one Facebook $280 put option contract quoted at $3.5. where $290 and $280 are the strike prices for the call and put options, respectively. The two options have the same expiration date. You must provide detailed calculation to receive credits. A) If the Facebook stock price is $270 at expiration, what is your total payoff from the straddle? What is your profit (loss)? (6 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started