Answered step by step

Verified Expert Solution

Question

1 Approved Answer

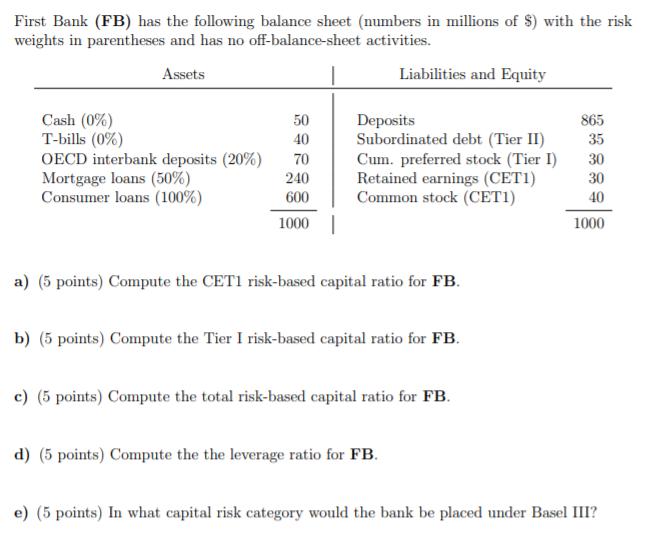

First Bank (FB) has the following balance sheet (numbers in millions of $) with the risk weights in parentheses and has no off-balance-sheet activities.

First Bank (FB) has the following balance sheet (numbers in millions of $) with the risk weights in parentheses and has no off-balance-sheet activities. Assets Cash (0%) T-bills (0%) OECD interbank deposits (20%) Mortgage loans (50%) Consumer loans (100%) 50 40 70 240 600 1000 Liabilities and Equity Deposits Subordinated debt (Tier II) Cum. preferred stock (Tier I) Retained earnings (CET1) Common stock (CET1) a) (5 points) Compute the CET1 risk-based capital ratio for FB. b) (5 points) Compute the Tier I risk-based capital ratio for FB. c) (5 points) Compute the total risk-based capital ratio for FB. d) (5 points) Compute the the leverage ratio for FB. 865 35 30 30 40 1000 e) (5 points) In what capital risk category would the bank be placed under Basel III?

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a CET1 riskbased capital ratio CET1 capital riskweighted assets CET1 capital Common stock Retained e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started