Question

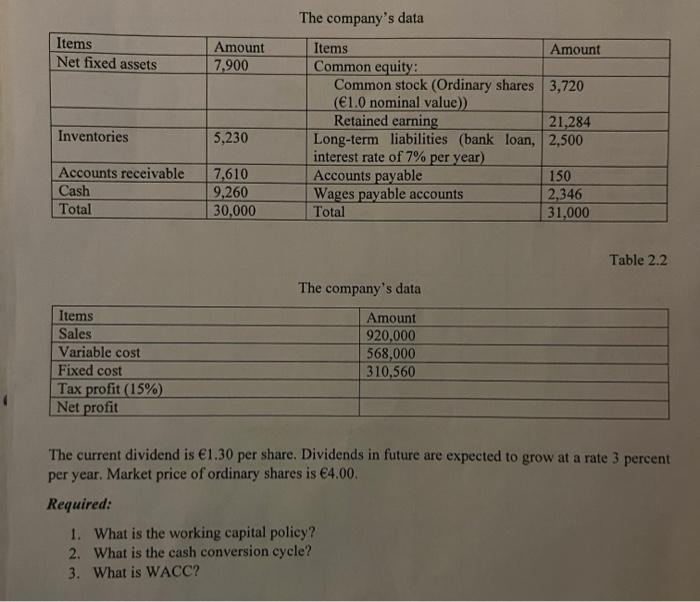

Items Net fixed assets Inventories 5,230 Accounts receivable 7,610 9,260 30,000 Cash Total Amount 7,900 Items Sales Variable cost Fixed cost Tax profit (15%)

Items Net fixed assets Inventories 5,230 Accounts receivable 7,610 9,260 30,000 Cash Total Amount 7,900 Items Sales Variable cost Fixed cost Tax profit (15%) Net profit The company's data Items Common equity: Common stock (Ordinary shares 3,720 (1.0 nominal value)) Retained earning 21,284 Long-term liabilities (bank loan, 2,500 interest rate of 7% per year) Accounts payable Wages payable accounts Total The company's data Amount 920,000 568,000 310,560 Amount 150 2,346 31,000 Table 2.2 The current dividend is 1.30 per share. Dividends in future are expected to grow at a rate 3 percent per year. Market price of ordinary shares is 4.00. Required: 1. What is the working capital policy? 2. What is the cash conversion cycle? 3. What is WACC?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the provided image youre looking to answer three questions about the companys financial data Lets address each question one by one 1 What is the working capital policy Working capital policy ...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started