Answered step by step

Verified Expert Solution

Question

1 Approved Answer

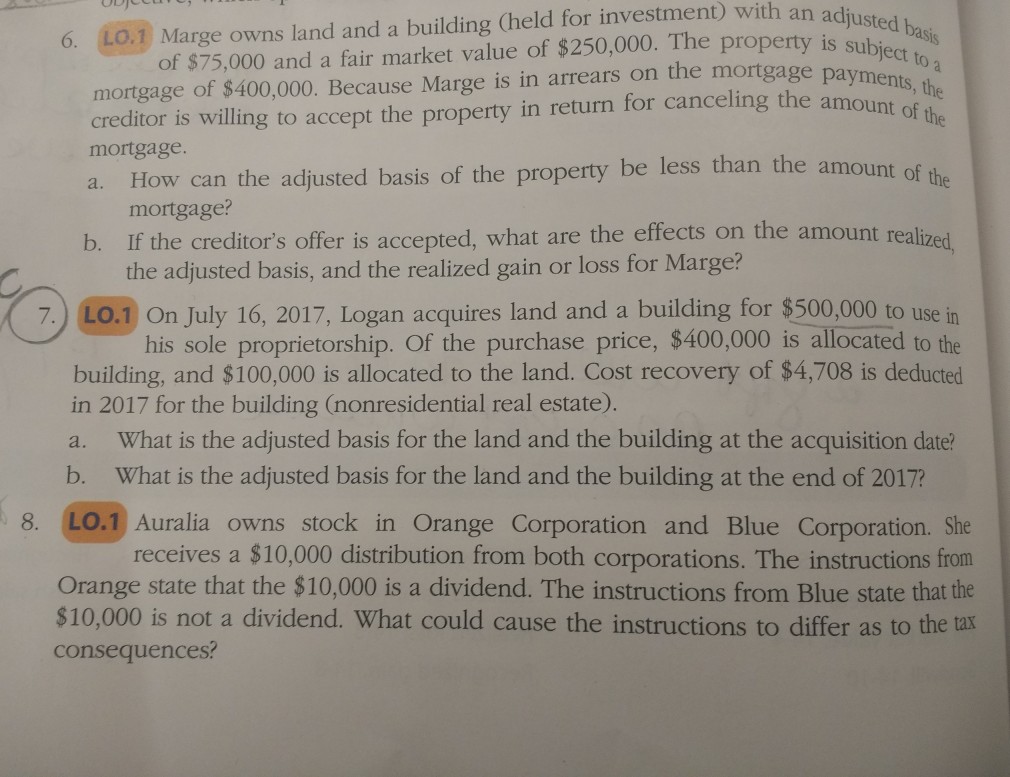

ith an adjusted basis 6. LO.1 Marge owns land and a building (held for investment) with an a of $75,000 and a fair market value

ith an adjusted basis 6. LO.1 Marge owns land and a building (held for investment) with an a of $75,000 and a fair market value of $250,000. The property is sa mortgage of $400,000. Because Marge is in arrears on the mortgage pa creditor is willing to accept the property in return for canceling the amo mortgage payments, the of the a. How can the adjusted basis of the property be less than the amount mortgage? b. If the creditor's offer is accepted, what are the effects on the amount realizer the adjusted basis, and the realized gain or loss for Marge? 7.) LO.1 On July 16, 2017, Logan acquires land and a building for $500,000 to use in his sole proprietorship. Of the purchase price, $400,000 is allocated to the building, and $100,000 is allocated to the land. Cost recovery of $4,708 is deducted in 2017 for the building (nonresidential real estate). a. What is the adjusted basis for the land and the building at the acquisition date? b. What is the adjusted basis for the land and the building at the end of 2017? 8. LO.1 Auralia owns stock in Orange Corporation and Blue Corporation. She receives a $10,000 distribution from both corporations. The instructions from Orange state that the $10,000 is a dividend. The instructions from Blue state that the $10,000 is not a dividend. What could cause the instructions to differ as to the tax consequences

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started